Does the Eurozone Have a Pulse?

After the ECB officially began its QE program in the second week of March with €60 billion in liquidity due to be injected per month, the Euro has, not surprisingly, continued with its nose dive. Yet, while the Euro has plunged, Euro-denominated indices, such as the German DAX , the French CAC40 and the Spanish IBEX, have surged amid optimism that the low Euro will lead to better growth and that the ECB’s QE will favor European indices. Coming in to this week, investors in European indices will want to see more evidence of a Eurozone recovery before pushing indices even higher.

The series of upcoming sentiment indicators, from Germany, France and then the Eurozone as a whole, will provide an answer to a very important question; does the Eurozone still have a pulse? The series of PMIs data will shed light on whether businesses are turning more optimistic, and if they are, the chance for better than expected Eurozone growth along the road. All PMIs are set to be released this Tuesday, led off by the German manufacturing PMI and services PMI. Alongside Germany’s PMI, France is also due to release its own PMIs and then it will all be followed by the Eurozone’s composite PMI, which will reflect on the business climate in the entire economic block. With these broad-based sentiment indicators, investors are expected to get a pan-European sentiment reading, but what will they want? Two things; first, that all PMI indicators must all be above 50, since a reading above the 50 threshold signals growth, and second, that all have surged above their respective reading from the previous month. A combination of both will signal that the Eurozone does still have a pulse, and it could give the green light to investors in European indices to keep crowding into bullish bets and push indices higher, while it may also suggest that there is a chance for a Euro bounce somewhere along the road.

Inflation Coming Back?

After measuring the Eurozone’s pulse, investors will quickly shift to another important set of data points, specifically, inflation. Inflation around the world has dramatically slowed yet only the US and UK central banks are able to even ponder the possibility of a perhaps imminent rate hike. With UK and US CPI readings (inflation) due this Tuesday, investors will want to see core inflation (which excludes food and energy) bouncing back. Why? In the US, a core inflation reading of 1.6% or above will provide support for the dollar and anchor the bullish trajectory. In the UK, a reading of core inflation above 1.4% could allow the Pound Sterling to establish a floor against the dollar and regain bullish momentum against it other peers, the Euro and the Yen. Of course, a disappointment on either or both fronts will lead to profit taking in the respective currencies, i.e. the pound or dollar or both.

US Final for 2014

The week will finish with the US final release of 2014 GDP growth numbers, thus officially sealing 2014 for the US economy. After 2.6% in annualized growth was disappointingly revised downward to 2.2%, dollar bulls are likely not going to handle another disappointment very well. If the final 2014 revision of growth for 2014 is once again lowered to below 2.2%, it could undermine dollar strength mainly against the Pound Sterling and Gold, which is considered a counter-dollar trade.

Down to Business

Overall when it comes to the dollar, core inflation has to be at or above 1.6% and GDP growth at or above 2.2% annualized. Both will allow the dollar to preserve its appeal if, indeed, they meet expectations, but a disappointment in either or both could curb dollar gains. When it comes to Europe, PMIs must deliver for further gains on European indices, and in the UK, core inflation must crawl higher, above 1.4%, for Sterling to hold ground.

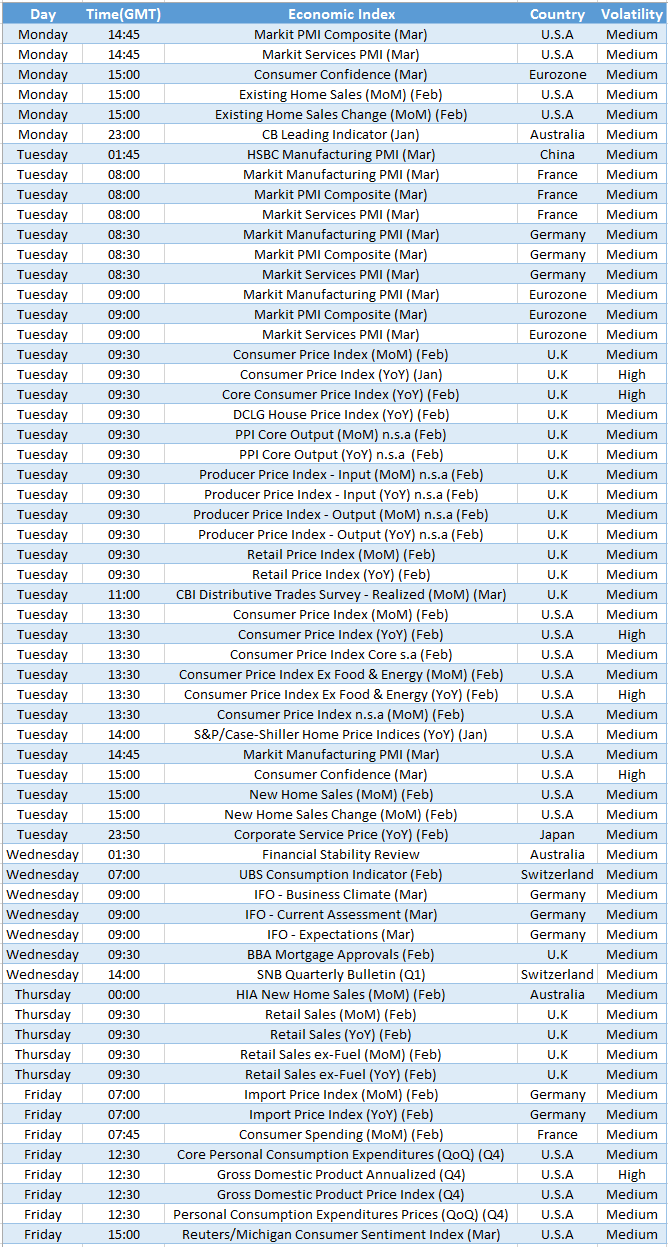

On the Plate

European PMIs (Tuesday-) PMIs from Germany, France and the Eurozone as a whole are set to determine sentiment for European Indices.

UK CPI (Tuesday) – The main focus will be the core CPI (excluding food and energy). If the Core CPI YoY is at or above 1.4%, it is expected to favor the Pound Sterling.

US CPI (Tuesday) – If US Core CPI will hold or rise above 1.6% it is expected to benefit the US Dollar.

US Consumer Confidence (Tuesday) – If consumer confidence rises above 96.4, it is expected to favor both the dollar and Wall Street.

Germany IFO Business Climate (Wednesday) – Alongside the PMI data, the IFO is expected to impact sentiment for the German DAX.

UK Retail Sales (Thursday) – If UK retail sales bounces back after falling by -0.7% MoM, that will raise appetite for the Sterling as well as for the FTSE100.

US GDP (Friday) – If US GDP for 2014 holds at 2.2% annualized that will be positive for the dollar. Anything lower could ignite some form of profit taking.

Chart of the Week – USDJPY