Summary

Room for another ‘less bad’ earnings season

Another crucial earnings season as recession fears mount. We see some relief, with forecasts too low. JP Morgan kicks of global Q3 earnings Friday, Oct. 14. S&P 500 profit growth forecasts fell to 3%. Discretionary and communications led latest profits downgrades, with energy only one seeing upgrades. But companies issuing positive guidance is running at twice average levels. Rest of world outlook is better, with European profits seen growing ten times the S&P 500.

A better start to the fourth quarter

New quarter off to a better, but volatile, start as dollar and bond yields stabilised but jobs data strong. US equities rose, but commodities led after OPEC’s big production cut. Australia’s RBA blinked and cooled rate hikes. UK was forced into partial U-turn on controversial tax cuts. Tesla Q3 volumes disappointed. Semiconductor fears rose. Elon Musk resuscitated Twitter deal. See video updates, and twitter @laidler_ben.

The slowing jobs market catalyst

US jobs market is last big inflation driver needed to turn lower and give hope nearing a Fed rate peak. A feared wage-price spiral unlikely, and the unemployment rise to be modest.

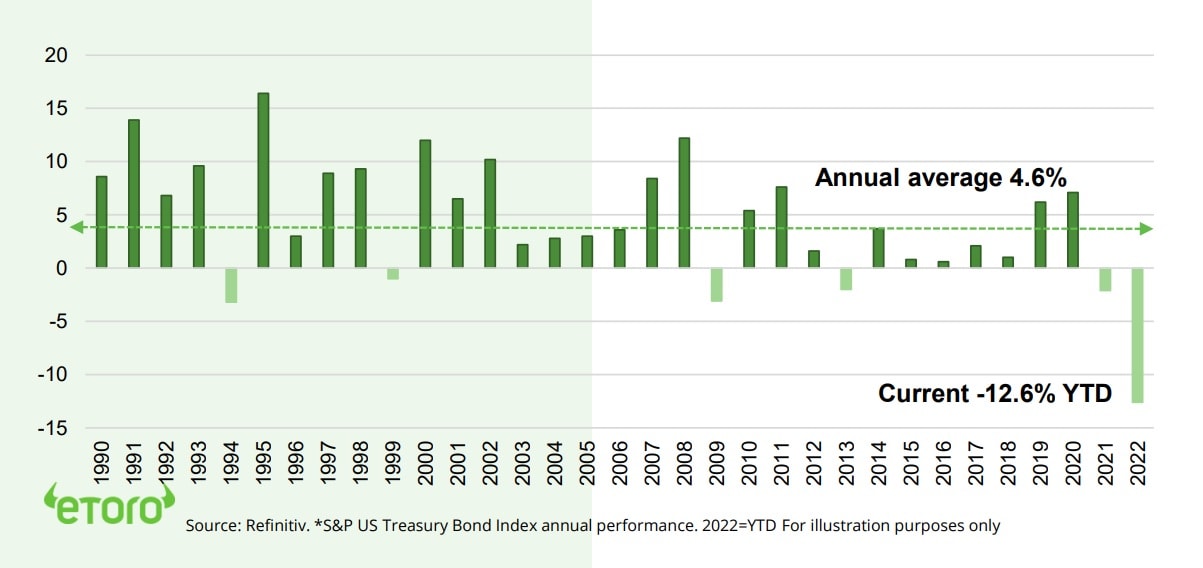

Bond market vigilantes and valuation

This years US bond market sell-off is historically unprecedented, pressuring equity valuations and giving investors nowhere to hide. Our outlook for higher bond prices is a key catalyst.

Mixed messages from commodities

Commodities been roller-coaster this year. Gives unsettling view of Chinese growth, US housing, and discretionary consumption. But is reassuring on food demand and EV adoption.

Work from home is here to stay

Many ‘work-from-home’ (WFH) trends stubbornly enduring. This opens up select opportunities in cratered WFH stocks. @RemoteWork.

Crypto markets hold their own

Crypto prices held their own, building on their resilient Q3 performance, as equities stabilised. The European Council passed its landmark MiCA crypto regulation, whilst US Biden administration called on Congress to hurry up on its own regulation efforts. SWIFT successfully tested payment interoperability with CBDC’.

Commodities rebound as OPEC flexes muscle

Brent oil prices surged to over $95/bbl. as OPEC cut supply quotas by a big 2mbpd, or 2% global supply. Precious metals rose, led by silver and palladium, as saw rare relief after US dollar and bond yields stabilised. Zinc, used for steel galvanising, boosted as a 3rd European smelter shutdown on soared energy costs.

The week ahead: Q3 earnings and inflation

1) JPM kicks off global Q3 earnings (Fri). S&P 500 earnings est. +3%. 2) Fed FOMC meeting minutes (Wed) and sticky est. 8.3% Sept. inflation (Thu). 3) China markets reopen as head into key 5-yr Party Congress. 4) IMF/World Bank meeting and G20 (Wed), with focus on dollar comment.

Our key views: Fed risking a policy mistake

Fed is risking a policy mistake, spreading its hawkish rate stance globally even as inflation pressures fall. This raises risks but also takes us nearer a market inflection point. But recovery to be U-shaped only. Focus on cheap and defensive assets like healthcare, and styles like dividend yield, and related markets like UK.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.99% | -8.88% | -19.38% |

| SPX500 | 1.51% | -10.52% | -23.64% |

| NASDAQ | 0.73% | -12.05% | -31.91% |

| UK100 | 1.41% | -4.90% | -5.33% |

| GER30 | 1.31% | -6.23% | -22.74% |

| JPN225 | 4.55% | -3.89% | -5.82% |

| HKG50 | 3.00% | -8.38% | -24.18% |

*Data accurate as of 10/10/2022

Market Views

Some early relief in the fourth quarter

- New quarter off to a better, but volatile, start as the US dollar and bond yields stabilised but jobs data was strong. US equities rose, but commodities led after OPEC’s dramatic production cut. Australia’s RBA blinked and cooled rate hikes. UK was forced into partial U turn on controversial tax cuts. Tesla Q3 volumes disappointed. Semiconductor demand fears rose. Musk resuscitated Twitter deal.

The slowing jobs market catalyst

- US jobs market is the last big inflation driver needed to turn lower and give hope are near a Fed interest rate peak. Commodities, PMI’s, inflation breakevens, supply chain and housing indicators are all down. Fed is watching as 5% wage growth boosted sticky services inflation.

- But historical analysis shows wage-price spiral unlikely with real wages and inflation expectations falling. Hopes are for a goldilocks non farm payrolls reset below 300,000. But not so low, to stoke recession fears more.

Bond market vigilantes and valuation

- Only the US dollar and bitcoin rose last quarter, of major assets. This continued sell off in both bonds and equities, the two biggest and most traded liquid assets, has given investors nowhere to hide. The equity sell off has been very painful, but bond version is historically unprecedented. Long dated bonds, like TLT ETF, done even worse than supposedly riskier S&P 500 equities.

- A stabilization of bond prices, and yields, is one of our three positive catalysts for the fourth quarter. It would ease global macro stresses and give needed valuation relief. Bond vigilantes already forced an embarrassing policy climbdown in UK.

Mixed messages from commodities

- Commodities been on roller-coaster ride this year. The Bloomberg commodity index fell 15% from its June high. But it is still by far best performing asset class this year. Recent weakness been driven by the surging US dollar and global recession fears. But cushioned by supply side tightened by decade of low investment and war to weather disruptions.

- Cross-checking individual performance against major uses is illustrative. It gives an unsettling view of Chinese growth, the US housing slowdown, and global discretionary consumption. Whilst being a lot more reassuring on basic food demand and the steadily accelerating EV adoption.

Work from home is here to stay

- Many ‘work-from-home’ (WFH) pandemic winners, from Zoom (ZM) to Twilio (TWLO), have cratered under pressure of post-pandemic return-to-work and higher bond yields. But WFH trends stubbornly enduring, and workers keen to extend, even as face test of rising unemployment and winter costs.

- This resilience may drive opportunity after the WFH stock rout. And also pressure ‘losers’, from city centers to office landlords. US office occupancy is under 50%. See @RemoteWork.

US Cyclicals* underperformance vs Defensive** equities (10-years)

Crypto markets hold their own

- Crypto markets treaded water, supported by better equity performance and building on its more resilient Q3 price performance.

- The European Council passed its landmark new Markets in Crypto-Assets (MiCA) regulation. It now goes to a EU Parliament vote, and has a 12- 18 month adaptation period. Meanwhile the Biden administration called on Congress to speed up its own crypto asset regulation plans.

- Global payments messager SWIFT successfully tested many distributed ledger technologies with existing payments systems in using Central Bank Digital Currencies (CBDC) and tokenised assets.

Commodities rebound as OPEC flexes muscle

- Commodities rebounded sharply as OPEC slashed oil production and the US dollar and bond yields stabilised after recent sharp gains.

- Brent crude prices surged back over $95bbl. As OPEC+ ignored US pleadings and announced a much bigger than expected 2mbpd cut to oil production quotas to offset weakening demand.

- Precious metals prices saw a rare positive week, led up by silver and platinum, propelled by relief from more stable US dollar and bond yields.

- Zinc, used for steel galvanising, rose as Europe saw its third smelter closure due to sky high energy prices. This tightened the supply outlook.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.72% | -9.37% | -33.84% |

| Healthcare | 1.10% | -3.78% | -15.62% |

| C Cyclicals | -0.04% | -11.01% | -31.71% |

| Small Caps | 2.25% | -7.09% | -24.19% |

| Value | 1.98% | -7.35% | -17.35% |

| Bitcoin | -1.14% | 1.32% | -59.04% |

| Ethereum | -1.72% | -16.14% | -64.59% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Q3 earnings and US inflation

- Global third quarter earnings starts Friday with JPM and US banks. Forecasts for +3% S&P 500 earnings growth, and +32% for Europe’s Stoxx 600. We see room for some relief.

- Fed FOMC meeting minutes are due (Wed) as it gears up for another 0.75% hike at next Nov. 2nd meeting. Partly dependent on September inflation report (Thu). Seen sticky at 8.3% YoY.

- Markets in China reopen after the long ‘golden week’ holiday. The key 5-year Communist Party Congress starts Oct. 16th. See Xi 3rd term and some hope for more pro-growth policy stance.

- Fall IMF/World Bank meeting and Oct. 12 G20 finance minister and central bank governors meeting. Likely to discuss recession and dollar.

Our key views: Fed risking a policy mistake

- The Fed is risking a policy mistake, spreading its hawkish interest rate stance globally even as inflation pressures fall. This both raises risks but also takes us nearer a market inflection point. Recovery to be U-shaped only. Gradually lower inflation will be a bumpy ride but will eventually start to de-risk markets and allow risk assets, like equities to perform better.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 5.06% | -1.17% | 18.12% |

| Brent Oil | 15.05% | 6.52% | 26.32% |

| Gold Spot | 2.01% | -1.49% | -7.03% |

| DXY USD | 0.56% | 3.43% | 17.48% |

| EUR/USD | -0.63% | -3.06% | -14.36% |

| US 10Yr Yld | 6.09% | 57.50% | 237.59% |

| VIX Vol. | -0.82% | 37.60% | 82.11% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Another big earnings season relief?

Another crucial earnings season as investors fears mount. Look for some relief.

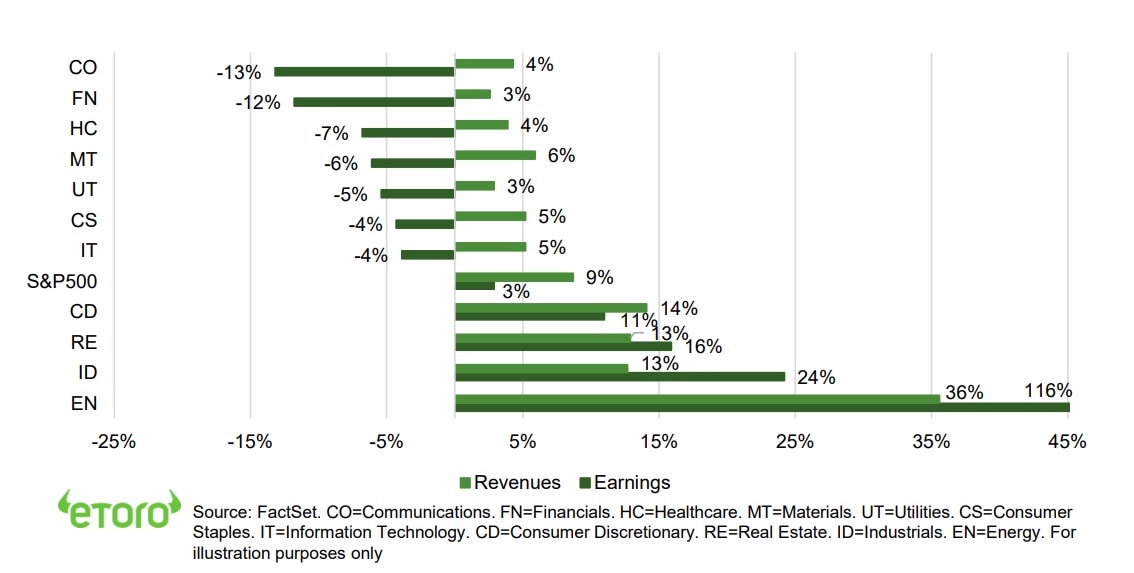

Markets are very worried about an impending collapse in corporate profits, with a cooling economy, inflation cost pressures, rising interest rates, and the strong dollar. Earnings have been robust in recent quarters as companies have flexed their pricing power to slow the decline. We see continued resilience, against low expectations, with room for some relief like that seen after second quarter. Third quarter earnings expectations have fallen sharply to only 3% nominal growth for S&P 500 vs last year and down 2% vs last quarter. This is despite near 9% inflation, the still growing economy, and lower gasoline prices.

JP Morgan unofficially kicks of global third quarter earnings season next Friday, Oct. 14th

S&P 500 Q3 earnings growth forecasts are 3%, down sharply from 10% three months ago. This is double the usual cutting of expectations into earnings that then sets up for over 70% of companies beating the newly lowered expectations. Revenues have been much more resilient, and stand at near 9%, as analysts’ pencil in lower profit margins. At 12.2% these would still be well above average. The dollar will also be in focus, especially as international-focused US companies have been leading recent earnings growth.

Cyclicals lead the earnings downgrades, with energy the only sector seeing upgrades

The biggest profit downgrades came from those cyclical sectors most sensitive to the economy, like materials and consumer discretionary, or with specific troubles, like communications. Freeport (FCX), Meta (META), and Amazon (AMZN) have respectively been the biggest downgrade contributors. Energy is the only sector to see upgrades into Q3, led by Exxon (XOM), and is set to lead growth for the quarter.

Not all doom and gloom, with companies issuing positive guidance running at twice average levels

The number issuing positive guidance is ahead of average, and highest in three quarters. Those issuing negative guidance is lowest this year. This gives hope companies have adjusted to the more challenging environment. Like Q2, company guidance on the future may be more important than the results themselves. With lowered expectations, price performance may be less asymmetric than in prior quarters.

Rest of world outlook looks even better, with European earnings growing ten times the S&P 500

The rest of the world may leave the S&P 500 in the earnings growth dust. Europe’s Stoxx600 is set to see 32% growth (12% excl. energy), as it enjoys low comparables and many helped by the weak euro. France and Italy are set to lead, with Germany and Switzerland lagging. UK earnings are seen rising 38%.

S&P 500 Third Quarter EPS and Revenue growth forecasts (%, Year over Year)

Key Views

| The eToro Market Strategy View | |

| Global Overview | The aggressive Fed interest rate hiking cycle and stubborn inflation has boosted uncertainty, recession risk, and hit markets hard. We see this gradually fading, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported by peaked bond yields and high company profitability. Faster Fed hiking cycle is boosting recession risks. Focus on traditional cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See a gradual ‘U-shaped’ rebound as inflation falls. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Strong USD and rising recession fears hitting commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil by slow return of OPEC+ supply and Russia 10% world supply problems. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Stake. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.