Global dividends reached a record $1.75 trillion in 2024, marking a 6.6% increase from 2024 and reinforcing the importance of income-focused investing. The UAE was among 17 countries that set new dividend payout records, continuing to make UAE-listed stocks appealing especially as they provide a mix of stability and solid returns. Clearly, 2024 was a year where UAE companies focused on rewarding shareholders and that means they are keeping pace with global stocks, offering compelling opportunities in banking, energy, and real estate.

The financial sector has been a standout performer, with UAE banks benefitting from higher interest rates and economic expansion. Abu Dhabi Islamic Bank (ADIB), for instance, raised its dividend payout to 50% of annual profit, reflecting the sector’s robust earnings growth. Meanwhile, energy companies have continued to deliver strong returns, with ADNOC Gas announcing a $3.41 billion dividend, backed by high oil prices and a commitment to 5% annual dividend growth. In real estate, Emaar Properties doubled its dividend to AED 8.8 billion, fuelled by record property sales and strong market demand. These sectors, driven by solid fundamentals, are offering investors an attractive mix of income and stability.

For income-focused investors, dividends aren’t just a bonus, they’re a core part of a long-term strategy. A steady payout means cash flow, stability, and the potential for compounding returns over time. The fact that UAE companies continue to prioritise shareholder returns underscores the resilience of the local market. However, the question is: can these dividends be sustained? While 2024 saw record distributions, some increases, such as Emaar’s 100% payout of its share capital, may not be repeated annually.

These sectors are cyclical, which means dividends could fluctuate with market conditions. In Australia, the world’s largest miners such as BHP and Rio Tinto have recently slashed their payouts from record levels, given the weakness in iron ore prices.

The power of dividends is underestimated by most investors, with income often not thought about until retirement. Compounding is why we reiterate to investors that it’s important to start investing as soon as you can and be consistent with your investments. The earlier you start investing, the more you will benefit from compounding over the long term. Good dividend-paying stocks often won’t see significant growth, given they are paying out profits to investors, but this usually means that these companies are known to be more stable with much less volatility.

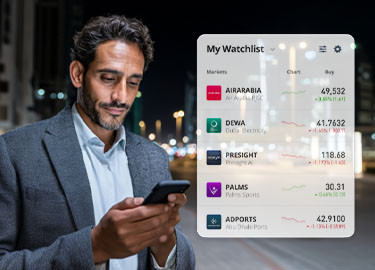

Looking ahead, the UAE’s dividend momentum seems to remain strong, supported by corporate profitability, government policies, and continued investor demand, meaning that growth in dividend payouts can be sustained. Whether you’re looking for high yields or just some extra income from your portfolio, the region is proving to be one worth watching.