Hi Everyone,

Wie schrijft, die blijft…

An old Dutch saying that I picked up yesterday. It means literally “who writes, stays.”

The origin seems to be from sports. Meaning, the player that is keeping score will always manage to stay in the game. But if we think back to many of the great artworks of history from books, to plays, and even music. Had they not been writen many would surely be lost by now.

It is my extreme pleasure and privilege to write to you every day. While I’m sure these musings won’t ever be referred to ever as art, I do hope that they’ll help all of us stay in the game.

Many thanks to the folks at Hard Fork for putting on an outstanding conference, I definitely learned a lot from the high-quality panels and speakers. Thanks to all the eToro clients who came out to see me from Amsterdam, London, and Germany. And special thanks to eToro for sponsoring this and many other events in the crypto space that serve as a petri dish for ideas and growth of the industry.

Today’s Highlights

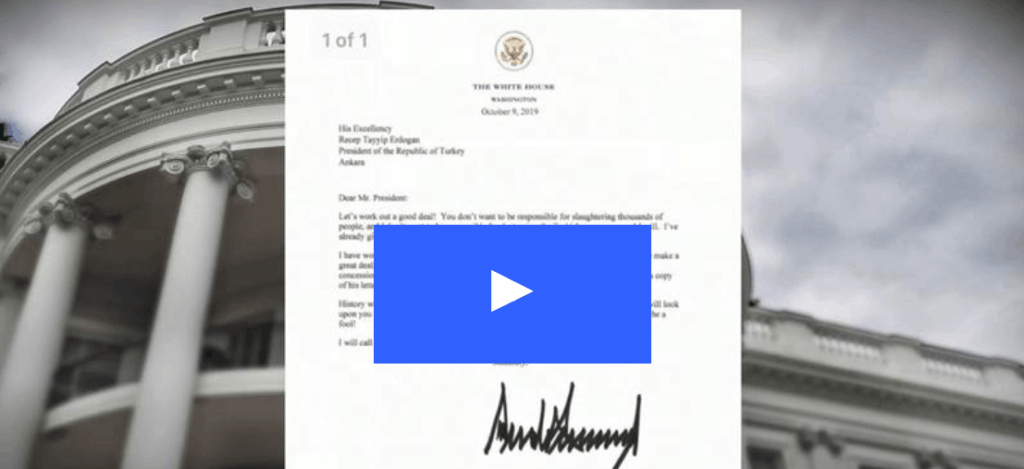

- Trump’s Letter

- The Tie

- Ton’s of fun

Traditional Markets

Ok, maybe they overdid it a bit. The language and syntax are certainly no surprise from this President and are more or less in line with what we see on twitter. The thing is, this letter is dated a week ago, before the incursion. Since then, it seems that Trump has changed his mind a bit, and no longer sees the Kurdish plight as an American problem.

Due to inaction from the President, it seems that Congress is now preparing its own measures.

The Tie Fighter

Even some of the bigger firms have started to scrape social media to gather market sentiment. This Reuters article from June, explains the phenomenon quite well. Now, thanks to social trading our clients can do it too.

The first product is a Smart Portfolio called TheTIE-

The Tie’s CEO Joshua Frank is quite sharp and the way he’s managed to cut through the noise of Twitter is pretty remarkable. I’ve personally been using the visual graphs at TheTie.io for a few months already and find them incredibly helpful.

More TON

The period of low volume consolidation in the crypto market persists. Though volumes are not quite as low as they were on Tuesday, it’s pretty clear that speculators are steering clear of taking any big bets for the time being.

Bitcoin does seem to be forming some solid support on the chart just above $7,500 per coin. It would be nice to see a bit of a bounce from here, but if it does break below there are still several levels of support just below.

Meanwhile, the delay of Telegram’s Gram distribution and the confidence blow to Libra have put a bit of a downer on the market. We should get more clarity on both of those pretty soon though.

Telegram’s hearing with the SEC is currently scheduled for October 24th. We hope for a clean resolution but it does seem like the devs are preparing for the worst and now considering a long delay of the launch, possibly until April 30th, pending investor feedback.

One day before that, on October 23rd, this coming Wednesday, Mark Zuckerberg himself will be taking the stand before Congress to pitch the Libra project once again. This should be interesting.

Wishing you a pleasant day ahead.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.