Commodities Hopes Hangs on China

The year of the Sheep on the Chinese calendar has only just begun and already economic events are plentiful. The Chinese central bank, the Peoples Bank of China, had surprisingly cut interest rates on the 28th of February and this week we expect a flood of data on China’s economy. With China the biggest force behind demand for commodities, especially precious metals and energy, it is unsurprising that commodities players are watching developments in the Chinese dragon with singular focus. The inevitable question arises then; can China’s economy stabilize? If it can, then a case can be built for crowding back into commodities such as Gold, Silver and perhaps even Oil. Investors, however, expect data to be rather weak in tandem with the latest rate cut and with another expected cut in the next quarter. So what do investors want to see happen in order to turn optimistic on commodities?

The first is inflation; with inflation falling to a YoY pace of 0.8% investors will expect it to slow to something in the ball park of 0.5% YoY, which would signal that China’s inflation is low enough for another rate cut but not so low that it turns ugly. But an inflation rate lower than 0.5% and closer to 0% will spell bad news as it will signal that the situation in China is deteriorating. The second will be loans; the slowdown in China’s credit market is at the core of China’s weakness and thus at the core of weakness in the commodities space. After the plunge in new loans in February, investors will expect a slight improvement in this Tuesday’s release of new loans data but be forewarned; further deterioration in the figures could spell more trouble for commodities. On Wednesday retail sales figures and industrial production are due. While China’s retail sales data is always important, industrial production data will actually be the final piece of the Chinese puzzle. If industrial production decelerates from 7.9% YoY, that will hurdle appetite for commodities, if it accelerates further, however, it will be a positive turn in the commodities space.

Overall for Gold, Silver and Oil, the bottom line will be this – a not-so-weak China is a great excuse for betting on a commodities rebound, while a deteriorating China means a rebound in commodities might be postponed.

Wall Street Wants Strong Retail

As the week progresses, the center stage will move quickly from Beijing to New York, with Wall Street eyeing the highly watched US retail sales figure. After the NASDAQ composite hit the 5,000 mark, its highest point since the dotcom bubble, and with the S&P500 revolving near an all-time high, investors will want the backing of a strong American consumer. With the US consumer the pillar of the US economy and a strong force behind Wall Street gains, it’s only natural to assume a positive retail sales figure is needed to allow further gains on Wall Street. After plunging -0.8% MoM in the latest reading, investors on the Street will want a turnaround, eyeing at least a 0.5% gain, if not more. If, indeed, retail sales turns a corner it could pave the way for further gains on Wall Street.

Down to Business

This week the play will be rather simple. On the commodities front, a picture that is not so ugly in China could help a rebound in Gold, Silver and Oil, although more is needed for a long term rebound. When it comes to America and Wall Street, simply put, Wall Street wants to see confirmation that the American consumer is back and spending in order to push indices higher into new records.

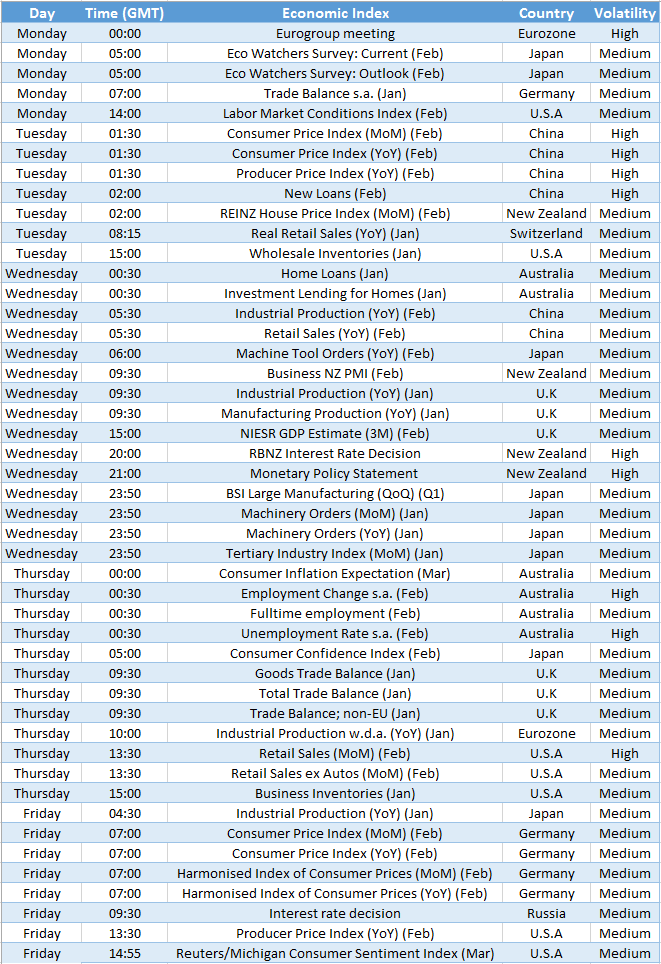

On the Plate

Chinese CPI (Tuesday) – If Chinese CPI will hold at or above 0.5% that will be considered positive for china and commodities.

Chinese New Loans (Tuesday After falling to 1.47Bln RMB on last month’s release, investors will want a rebound in new loans before turning optimistic on china and commodities.

Chinese Industrial Production (Wednesday) – If industrial production will continue its 7.9% YoY growth pace or rise above that will be perceived as positive for China and for commodities.

Chinese Retail Sales (Wednesday) – If Retail Sales will rise above 12% YoY that will be considered strongly positive.

RBNZ Rate Decision (Wednesday) – If the Reserve Bank of New Zealand will be tempted to cut rates, it could ignite a heavy Kiwi selloff.

Australian Unemployment (Thursday) – If Australian unemployment will surge above 6.4%, it could hurdle the positive sentiment on the Aussie from last week’s no rate change.

US Retail Sales (Thursday) – The main event for Wall Street. If Retail Sales will rise by 0.5% or more MoM, it will allow indices on Wall Street to surge higher.

The Reuters/Michigan Consumer Sentiment (Friday) – An improving consumer sentiment could help Wall Street rise higher, providing retail sales indeed deliver a day before.

Chart of the Week- EURGBP