Welcome to Summer!! Watch out, it’s hot.

After the prolonged crypto winter that was 2018, this year has seen the crypto market as the best performing asset class of 2019 by far, and that was just spring.

Last nights gain of about 14% is a clear indication of the extreme heat and the change of season. Careful before rejoicing though. If we’ve learned anything from the movie Frozen, euphoria can be dangerous. Remember Olav’s solo song?

Though we haven’t seen any of the dramatic hazards that sometimes arise from over-enthusiasm just yet (too much web traffic, congestion in the blockchain, etc.), a massive bull market retracement of 20% or more is always a possibility. So, please trade with caution and always diversify your portfolio.

Now, let’s take a look at who’s driving this thing.

Today’s Highlights

- Ghost Town

- Bitcoin is in charge

- It’s the insiders

Traditional Markets

We’ll make this section short and sweet today. Not only is it completely not what you’re interested in, but also nothing much has changed lately. Central banks are extremely dovish and everyone is looking forward to the Trump Xi Meeting in Osaka at the end of the week.

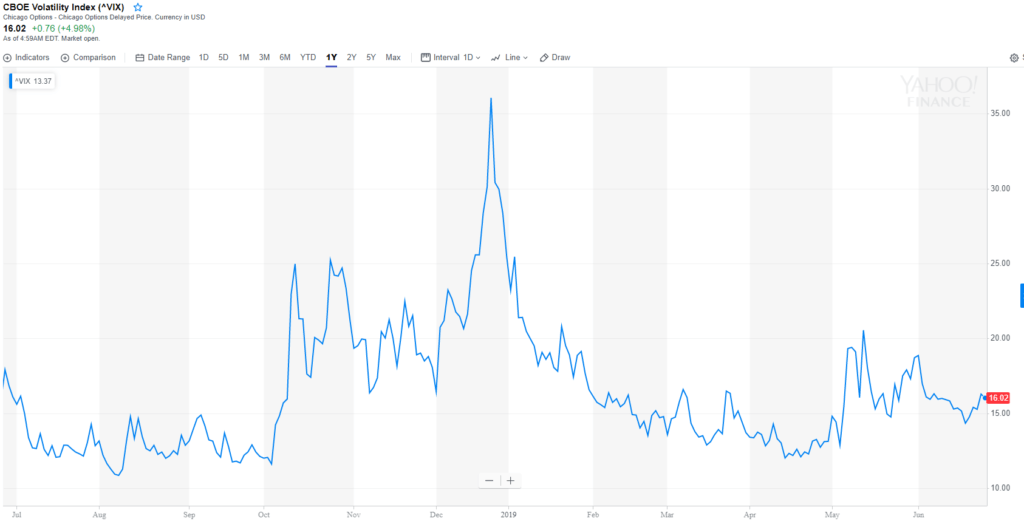

The VIX is dead. This place is a ghost town.

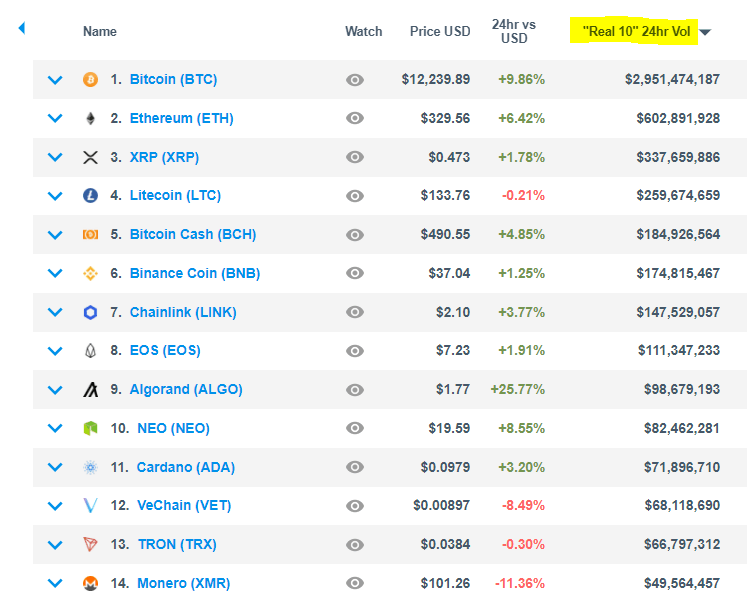

It’s not Alt-season

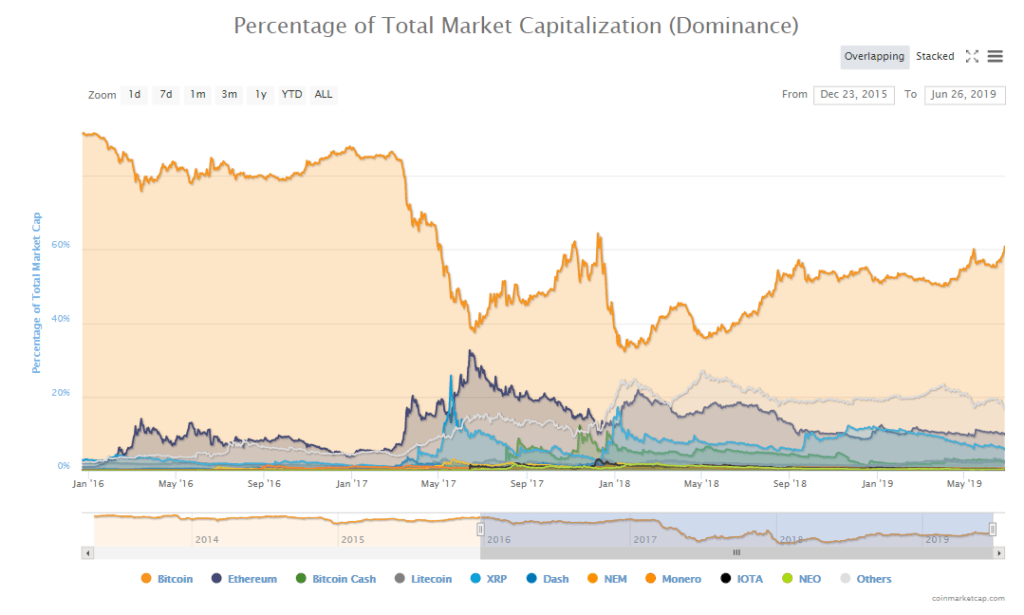

Yes, there has been some movement in the altcoins but please don’t call this altseason. Bitcoin is very much in the driver’s seat of the crypto market right now.

The bitcoin dominance index is at its highest level since 2017 and rising fast.

Not to mention performance. The only alt currently outperforming is NEO, and it would be difficult to say that ‘Chinese Ethereum’ is driving anything.

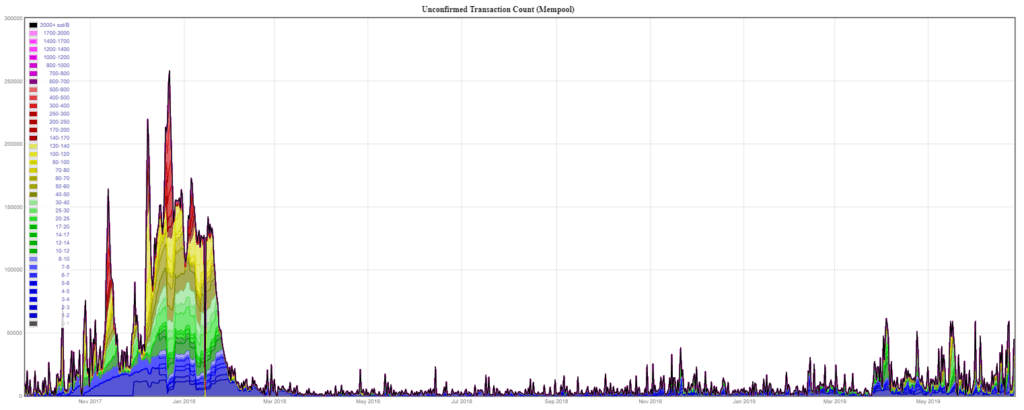

Overall, the breakout last night happened on very strong volumes across the board. That includes exchanges, futures, and on chain transactions. Still, bitcoin is handling the load with ease and the mempool’s waters are fine. Meaning, there’s absolutely no congestion in the bitcoin blockchain and there are very few transactions waiting to be confirmed.

So what is driving Bitcoin higher?

Industry insiders know very well what’s driving the market and indeed have been expecting this bull run for quite a while now. That’s because they are the main driver.

That’s right…

All the data that we have indicates that the current rally is coming from CryptoTraders, like you my readers, who are already familiar with this unique market.

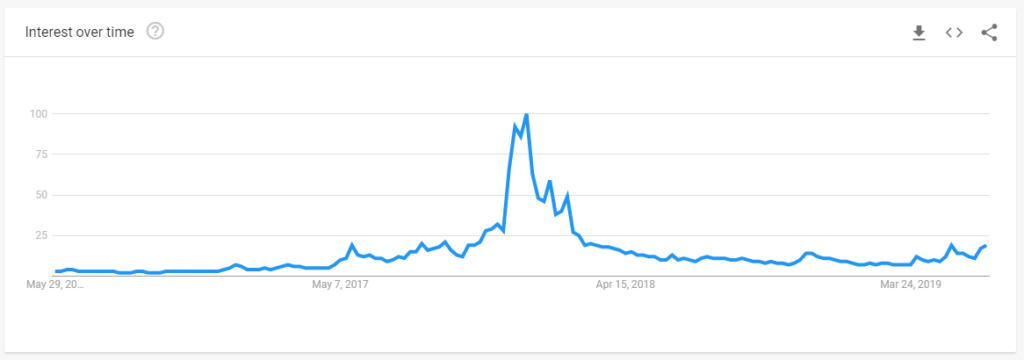

Let’s start off with this graph from google trends data for the search term ‘bitcoin’ over the last three years.

There has been a steady rise since the start of this year but the level of queries is nowhere near what it was at the peak of the last cycle. This tells us that those buying at the moment don’t necessarily need to go through google.

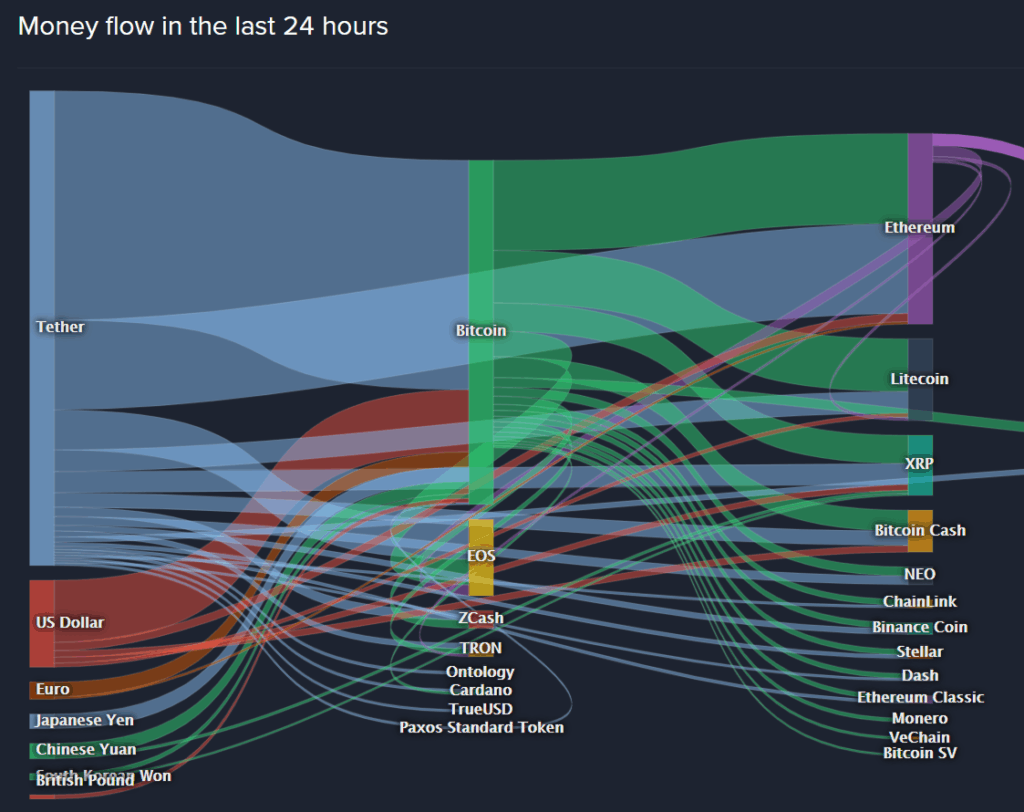

This assessment is consistent with data from coinlib, which shows the following map of money flows in the crypto market. As we can see, the bulk of inflows to bitcoin and ethereum are coming from USDT.

There is fresh fiat coming in, but it seems that most of the action is coming from money that’s been sitting on the sidelines in stablecoins.

The why is known as well. We covered the many reasons Monday’s market update, so feel free to review it here, or review our weekly interview with CoinTelegraph where we discussed the four main drivers.

As always, let me know if you have any questions or if you need anything further from my end.

Have a pleasant summer!!

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.