Nervous Jitters Ahead of Non-Farm

This week, both FX traders and Wall Street will be on high alert for some choppy trade. The reason? The Federal Reserve has essentially said that they are gauging the likelihood of a future rate hike solely on data. Since the Fed has now removed the word “patient” from their communications, it is data then which could tilt Fed policy, in either direction. A disappointment from US data could mean rate hikes in the US might be postponed even as far back as next year while robust data could bring a US rate hike even closer, possibly this June. This, of course, will have a significant impact on US dollar trade and on Wall Street. Strong data, which means a closer rate hike, could support the dollar but weaken appetite for indices such as the S&P500 or the Dow, while weak data would naturally mean lower rates for a longer period and thus favor Wall Street even as it undermines the dollar.

With rising volatility around the dollar and uneasiness on Wall Street, investors are preparing for a choppy time. For many investors, US data, good or bad, could warrant a rather quick reaction, flipping from bullish to bearish and vice versa at the speed of light before the dollar either plunges or surges. With US data likely to have that kind of impact it is not surprising that investors are twitchy this week, especially given the importance of Friday’s release of Non-farm Payrolls (NFP), perhaps the most highly watched US data set. Estimates range from between 280K and 300K job gains for March with the unemployment rate holding at 5.5%. Moreover, this time around, average weekly earnings will also be watched as an indication of whether US wages are set to continue to rise or not.

So how could this week’s NFP affect sentiment? If the NFP figure is north of 280K, and if employment holds at 5.5% and average earnings rise by more than 2%, that will allow the dollar to recover after losing some ground last week while Wall Street could take a turn south. However, a miss on the estimates will greatly disappoint and could lead many investors to trim their gains on the dollar, take profits and flip either to neutral or bearish on the dollar while crowding back into Wall Street indices such as the S&P500 or the Dow.

European Reality Check

While Friday’s NFP release is expected to be the week’s main event and the climax, until then the markets’ attention is set to revolve around Europe where investors will get an important reality check on the UK, Germany and the Eurozone. In the aftermath of unexpectedly positive PMIs from Europe last week, another round of better-than-expected data could prepare the grounds for a rebound in European currencies alongside European indices. On the agenda are Eurozone unemployment, Eurozone inflation and UK GDP growth. Of those three, Eurozone inflation and UK GDP growth will be the most highly watched. If the Eurozone’s CPI (inflation) bounces back from its 0.3% YoY low last month, and if the UK’s final GDP growth figure for 2014 is revised higher than 2.6% YoY (February reading) then investors could get the sense that the worst for the Eurozone is over and blue skies are ahead for the UK and thus they could begin to flip their positions towards shorting the dollar and buying everything European, from currencies to equities. However, for this move to get into motion with any significant momentum, Friday’s Non-farm Payrolls needs to be a miss.

Down to Business

Overall, investors are becoming increasingly uneasy about the dollar and increasingly more optimistic about Europe (both the Eurozone and UK) but they will still want tangible proof that their gut instincts are correct before betting against the dollar. Therefore, only if the NFP misses will the Euro and the Pound Sterling have the opportunity to properly rebound. Of course, this has to come with a beat from European data. Any other scenario could allow the dollar to regain lost ground while Wall Street gains could face some headwinds.

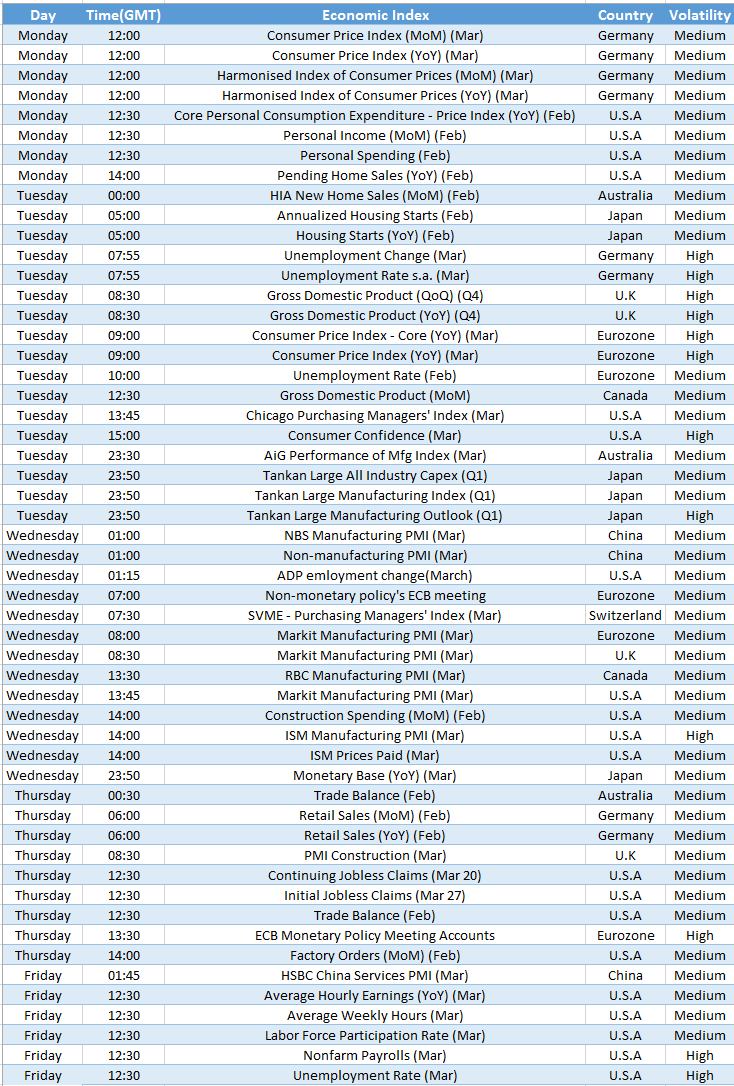

On the plate

US Personal Spending (Monday) – If personal spending rises by 0.2% or more it will positive for the dollar.

UK 4th quarter GDP (Tuesday) – if UK growth YoY is revised above 2.6%, it will benefit the Sterling.

Eurozone Inflation (Tuesday) – If Eurozone inflation will bounce back from -0.3% it will favor the Euro.

Eurozone Unemployment (Tuesday) – If Eurozone unemployment will rise above 11.2% it may undermine a Euro rebound.

US Consumer Confidence (Tuesday) – If consumer confidence rises above 96.4, it will raise the bar for Friday’s NFP and could favor the dollar in case European data is mixed.

US ISM Manufacturing (Wednesday) – Will shed light on US Manufacturing. If the ISM figure beats estimates, it will support Wall Street gains while dollar traders are expected to wait for Friday’s nonfarm.

ECB Meeting Minutes(Thursday) – Investors will read through the protocol of the last ECB meeting in order to understand whether there is a chance for more ECB easing in the future.

Nonfarm-Payrolls (Friday) – The main event of the week, if the NFP is at 280-300k or above it will allow the dollar to maintain its bullish momentum.

Chart of the Week – Oil