A Critical Week for the Euro-Dollar

This week will undoubtedly be a critical one for the EUR/USD pair, the most traded FX pair in the world. Central to it are two major events, oceans apart but which will, nonetheless, dominate the dynamics for the pair in the weeks that follow. In Europe, the ECB rate decision is due out followed shortly thereafter by the eagerly anticipated speech from Mario Draghi. Meanwhile in the US, we have its equal measure in anticipation, the release of the Non-farms payroll report. Both events due to be released within a span of only 24-hours between them will shape sentiment for the EUR/USD.

The ECB Decision

After a deal on extending the Greek bailout for another four months, it seems that markets are ready to shift its focus back to the economics of the Eurozone, and the ECB, from its own view, will be happy to make that shift as well. But while the chances of a Greek exit may have painted an ugly scenario, the economic reality after those fears were allayed still isn’t all that pretty. The latest data revealed Inflation in the Eurozone had plunged to -0.6%, deep in deflationary territory. For Draghi, this trend might be a catalyst for making more promises. After the ECB announced a massive QE program of €60 billion a month, investors want still more assurances just in case things continue to deteriorate. While Draghi is not expected to announce any new measures, a promise for more easing if things deteriorate further would please investors even as it tanks the Euro. But if Draghi sounds more cautious and tries to divert attention to growth, this will put in question more ECB easing in the coming months and thus could eventually favor the Euro.

The Almighty Non-farm

Just a single day after Draghi makes his speech, the main event of the week is due out; namely, the US non-farm payrolls report. After Janet Yellen’s speech last week in which she generally pleased everyone (another way of saying she didn’t commit to anything, nor did she confirm June as the time for a rate liftoff in the US), it makes it all the more important for investors to search for data for clues on the possible path of rates in the coming months. Of course, one of the strongest indicators is the Non-farm payrolls. After all, if Non-farm is rising at a fast pace it could signal that the US economy is faring fairly well. Moreover, a strong NFP release increases the likelihood of wage rises which raise inflation which in turn makes a rate hike more probable. For dollar bulls to be satisfied, the NFP figure must be north of 250K, which will confirm that rate hikes from the Fed are likely getting closer. Anything lower wouldn’t necessarily rule out a rate hike but would raise uncertainty and doubts.

The Bottom Line

Overall, investors will focus on two possible scenarios that have a chance to ignite swings in the EUR/USD. The first scenario is that Super Mario Draghi will pledge to provide more stimulus in the future, if the economic situation there continues to deteriorate, while in the US, the NFP comes out north of 250K. This will, once again, enforce the bearish case for the EUR/USD and then the pair may resume its slide south. In the second scenario, if Draghi conveys a wait-and-see approach and the NFP figure released the following day is a bit on the weak side, then EUR/USD bears could move to profit taking and the pair could rebound. In any event, the long term fundamentals still anchor a bearish case for the pair.

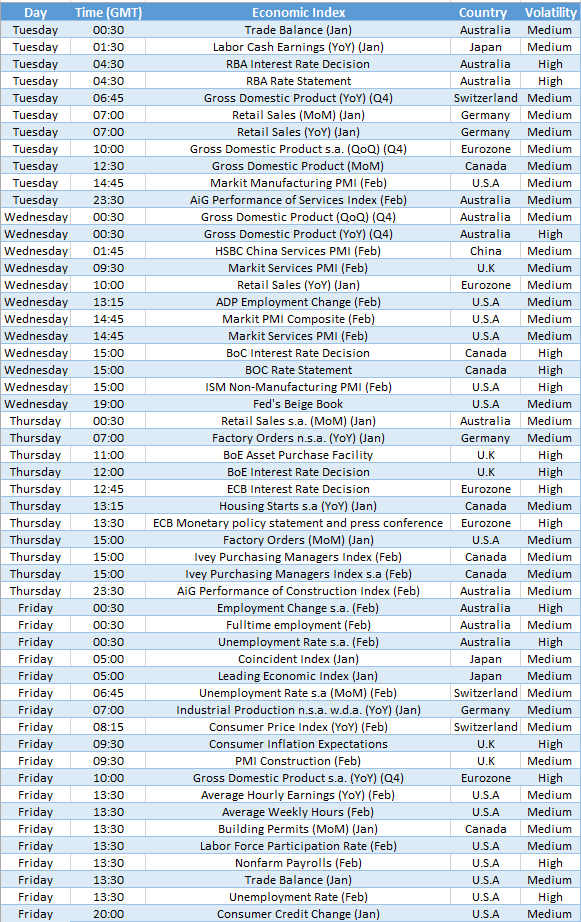

On the Plate

RBA Rate Decision (Tuesday) – Investors will watch the RBA rate decision with keen attention. After data from china last week surprised for the better and after the RBA has already cute rates once this year, investors will want to see if the RBA is still dovish. If the RBA turns less dovish (pessimistic) then the Aussie could recover.

Australian GDP(Wednesday) – In the aftermath of the RBA rate decision , the GDP figure will provide further clarity on the path of the Aussie. Steady rates from the RBA and a better than expected GDP growth could allow the Aussie to regain lost ground.

Fed Beige Book(Wednesday) – The Beige book will provide a reality check on the US economy just two days before the NFP release , and raise or lower expectations before the release.

BoE Rate Decision (Thursday) – Rates in the UK are expected to remain unchanged by an overwhelming majority of analysts. Therefor any surprise change would create high levels of volatility around Sterling.

ECB Rate Decision (Thursday) – One of the two major events of the week. If Draghi will hint on more easing the Euro could plunge further. A wait and see approach would have the opposite effect.

Eurozone GDP Growth Q1 (Friday) – The first release of Q1 GDP in the Eurozone. If Draghi will take a wait and see approach a day before and Q1 GDP growth will surprise for the better, the case for a Euro rebound will strengthen.

Nonfarm Payrolls (Friday) – The main event of the week. If the NFP figure is above 250k that will be perceived as bullish for the dollar and vice versa.

Chart of the Week- GBPUSD