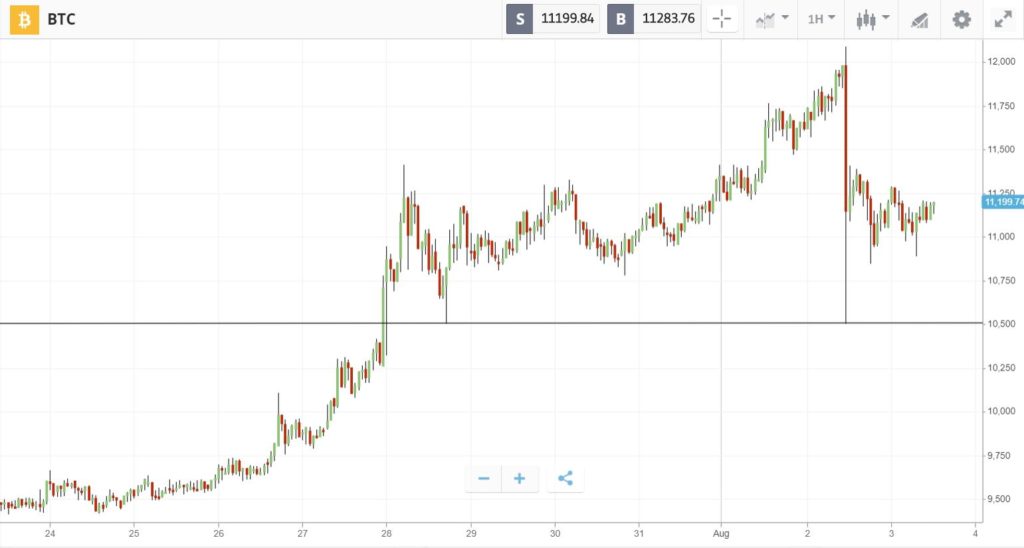

Bull market confirmed as bitcoin tags 12K

The Bitcoin bulls are on parade, with the leading cryptocurrency climbing above $12K on Sunday, before shedding $1.4K in 15 minutes and then rebounding to settle above $11K.

On Friday, Bitcoin closed the month of July with 25% gains, beating all major stock indices and setting a record with the highest monthly close since almost reaching $20K in December 2017.

This record monthly close confirms the arrival of a bull market, which is widely thought to be driven by two key narratives: The DeFi economy catalyzing the growth of ethereum, and the diminished supply of bitcoin from the May Halving.

This Week’s Highlights

- Ethereum Capitalizes on DeFi

- Bitcoin Plays Catch-up With Gold

Ethereum Capitalizes on DeFi

With Kodak hitting headlines and small-cap altcoins riding high, echoes of the 2017 bull run are reverberating around the crypto market.

Yet while ICO mania drove the market higher in 2017, this time DeFi is in the driving seat. Surging activity on a new wave of decentralized protocols has given Ethereum a new lease of life, and made the cryptocurrency one of the best performers of the week with 19% gains.

This rising interest is reflected in the hockey stick growth of the number of searches for Ethereum on Google. According to this metric, interest in the blockchain is now approaching the peak of July 2019, with the most interest coming from West Africa and East Asia.

Bitcoin Plays Catch-up With Gold

As gold blows past all-time highs, bitcoin is following close behind. The digital gold now seems to have let go of its correlation with stocks, and is trailing behind its physical namesake in reaction to the same macroeconomic forces.

Coronavirus concerns, U.S.-China trade tensions, and critically, weakness in the dollar, are all thought to be driving the traditional safe haven of gold higher. And by following, bitcoin is reasserting its own safe haven status.

This vindicates the investment thesis of macro investors like Paul Tudor Jones and Nigel Green, who are increasingly seeing the cryptocurrency as a refuge from the turbulence of traditional markets.

The Week Ahead

With funds flowing into DeFi at a record rate, and the bitcoin chart showing a major technical breakout, the market outlook is more positive than ever.

This sentiment is reinforced by news that the perpetrators of the PlusToken scam have now been arrested. Members of this criminal group were thought to be responsible for catalyzing the bear trend of 2018 by dumping billions of dollars in bitcoin on the market.

In response to the positivity, the cryptocurrency Fear & Greed Index is lurching into extreme greed. Historically, each time the index has registered this emotion, bitcoin has corrected. However, the market could run higher yet, with levels of greed still not approaching those recorded during the peak of June 2019.