Fed Rate Hike Coming Soon?

After last week’s NFP figures, new US data will shed even more light on the chances for a Fed rate hike and are set to dominate sentiment across markets. On the agenda; US inflation, capacity utilization, retail sales and the Fed’s beige book, all of which will help draw a conclusion to the big rate question.

In order for investors to feel more confident about the prospects of rate hikes in the US they need a combination of three pillars. The first is inflation; without inflation meeting the Fed’s target, it’s hard to imagine the Fed moving ahead on a rate hike hence the first priority is for inflation data (which is due out this week) to reflect an accelerating inflationary picture. Considering the slack to inflation that is expected to result from Oil’s slack, if core inflation (which excludes food and energy) holds at 1.7% or even crawls higher that will signal internal inflationary pressures in the US are rising and thus rate hikes are closer. With core inflation at 1.7% and the Fed inflation target at 2%, any data that suggests inflation inching closer to 2% would be viewed as an important cue for an approaching rate hike.

The second pillar is spending which is a reflection of retail sales; as a consumer-oriented economy and home of the world’s largest consumer sector (by dollar value) the US retail sales figure is tremendously important to global growth and especially for the dollar outlook. If retail sales continues to grow at a robust pace and adds more than 0.8% of growth in sales it will signal spending across the US economy is accelerating, a major pillar in the buildup towards a rate hike.

And the last pillar? The Fed’s Beige Book, which is also due out this week. With all the fuss around the Fed rate hike happening sometime this year it’s only natural that the Fed’s own account on the US economy catches investors’ attention. In the Fed’s Beige Book, the Fed will reflect on the latest trends in the US economy, encompassing all of the Federal Reserve Bank’s 12 major districts.

By aggregating those three pillars, by the end of this week investors will have gleaned a better sense of how close the Fed’s first rate hike in more than seven years may be and this “sense” will shape Dollar sentiment, as well as Wall Street’s.

Aussie Reality Check

While the major market moving events will generally revolve around US data, Aussie traders will have some drama of their own. The Reserve Bank of Australia (RBA) has moved its policy bias from that of easing to neutral over the past few months. Yet one of the RBA’s major concerns is the Australian unemployment level which had crawled to 6.3%. If Aussie unemployment deteriorates once again it could hit the Aussie Dollar. An improvement in the unemployment figure, however, could help fend off rate cut bets and allow the Aussie to recover lost ground, mainly against its Kiwi neighbor.

Down to Business

As expected, data from the US on inflation, retail sales and economic outlook (the Fed’s Beige Book) will dominate markets. If, indeed, investors get the sense that all barometers are pointing to accelerating inflationary pressure, bets on a US rate hike within the next few months will climb and the US Dollar could get another boost. If data is optimistic enough it could even allow Wall Street to climb higher. If Oil prices continue to take a swan dive this week, however, energy producers could weigh on Wall Street even while the outlook for the Dollar brightens.

On the plate

UK CPI & Retail Sales (Tuesday) – If UK inflation bounces back and Retail Sales return to grow, the Sterling could gain ground mainly against the Euro and the Yen.

US Retail Sales (Wednesday) – One of the three major events for the week. If US Retail Sales gain more than 0.8% MoM, it will enforce the case for a higher dollar.

Fed Beige Book(Wednesday) – The Fed’s account on the US economy from its 12 different districts. If the Fed will be upbeat on the US economy that will be reflected in a stronger Dollar.

Aussie Unemployment(Thursday) – If Australian unemployment falls below 6.3% or at least holds at 6.3%, it could fend off speculations on an RBA rate cut and assist the Aussie in gaining lost ground vs the Kiwi.

US CPI (Friday) – If US core inflation moves closer to 2% it could ignite strong demand for the dollar.

Eurozone Inflation Final Release(Friday) – After the flash estimate last week , the Eurozone finale CPI will reveal just how deflationary is the Eurozone and therefor how imminent is another ECB QE.

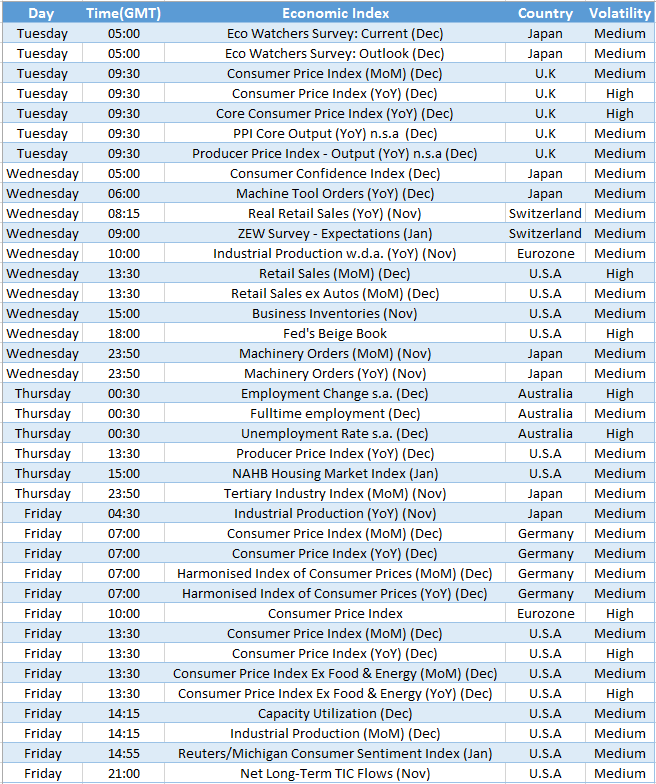

Chart of the Week – AUD/JPY