Inflation, Growth and Central Banks

This week, the focus of the financial markets will have three dimensions; inflation, growth and central banks. On the agenda for the week: Growth figures from Germany, the UK and US, inflation data from the US, the UK and Japan, and speeches from ECB President Mario Draghi and Federal Reserve Chairman Janet Yellen. Overall, what investors will try to draw from all of that is a global heat map – a heat map of opportunities. Investors will try to identify the good, the not so good and the ugly. The combination of data and speeches should leave FX investors with a much clearer picture of where the market might be heading, whether it’s a Dollar rally, a Sterling recovery or a Euro collapse. The question is how will investors use the data to carve out a strategy?

German Growth, European Inflation

When it comes to the Euro, after such a significant collapse in value, investors are constantly on the lookout for the “sweet spot,” aka the moment when things in the Eurozone prove not to be as bad as initially feared. For a Euro rebound to happen this week, investors will need three things to occur: Inflation to stop falling, German growth to be higher than expected (say, a 4th quarter surprise of upwards of 0.7% QoQ) and for Super Mario Draghi to outline no more easing ahead, at least in the near term.

While a surprise in German growth is very much possible, a halt in the slide of Eurozone inflation seems somewhat more farfetched. After all, the fall in inflation is the key reason why the ECB started its massive easing program in the first place. The fall of inflation into deflation (below 0%) appears to be “stickier” than any of the other Eurozone problems. Analysts expect to see a fall of the Eurozone’s headline inflation of as much as -0.6%, a worrying sign that could undermine the Euro if confirmed. Therefore, if inflation falls “only” by 0.2% (YoY), which is similar to last month’s decline, it could suggest that the downward pressure on inflation, which has been relentlessly hammering the Euro, could finally be abating. Last but not least, its Draghi’s words this Tuesday that will be thoroughly scrutinized by investors. If both German growth and Eurozone inflation surprise for the better, the final boost that the Euro will need in order to rebound would have to come from the ECB. If Draghi mentions the ECB’s readiness for more easing it could dash any hopes of a rebound. If, however, Draghi signals no more easing for now, and provided that the other parameters surprised to the upside, then a Euro rebound could form.

Fed Closer to a Rate Hike?

While in the Eurozone investors are hoping that things are not as ugly as first thought, in the US hopes are being pinned on a brighter picture than the one previously projected, especially after some disappointing data. However, data on 4th quarter growth and US inflation will be preceded by Janet Yellen’s testimony. In her testimony, the Fed Chairman will be asked to comment on the Fed’s policy. If Yellen presents a rather firm position that rate hikes are closer, it could prepare the groundwork for a Dollar surge. Then after the speech, the markets’ focus will move towards US inflation. For investors, low inflation, which is the highest threat to a rate hike, could compel the Fed to push back the timing on a rate hike. Low inflation, in this particular case, means a fall in US Core Inflation to below 1.5% YoY. Finally, the second release of US GDP for Q4 is due for release; if the figures are revised higher than 2.6% annualized, it would be an upbeat result and if combined with an optimistic Fed and stable inflation, together they could push the Dollar higher.

Down to Business

Overall this week will focus on the good vs the not so ugly. If Eurozone inflation outlook is not that ugly and Draghi is more upbeat, the battered Euro could stage a rebound. However for a rebound to metalize, US inflation must cool. Otherwise investors will judge US rate hikes to be close, an effect that will outweigh good news from the Eurozone.

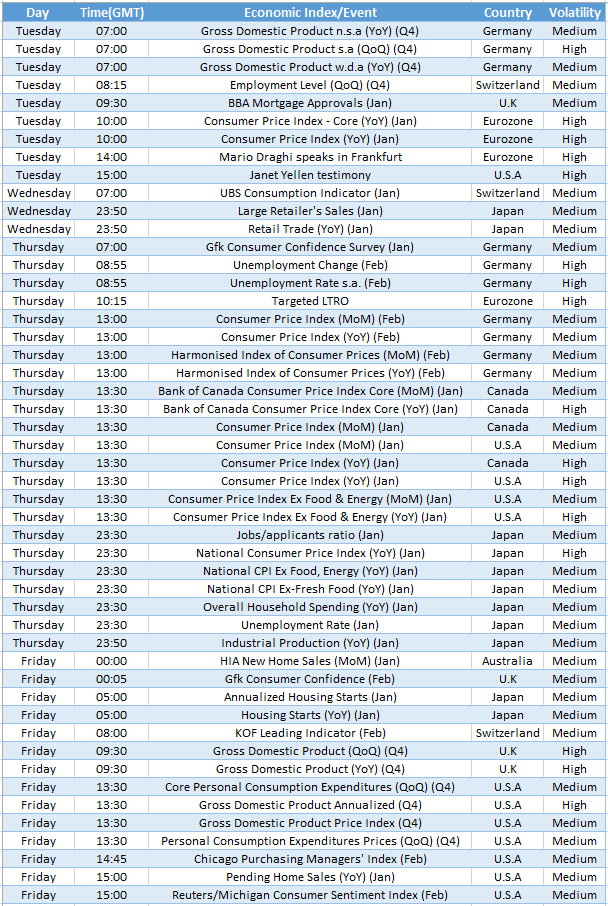

On the plate

German GDP Growth (Tuesday) – If German growth will be higher than 0.7% QoQ , it will be upbeat for the Euro.

Eurozone Inflation (Tuesday) – If Eurozone inflation will slide below -0.2% YoY it could hurdle a Euro rebound.

Mario Draghi Speech (Tuesday) – What Draghi will say is expected to have a strong impact on appetite for the Euro. If Draghi is ready for more easing the Euro could be hit, if Draghi is taking the wait and see approach it could benefit the Euro.

Janet Yellen Testimony (Tuesday) – If Yellen will signal rate hikes are getting close it will be highly positive for the dollar.

US Core CPI (Thursday) – A stable US inflationary picture is a key ingredient for rate hikes. If US core inflation is above 1.5%, it will raise chances for a rate hike.

UK GDP Growth (Friday) – If UK growth will exceed 2.7% YoY, the Sterling could regain some lost ground.

US GDP Growth (Friday) – If US growth will be revised to an annualized pace of above 2.6%, it could be a catalyst for more dollar gains.

Weekly Chart- EURJPY