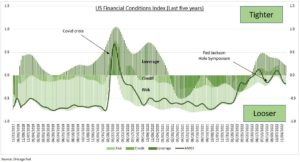

REPLAY: US 10-yr government bond yields fell 0.75% from recent highs. The US dollar index is down near double-digits. The S&P 500 rose 15% since October. Overseas equities even more. This has all combined to significantly loosen US financial conditions (see chart). The market is fighting the Fed again. Unwinding the Fed’s hard-won tightening since March to slow inflation. As at August’s Jackson Hole the Fed could now respond strongly. Telegraphing a terminal Fed funds rate above 5% at its looming Dec. 14th meeting. This would be a reality check to rallied markets. We think we’ve seen the lows, and would add on significant weakness. But this is likely the 6th bear market rally of this correction and with only a gradual U-shaped recovery ahead.

FED: They have been clear on a likely step back from the 0.75% hiking pace at its meeting next week. Markets are clearly pricing this slowdown. But the Fed has also been clear it could be a longer cycle, with inflation still sticky. This is a big risk to the coming ‘dot plot’ terminal interest rate outlook. This is 5% for mid-2023 but set to be raised. Absent a significant downside inflation surprise next week we see room for a Fed-driven markets reality check. S&P 500 valuations are now back over long-term averages. Whilst earnings downgrades set to continue well into 2023.

INDEX: The Chicago Fed US financial conditions index is now well back in ‘easy’ territory. This is below the 1.0 level that shows average conditions since 1971. It is now looser than when the Fed forcefully warned at August’s Jackson Hole symposium. It is also even looser than in March 2022 when the Fed just started to raise interest rates from the zero-bound. This has been the sharpest rate hike pace in forty years. All three sub-indices (105 components) are looser: risk (financial sector volatility and funding), credit (market conditions), leverage (debt and equity).

All data, figures & charts are valid as of 05/12/2022