Hey Joe…

I heard you shot Bitcoin down. And that ain’t cool.

For those of you who don’t know, Joe Weisenthal is one of Bloomberg TV’s most talented anchors. He has 180,000 followers on Twitter and is considered by many, myself included, to be a world-class economist.

In lieu of his recent attacks on the crypto community, and with homage to the greatest guitarist who ever lived, this is an open letter to him.

Don’t get me wrong, the explanation you gave about the way price discovery works in the Bitcoin market is spot on. Excuse the pun. In fact, I’ve used the same exact analogy to describe the harmony between speculators and real-world supply and demand.

However, the premise of your argument is fundamentally flawed, which seems to have led you to a false conclusion that “Bitcoin is for making transactions against the man.”

Bitcoin is a free and open network. Meaning, that any person can use it in any way that they wish. Other purposes to use Bitcoin that are not ‘sticking it to the man’ related include but are not limited to…

- Remittances – Sending money from the 1st world to the 3rd much faster and cheaper than current options, especially for those who don’t have a bank account but even for those who do.

- Embedding information (links/text/images) within the blockchain, creating a permanent and public record of them.

- Reconciliation of data. To some estimates, more than 30% of BTC transactions are done by VeriBlock.

Of course, I was delighted to see your latest clarification that you were not actually attacking Bitcoin, but rather some of the members of the community who are trying to whitewash Bitcoin’s anti-establishment roots.

Here again, you are absolutely correct!

Satoshi Nakamoto was very explicit in the reason for creating Bitcoin. As a kind reminder within Bitcoin’s first block, he embedded the following image so that we never forget.

The intention here is clear. Bitcoin was created to provide an alternative to the current financial system, which is controlled by governments and banks. To give people the choice to opt-out.

Now, that doesn’t mean that these people are necessarily doing something wrong.

In a memo to investors yesterday, Howard Marks of Oaktree Capital, who’s words always penetrate, spoke about the alarming level of negative-yielding debt and the possible devastating consequences it could have on the global economy. In it, he recalled a conversation he had with his banker in 2014.

The point is, for those with large wealth, there’s no real alternative to banks and with interest rates only slipping deeper, this doesn’t quite seem fair.

So in addition to the above, we should probably also list some of the reasons that people use Bitcoin that are ‘anti-establishment’ but not necessarily illicit.

- Hedge against inflation and/or avoidance of negative interest rates.

- Divestment from traditional financial assets for ideological reasons.

- Protection from oppressive governments. Many thousands of Venezuelans have already reaped these benefits and certainly many more nations throughout history would have benefited from having an option like this.

- In 1999, Nobel Laureate Milton Friedman stressed the benefitsof an e-cash system for the purpose of avoiding taxation, which he felt would have a very positive impact on the economy, and will be a good thing despite the possibility of illicit use.

Due to the pseudo-anonymous nature of Bitcoin, it’s very difficult to say exactly how people are using Bitcoin most.

Again, you say you’re not attacking Bitcoin, but the end of your editorial note you did specifically urge lawmakers to think twice before approving a Bitcoin ETF. Ergo, according to your own explanation of price discovery would be somewhat harmful to price stability.

As an influencer, you have a loaded gun and you’ve handed it to the lawmakers who are trying to shoot Bitcoin down.

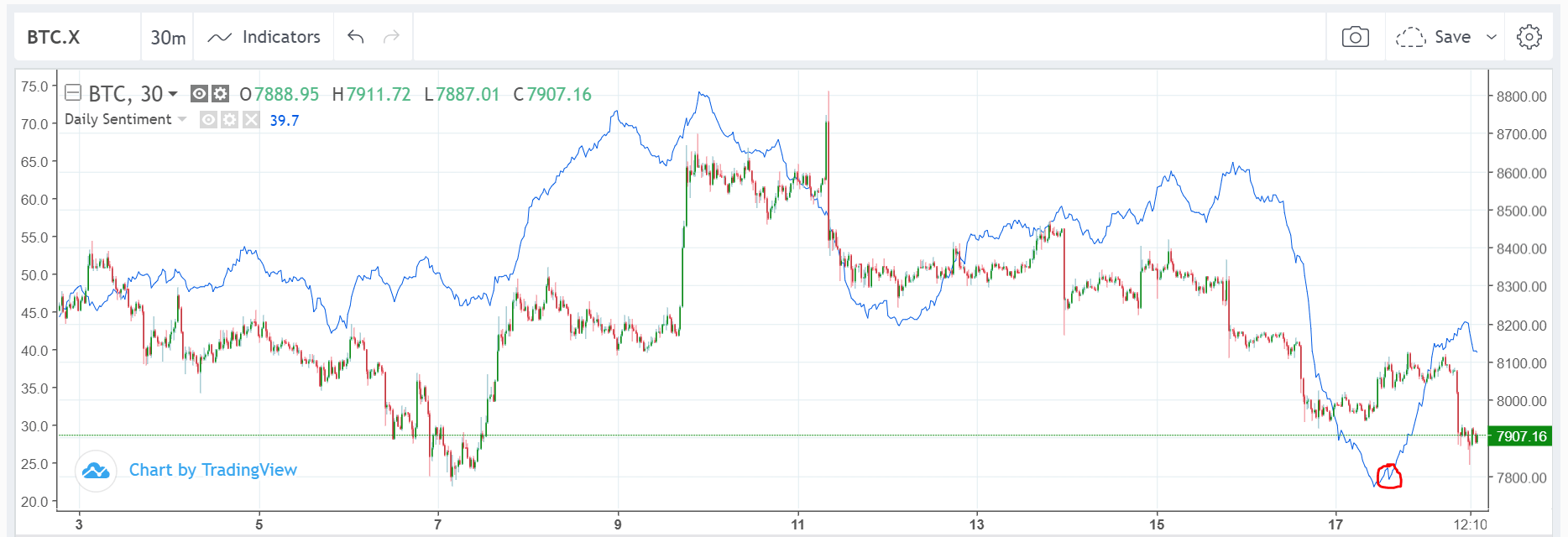

Still, the discussion you’ve created on Twitter does seem to have had a positive impact on overall sentiment. We can see that Twitter sentiment (the blue line) was at an extreme low at the time of your original tweet (red circle) but has since rebounded.

(Chart source The TIE. Past performance does not indicate future results.)

In conclusion, I just wanted to say that Bitcoin is nothing less than a vehicle for freedom. If US authorities believe in the principles on which the country was founded, if America truly is the land of the free, they should be embracing it. If they do not… well that’s why bitcoin was invented.

Please note that this is not investment advice. I myself have only a small percentage of my own portfolio in crypto at the moment as it is very risky at this time.

For all dedicated readers of these daily updates, thanks for following along. Please note that there will be no market update on Monday due to a local holiday. We’ll resume as usual on Tuesday the 22nd. Have a fantastic weekend. Goodbye everybody. Ow!!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.