ARGAN SA ($ARG.PA) is a French REIT that offers a 5.5% dividend yield today, but also presents an opportunity to keep growing revenues in the future. The main customers of the company consist on great well-known companies like Carrefour, L’Oreal, DHL, Aldi, Decathlon, Amazon, or BMW.

Key Highlights:

- ARGAN combines a high dividend yield with long-term revenue growth

- Skin in the game: the management owns over 37% of the business

- Applying a fair valuation approach, ARGAN trades at a discount

The business model:

ARGAN’s business consists on renting premium logistics facilities. They can build, develop or acquire warehouses, and then rent it, taking care of the property management during the whole lease. The company was created in 2000 by Jean-Claude LE LAN, who is still the Chairman of the company. Listed in 2007, right before the Great Financial Crisis, the company has returned over 321% plus dividends.

Skin in the game:

ARGAN is a company with a market capitalization of 1.6 billion Euros. As we’ve said before, the founder is still in the company, but not just as an employee; his family still owns 37% of the shares outstanding. This gives him and his family a long-term vision, since their wealth is tied to the performance of the business. Predica, a subsidiary of Crédit Agricole Assurances, has owned 15% of the company for a long time, serving as a good counterweight for the family’s influence within the business.

The current valuation:

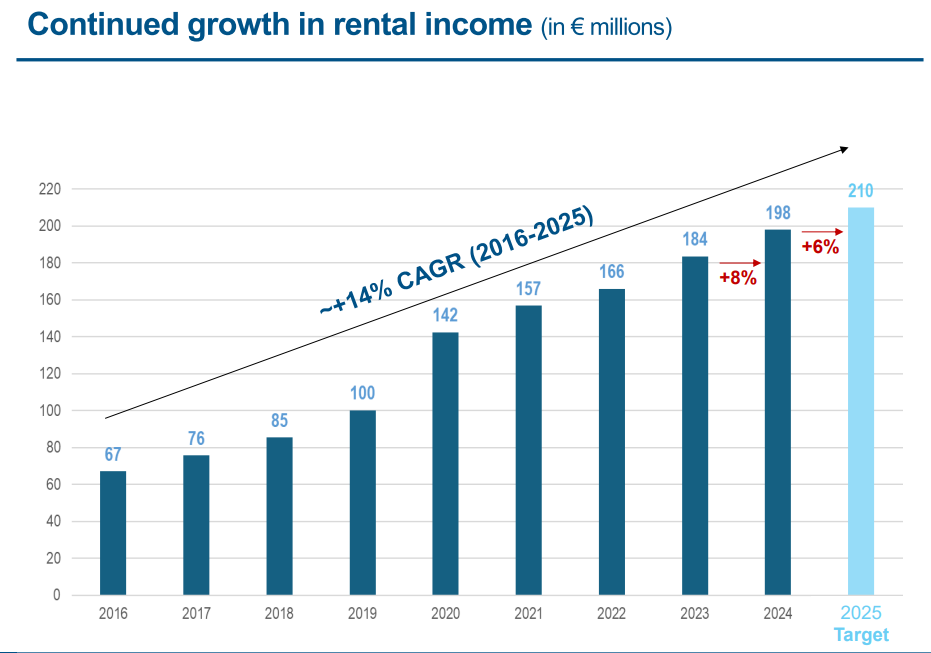

ARGAN has generated 137 million Euros in Recurring Net Income in 2024, up 9% from the previous year. This means that the company is currently trading at 11.6 times recurring earnings. For comparison, the current earnings ratio of the SP500 is 28 times.

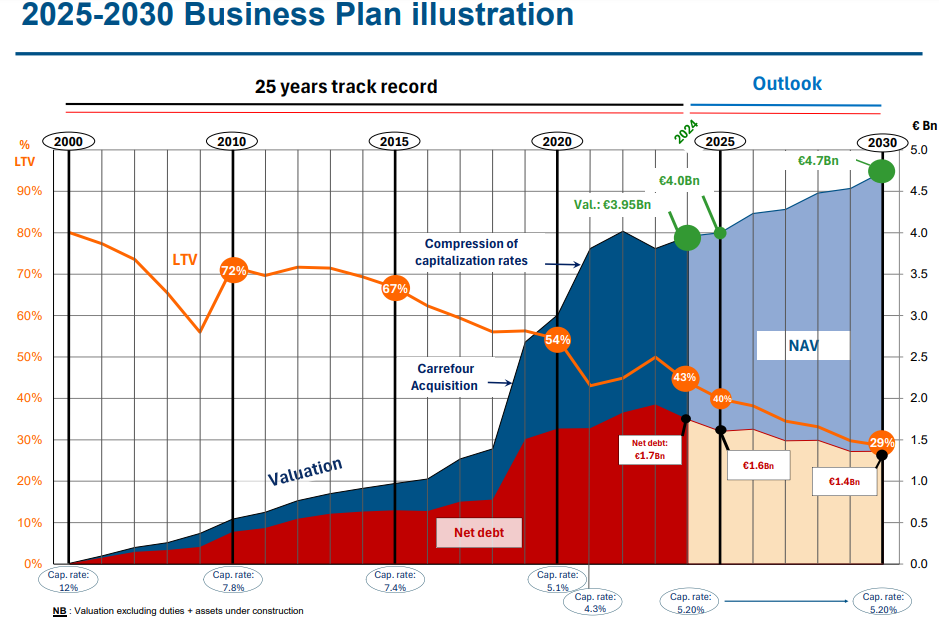

The EPRA NAV NTA of the company, which is the Net Tangible Value of the assets, stays at 85.5 Euros per share. With a current price per share of 63.30 Euros, we are acquiring the company’s assets at a 35% discount to fair value. This value has grown by 8% in 2024, and is expected to keep growing in 2025.

For 2025, the company expects to increase its revenue by 6%, given new projects and the indexed increases in price of the current tenants; and its net recurring income by 11%, to 151 million Euros.

But is this cheap?

A fair valuation:

ARGAN has a skillful management that has overcome difficult times like the Great Financial Crisis while delivering exceptional returns to shareholders. Also, their wealth is tied to the business, so they are incentivized to make ARGAN a successful business.

I consider two ways to safely approach the valuation of ARGAN.

First, a multiple on the net recurring revenue. But there’s a trick here. In 2021, the company managed to secure 500 million euros through a bond with a 1% interest rate, which is due in November 2026. This is basically free money that the company is and has been using. However, once the due date arrives, they’ll have to refinance this money. Probably not the full amount, but if they did, refinancing at a 3.5% interest rate would reduce net profits by about 12.5 million euros.

Thus, I consider that the company’s earnings power remains at 140 million Euros in 2025, being very conservative, which at a multiple of 15 times (in line with international peers), gives us a margin of safety of over 30%.

Second, it’s also fair to value the company at book value. It would probably be wise to apply a premium to it, given the better than the average quality of the company’s assets. But being conservative, and thinking of book value as a good valuation method, the company also trades at a 30% discount today.

If the company traded at a premium, which I think is likely, the discount could go up to 57% using a multiplier of earnings of 18 times, or to 48% if we applied a 10% premium on the book value of the company.

Not everything is perfect:

Opportunities exist for a reason in the stock market. And I find four reasons for ARGAN to be cheap:

1. Debt

Although the company has been deleveraging its balance sheet lately, the debt to assets ratio is relatively high. The current Loan to Value ratio of the company is 43.1%, which means that debt finances 43% of the assets; and the Debt to EBITDA ratio stays at 9.2 times. In 2023, these ratios were 49.7% and 11 times, respectively, which shows the effort of the company to deleverage the balance sheet while still paying over 3 euros per share in dividends.

The current cost of debt is 2.25%, compared with 2.30% in 2023, and is expected to go down to 2.10% in 2025. 22.13% of the rental income is destined to interest on loans, while 22.54% was destined in 2023.

In the future, the plan of the company is to keep reducing the debt while investing to grow more. They plan to finance new investments selling their existing assets. The criteria they will follow is: seniority (older facilities will be sold, preferably); profitability (facilities with lower profitability will be sold, preferably); and ESG reasons (facilities with higher CO2 emissions, which are typically older, will preferably be sold first).

2. Capital increase

To fight the high impact of debt on the company, coupled with the higher interest rates scenario that we’ve lived during the past two years, the management decided to increase the capital in 2024. With a price of 74 euros per share, the company created 2 million new shares, valuing the company at 1.7 billion euros.

Although the company disclosed that this capital increase was targeting new investments, it is also a measure to comply with their debt covenants and to maintain their BBB- rating by S&P. Capital increases are rarely favored by investors, as it often signals overleverage and a potential mismanagement.

3. Writedowns

The French REIT industry has been impacted during the past years of massive writedowns. REITS are required to value their assets at fair value, and in 2022 and 2023 ARGAN had to writedown its assets, lowering its book value. In 2024 this trend has reverted, although some competitors are still going through it.

The overvaluation of the book value is always a risk regarding REITs, and the recent writedowns have scared investors. However, ARGAN is not too affected by this, since the facilities they own are relatively new (11.6 years as an average), and warehouses are less affected by overvaluations than housing.

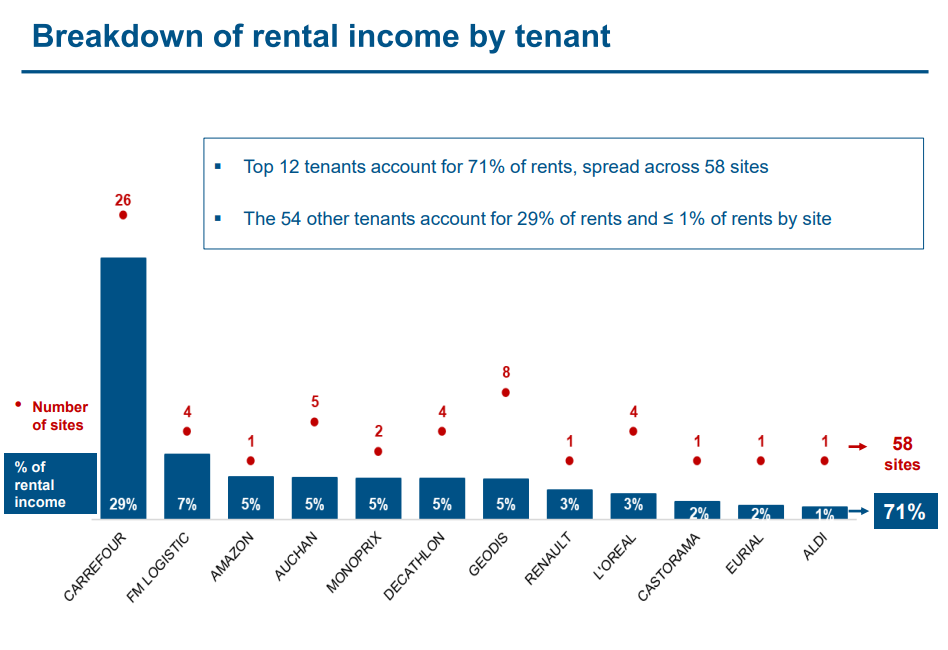

4. Concentration of clients

Carrefour, ARGAN’s main tenant, accounts for 29% of the rental income of the company. This may pose a risk to the company in the long term. However, the average fixed length of the leases is over 5 years, with 43% of the leases with a term of over 6 years from 2024. Besides, the company has been managing perfectly the occupancy ratio, which has been 100% in the past two years, and hasn’t been lower than 99% since 2016.

Conclusion:

ARGAN is a business that is trading below its fair value. With a discount ranging between 30% to 50%, I think that risks are being overweighted by the market. The company has a solid history of revenue and dividend growth, even through rough times (Great Financial Crisis, pandemic). Furthermore, the management has skin in the game and a proven trajectory of being too conservative when releasing estimates. Although the main focus today is reducing debt, I don’t discard (nor do they, according to their latest earnings call) that they become more aggressive with leverage and growth if a good opportunity comes.

Catalysts:

- Lower interest rates

- Improvement of European economic perspectives

- Improvement of S&P rating (2026)

- Time

If no catalysts occur, I’m still happy to be waiting for the market to recognize the value of a company while receiving a 5.5% dividend yield and a net recurring income growth of high single digit.

Risks:

- Portfolio concentration: Carrefour is a big part of the revenue.

- Debt: Although the company has historically had an occupancy rate close to 100%, lowering it to market standards (about 95%, although it depends widely on the regio) could mean difficulties in paying down the debt.

- Difficulty finding new developments.

How do you see ARGAN? Do you find the dividend and the potential growth compelling?

I own a position in ARGAN at the time of writing.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.