Finally, a Euro Rebound?

Hopes of a Euro relief rally are beginning to appear. The EUR/USD has bounced back above $1.05 and thus far recovered more than 300 pips of its value. With PMIs readings from various Eurozone members coming in better than expected, and with unemployment falling and, most importantly, the fall in inflation slowing, Euro investors are becoming optimistic, albeit very cautiously. It’s hard to believe that only two weeks ago these fledgling hopes of a Euro rebound were nothing more than a distant perhaps even untenable dream, given the looming presence and outperformance of the US economy which tipped the scales firmly in favor of the Dollar and threw up roadblock after roadblock on the Euro’s attempt to recover above the $1.1 level. But, ever since the rude awakening and cold water that dollar bulls were splashed with after this month’s unexpectedly weak NFP results, Dollar sentiment has become noticeably shakier and the prospect for a wider Euro rebound notably higher. Still, with the $1.1 level posing formidable resistance, investors want more, and that brings us to this week’s events.

Is Draghi Ready to Hit the Brakes?

Of course, one of the main reasons for the Euro’s collapse over the past many months was ECB chief Mario Draghi’s willingness to add more stimulus to the Eurozone in the form of printing Euros. With 60 billion Euros printed each month, investors have either feared or hoped (depending on which side of the trade you are) that Draghi would be compelled to add more stimulus as the Eurozone economy continued to deteriorate. Yet, with the latest signs of a moderate recovery, or more aptly, signs of stabilization, Draghi may take a wait and see approach that could signal no additional easing from the ECB. If that does turn out to be the case, then at this Wednesday’s meeting, Draghi will hit the brakes on further stimulus (that is beyond the existing) and then the build up for a Euro rebound could start. But, as the saying goes, “it takes two to tango,” and the case for a rebound will also depend on what is happening on the other side of the equation, meaning the good ol’ US dollar.

US Inflation to Save the Greenback?

While the ECB’s rate decision is expected to be the key event for the week, in this dance between the Euro and the Dollar, more disappointments from the US economy need to materialize. This week we look to a rather important piece of data, namely US inflation. With US unemployment at 5.5% warranting a rate hike even despite the weak NFP figures for March, there are still the two other pieces of the puzzle that need to fit into place; the first is growth and the second is inflation. With growth for Q1 of 2015 due at the end of the month, the second piece of the puzzle, inflation, is the one in near focus. Inflation, thus far, is lower than the 2% threshold that is required for a rate hike. For the Dollar to weaken and the Euro to strengthen, US Core Inflation (inflation ex food and energy) needs to cool. Yet here lies the risk for a Euro rebound; on the last reading, US Core inflation surged to 1.7% YoY from 1.6% YoY. If Core Inflation surges even more in this Friday’s release, even as modestly as a rise to 1.8% YoY, investors could begin to speculate that rising inflation has just become a trend and, therefore, support the Dollar.

Down to Business

Overall, as we have illustrated, the EUR/USD is an intricate dance between the Euro and the Dollar and, therefore, two things need to happen for the EUR/USD to bounce back. Firstly, Draghi must become less pessimistic to convince investors to buy the Euro, and secondly US Core Inflation needs to cool or at least hold at 1.7%. If US inflation heats up, though, then rate hike bets on the Dollar will rise and it will be difficult for the EUR/USD to advance higher.

On the Plate

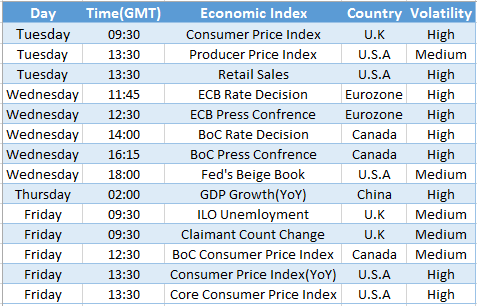

UK CPI (Tuesday) – If Inflation in the UK accelerates, it will support sterling demand ahead of the ILO unemployment release in Friday.

US PPI Index (Tuesday) – Will shed light on inflationary pressures coming from the producers’ side.

ECB Rate Decision (Wednesday) – Possibly the main event of the week. If Mario Draghi turns more optimistic it could lay the grounds for a Euro rebound.

US Retail Sales (Tuesday) – Will be highly watched by Wall Street. If retail sales rise more than 1.7% Yoy, US Indices could surge higher. Nevertheless, FX market movers are expected to wait for US inflation figures on Friday before deciding on their next move.

Fed Beige Book (Wednesday) – Will provide a reality check on the US economy ahead of the inflation numbers.

China GDP Growth (Thursday) – China’s data is always critical for sentiment in commodities and this time around it is no different. If China’s GDP growth for Q1 YoY will slow from the 7.3% YoY in Q4 2014, commodities could be exposed to selling pressure.

UK ILO Unemployment Rate(Friday) – Although a lower unemployment reading than the current 5.7% wouldn’t necessarily mean an imminent rate hike, it may certainly bring a rate hike closer and therefor support the Sterling.

US CPI & Core CPI (Friday) – The US Consumer Price Index and Core Consumer Price Index will dominate dollar sentiment. While CPI is important, most focus will be on Core CPI which excludes food and energy prices. If US Core CPI rises by 1.8% YoY or higher, it will support the dollar. If Core CPI rises by less than 1.7% YoY, dollar demand could soften.

Chart of the Week – EURUSD