The US Finale

As the dust from the ECB QE announcement begins to settle, investors’ focus will shift to what we call the US finale; that is, a combination of US growth figures for 2014 and the Federal Reserve’s rate decision which, together, will set the final tone for the US economy for last year and establish the future tone for the US Dollar and Wall Street.

The first of the two major events will be the Fed’s rate decision which always takes place on a Wednesday. Thus, the first part of the week will be a buildup of sorts to the FOMC meeting, its results and what the FOMC members have to say about the rate outlook for the US Dollar. Interestingly, there are two diverging dynamics which worry Dollar bulls and support Dollar bears; the first, the fact that while US growth seem to be robust, inflation, the second, is cooling, to a large extent, thanks to Oil. It is this divergence that intrigues investors who are looking to see how exactly the Fed will approach the latest fall in CPI (MoM) of -0.4% and the slowdown in core inflation to 1.6%. If the Fed (and by the Fed we mean Janet Yellen, in her speech) refers to the latest cooling inflation as “transitory” and shrugs it off with positive upbeat views on US growth and through further hints on an upcoming rate hike, then investors will treat inflation as a secondary affect and will continue to pile on the Dollar. But if Yellen voices concern over the latest inflationary figures, investors will conclude that it might be time to take a wait-and-see approach; that is, wait for more US data to shed brighter light on the US economy before assessing the chances of a Fed rate hike.

And that brings us to the second major event. This Friday, analysts in the bullish camp will be looking for a nice round 5% growth figure for the US economy in 2014, which would certainly be a robust figure. If, earlier in the week, the Fed seems rather vague and balances its rhetoric between the positivity of growth and the slack of low inflation, then US growth at 5% could leave investors with a taste for higher rates. For investors, a 5% growth rate is sufficient to continue to lower unemployment, bring wages higher and eventually heat inflation back to 2%, and as you guessed it, bring forth the Fed’s long awaited rate hike. If the Fed remains hawkish in its view, however, investors will approach the growth figures with less worry and might then swallow even a 4.8% growth pace without automatically liquidating Dollar bullish bets. Nevertheless, and this is the third option, a balanced Fed that raises concerns of falling inflation and growth below 5% could turn sentiment a bit sour for the Dollar and shift trade to somewhat more of a range bound. As for Wall Street, a chance for a postponed interest rate hike, coupled with a decent growth pace, might actually benefit major indices in the short term. However, for the long term, even Wall Street would “prefer” to see a new balance of high growth, stable inflation and higher rates in order to prosper.

Down to Business

As expected, the two main events, the FOMC rate decision on Wednesday and US growth on Friday, will dominate global sentiment. Overall, we see three major options. The first is a hawkish Fed and an upbeat growth figure of 4.8-5% growth; this will continue to support the dollar. The second is a balanced Fed and a growth figure at 5%, which will still allow a firm Dollar. The third is a balanced Fed and disappointment from US growth, which could move the Dollar into range bound while Wall Street might end mildly higher.

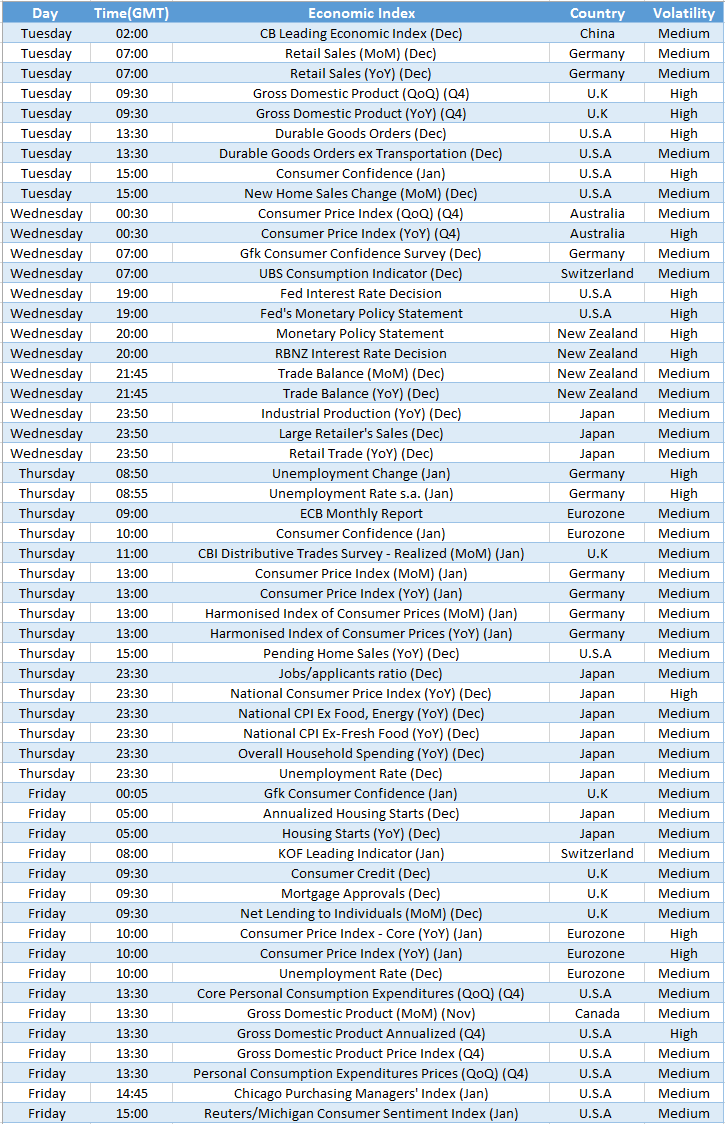

On the plate

UK GDP(Tuesday) – If figures will confirm assessments of a 2.6% growth, it will allow sterling to advance vs its weaker peer, the Euro. However it is doubtful it will allow some headway vs the dollar now that the US is growing almost twice as fast. Nevertheless a reading closer to 3% could change that.

US Durable Goods(Tuesday) – Will provide a sneak preview on the potential of US growth for 2014, but will take a back seat to the actual figures in Friday.

US Consumer Confidence(Tuesday) – US Consumer confidence is always important amid the pivotal rule of the US consumer in the US economy. A strong figure will create a positive buildup ahead of the FOMC Meeting.

FOMC Rate Decision( Wednesday) – One of the two major events of the week. If the Fed chairman will signal she is concerned with the fall in inflation it could soften the dollar until Friday’s GDP release. A hawkish Fed however, will continue and support dollar strength.

Japanese CPI(Thursday) – If Japanese inflation will tick higher it will be positive for the Yen. A fall in inflation however, could raise bets on further BoJ stimulus.

Eurozone CPI(Friday) – If Inflation(CPI) in the Eurozone will fall further into negative territory and below -0.2% ,it could undermine the Euro even further.

US GDP growth (Friday) – The most important GDP result of the year, as it will reveal the growth picture of the US economy for 2014 as a whole. If figures will reveal a 4.8-5% growth it will be considered positive for the Dollar and Wall Street. Anything lower and dollar bullish bets may be put on hold, depending of course on the Fed statement two days before.

Chart of the Week – USD/JPY