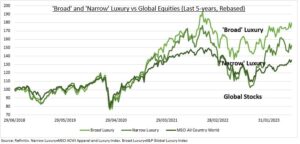

LUXURY: It has strongly outperformed this year, with its valuations rerating on a combination of resilient consumer demand and strong pricing power. It also benefits from a broadening definition of luxury. ‘Narrow’ traditional luxury stocks, selling leather goods, clothing, beauty, watches, and jewelry are being joined (see chart) by ‘broad’ luxury plays including cars (like TSLA and RACE), spirits (RI.PA), and sportswear (NKE). This broader luxury industry is looking ahead to Chinese buyers now regaining their pole position atop industry demand, whilst increasingly important younger demographics drive tech-enabled, experiential, and online sales.

INDUSTRY: The global luxury business grew by a fifth last year to €353 billion of sales, a 70% rise in just the past decade. Global household wealth doubled in the same time and the number of luxury consumers rose to an estimated 400 million, equal to 5% of the global population. This backdrop allowed the now-much larger and more diversified industry to navigate the pandemic lockdown and the cost-of-living crisis with limited impact so far. China’s counter-cyclical recovery gives a positive tail-wind helping the industry be recession resilient, though not totally immune.

FOCUS: The industry is dominated by French, Italian, and Swiss brands. The ten largest, like LVMH (MC.PA), Richemont (CFR.ZU), and Hermes (RMS.PA), are 55% of global sales, 80% of growth, and 85% of profits. LVMH has become Europe’s largest listed company with a market capitalisation near 500 billion euros, and 75 luxury brand ‘maisons’ across six segments. But the broadening luxury definition is reordering other industries. Ferrari has a bigger market cap. than Ford (F), despite building only 13,000 cars last year versus Ford’s 4.2 million. China-only spirits stock Kweichow Moutai now has 2.5 times the market cap. of the world’s biggest brewer, ABI.

All data, figures & charts are valid as of 04/07/2023.