With a current market cap of $142 billion USD (at the time of writing), bitcoin is doing pretty well for itself. Fuelled by accessibility, exchanges like eToro are bringing Bitcoin to the masses and creating a convenient entry level to buying and trading the cryptocurrency. The once fledgling (and only) cryptocurrency has grown from its incredibly humble roots to be the leading coin at the helm of a cryptoasset empire. So when will bitcoin reach a $1 trillion market cap?

Current market cap

Bitcoin’s price currently sits at $7943.77 USD a coin, and the overall market cap is $142 billion. Bitcoin has been the catalyst for establishing a flourishing cryptoasset market in only 11 years. As the coin’s market cap grows, so too will the rest of the industry. Bitcoin reaching $1 trillion will be hugely influential on the longevity and long-term success of the cryptoasset sphere.

INVEST IN CRYPTO NOW

Your capital is at risk.

So, when is it going to reach a $1 trillion market cap?

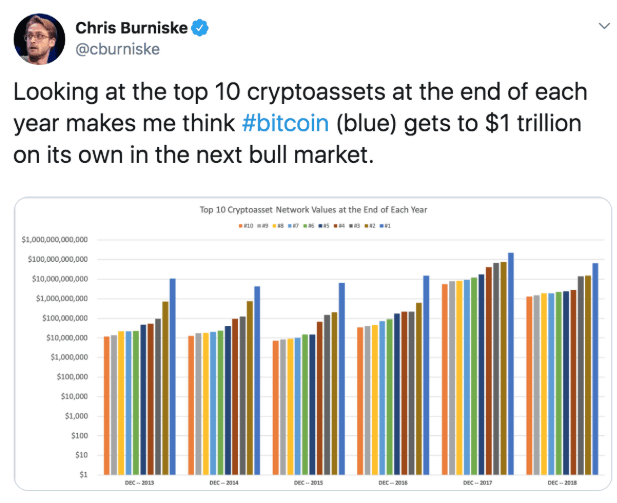

Chris Burniske, a prominent investor, partner at Placeholder, and former crypto lead at ARK Invest, believes that Bitcoin will reach $1 trillion USD in the next bull market, and he might be onto something. In a recent tweet, Burniske stated, “Looking at the top 10 cryptoassets at the end of each year makes me think #bitcoin (blue) gets to $1 trillion on its own in the next bull market.”

And he’s not the only one. Karim Heiden, a business developer with over 27 years of experience, released an article on Medium arguing that bitcoin would reach $1 trillion if the bitcoin ETF is approved. He also believes that bitcoin ETF approval is inevitable, and will be followed by a long bull market – similar to when gold was ETF approved.

Willy Woo, a cryptoasset market analyst and partner at Adaptive Capital, believes that bitcoin’s market capitalisation will surpass $1 trillion in the next few years. He argues that the next cycle will take bitcoin’s market cap to heights that rival gold in regards to value. Woo also states that he sees bitcoin as the dawn of a “digital age”, and as something we should consider in a wider context, not just within the realms of the cryptoasset industry.

Bobby Lee, CEO of BTCC, believes that bitcoin could reach $200,000 in the near future. Lee said, “We are in one of many, many cycles to come. Any cycle will take us to higher and higher heights. I’m quite confident sitting on my bitcoin investment that in a very short amount of time we’ll exceed $20,000 and go to $50,000, $100,000, even $200,000.”

He reiterated Woo’s thoughts – claiming that bitcoin could surpass the market cap of gold within the next few years ($7 trillion).

How will bitcoin reach $1 trillion?

In order to reach a $1 trillion USD market cap, bitcoin (BTC) would need to trade at $58,000 a coin at the current supply (around 18 million). Considering that the price of BTC has been climbing steadily this year, it wouldn’t be far fetched for it to reach that within the next few years, particularly if we enter a bull market.

As more bitcoin enter the cryptoasset markets, the less each coin would have to be valued at to reach $1 trillion. Once we hit total supply of 21 million coins, each bitcoin would need to cost $47,400 to hit the $1 trillion market cap.

INVEST IN CRYPTO NOW

Your capital is at risk.

Bitcoin to reach $1 trillion sooner rather than later

There are some widely differing opinions among the various analysts in this article. However, one thing remains pretty constant: they all believe that Bitcoin could viably hit a $1 trillion USD market capitalization within the near future. “Near” being within months or a few years. So, when will Bitcoin reach a $1 trillion market cap? Potentially a lot sooner than we think.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.