Good morning everyone,

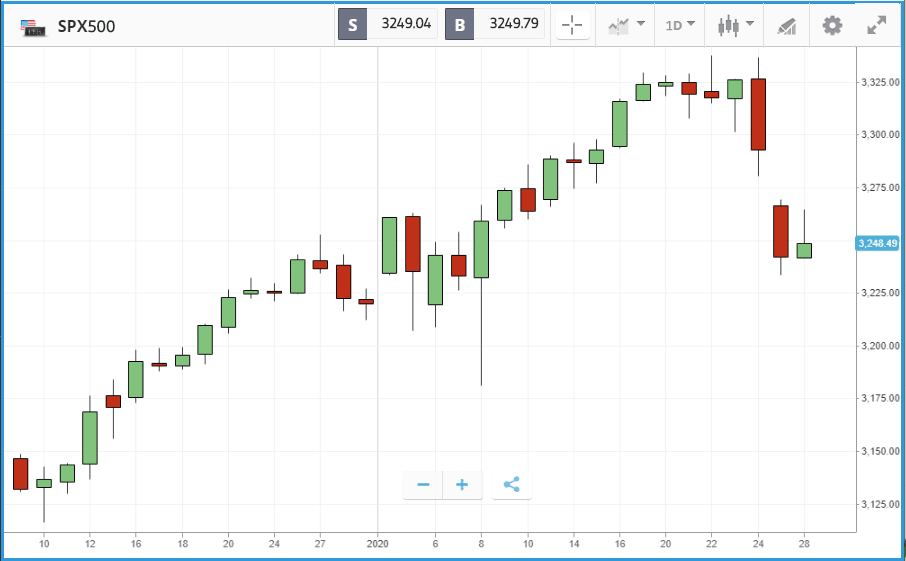

Global markets sank heavily on Monday as more cases of coronavirus were confirmed over the weekend, with the total number of confirmed cases in the US hitting five. All three major US indices fell by more than 1.5%, with the FTSE 100 and FTSE 250 off more than 2% and shares around the globe also tumbling. For the FTSE 100, it was the fourth biggest daily loss from the last 12 months, and it ranked in the 10 worst days the S&P 500 has posted over the same period. Out of 350 firms in the FTSE 100 and FTSE 250, only eight posted a positive day, with two names gaining more than 1%. It is worth noting that in past epidemics – including avian flu and swine flu – the S&P 500 has delivered a positive six-month return in 11 out of 12 instances, according to MarketWatch. That includes SARS, when thousands were infected and hundreds died. The coronavirus death toll has just passed 100. Outside of stocks, the Bloomberg Commodity Index, which is a broad benchmark containing all major commodities, fell 1.4%.

Just Eat signs deal with McDonalds as revenue hits £1bn

Just Eat stole some headlines this morning after becoming fast food giant McDonalds’ second UK delivery partner. It said that 2019 concluded in line with the Board’s expectations, with the group expecting to report EBITDA of around £200 million, with group orders of 254 million and revenue of approximately £1bn. UK order growth in 2019 was 8%, with good momentum in Australia, Italy and Switzerland and continued strong growth in Canada.

Travel stocks tumble, while Walmart rises on plans to pay workers more

As with other days where coronavirus has been moving stock prices, it was travel-related firms that bore the brunt yesterday. Wynn Resorts, which operates properties in Macau, fell by 8.1% after Deutsche Bank lowered its target price citing a massive drop off in visits to Macau during the Chinese New Year holiday. It was joined by Las Vegas Sands and MGM Resorts, which fell 6.8% and 3.95 respectively. Royal Caribbean Cruises sunk 7.6%, after cancelling sailings of its only ship with a Chinese home port. Among the major US airlines, United fell 5.2%, American 5.5% and Delta 3.4%.

At the top end of the S&P 500, D.R. Horton gained 2% after beating both earnings and revenue expectations, and Walmart gained 1.3% after announcing that it is trialing higher hourly wages in some stores. The supermarket giant, one of America’s biggest employers, has for years been the poster child for the need to reform minimum wage laws.

S&P 500: -1.6% Monday, +0.4% YTD

Dow Jones Industrial Average: -1.6% Monday, 0% YTD

Nasdaq Composite: -1.9% Monday +1.9% YTD

IAG and IHG both down over 10% since virus outbreak

The story in the UK markets on Monday mimicked the US. Travel-related stocks sank heavily. Intercontinental Hotels Group and International Consolidated Airlines Group (which owns British Airways) both dropped by around 5%, taking them into double digit losses over the past week. Cruise giant Carnival fell 5%, as like its American counterpart Royal Caribbean it began to suspend its operations in China. Other non-travel companies with heavy exposure to Asia also sank. Insurer Prudential was the second biggest faller in the FTSE 100 at 5%, and luxury fashion house Burberry Group fell 4.8%. Only NMC Health, BT Group, Polymetal International and Flutter Entertainment had a positive day among FTSE 100 stocks. In the FTSE 250, copper miner Kaz Minerals was one of the heaviest fallers, dropping 6.4%.

FTSE 100: -2.3% Monday, -1.7% YTD

FTSE 250: -2.1% Monday, -2.7% YTD

Stocks to watch

Apple: Consumer tech giant Apple, one of a handful of firms to have surpassed a trillion dollar market cap, will report its latest quarterly earnings post-market close on Tuesday. Apple stock has gained more than 100% over the past year, driven by sales of wearable devices such as its AirPods and the Apple Watch. On the earnings call analysts will be looking for signs of the firm’s next act. In particular, they will be hoping for any update on the company’s anticipated entrance into the 5G market. Wall Street analysts’ 12-month price targets on Apple vary enormously, from $190 to $400, versus its $308.95 Monday close – the average is $296.21.

Pfizer: Pharmaceutical firm Pfizer’s share price has been digging itself out of a hole. Pfizer shares sank 20% last summer after the company announced a deal to spin off its UpJohn unit and merge it with Mylan, to create a new generic drug business. It also lowered its earnings guidance, but amid the wider bull run its share price is now close to recovering the loss. Investors will be watching closely for updates on the impacts of the deal, plus what Pfizer’s leadership has planned for the company’s future. Analyst predictions are for an earnings per share figure of $0.58.

Lockheed Martin: New York-listed Lockheed Martin’s share price has climbed by around double that of key London-listed rival BAE Systems over the past year, gaining more than 50%. Part of that was a rebound from a heavy drop in Q4 2018, but it has also benefited from the current US government’s increased military spending. The firm also won major contracts for its F-35 fighter jet last year. Lockheed, which reports its Q4 earnings results on Tuesday morning, has a recent history of beating earnings expectations. The average 12-month analyst price target on the stock is $424.58 to its $432.38 Monday close.

Starbucks: Starbucks, which fell 3.6% on Monday amid the broader coronavirus-related sell-off, will report its latest set of quarterly earnings post-market close today. In the past week, the firm put out a list of environmental policies, including expanding plant-based options, shifting to reusable packaging, investing in regenerative agricultural practices and eliminating waste. The company operates in China which it considers a key growth opportunity, so the coronavirus is likely to be a feature of the earnings call.

Other large US names reporting earnings today: Advanced Micro Devices, 3m Company, United Technologies Corporation, Hca Healthcare, Xilinx, eBay, Stryker Corporation, Equity Residential

Crypto corner

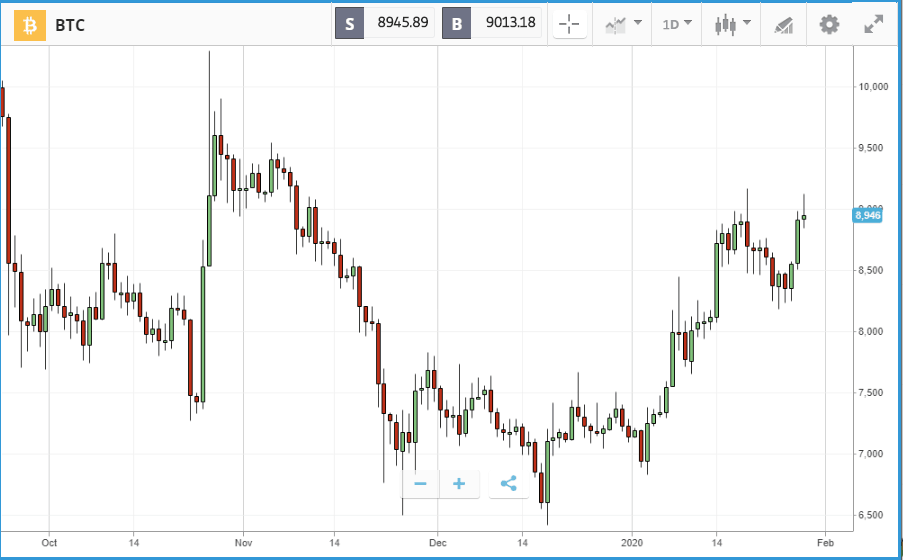

Bitcoin broke $9,000 again overnight, with most of its peers also rallying, contributing to cryptoassets’ growing position as a possible safe haven investment.

Prices jumped to near three-month highs following turbulence on traditional stock markets. Bitcoin held on to the majority of its gains this morning, still trading around $9,000. Smaller cryptoassets Ethereum and XRP closed in on three-month highs to trade at $170.2 and $0.229 respectively.

Cryptoassets seem to be mimicking the reaction seen in gold, the classic safe haven, which has also soared in recent days due to fears the coronavirus, which originated in China is now spreading globally. The precious metal is now trading at $1,576, its highest level since 2013, as investors seek shelter from the carnage in stock markets.