Good morning everyone,

Asian markets were lower on Monday following the news over the weekend that 97 patients who had contracted the coronavirus had died. Major markets across Asia – including Japan’s Nikkei and Hong Kong’s Hang Seng – were all lower as the economic disruption caused by the virus clouds the outlook for global growth.

It was a stark contrast to the end of last week where stocks in the US made gains in part due to optimism that the economic impact would be limited. The US delivered jobs numbers on Friday that were well above expectations. The January jobs report revealed that 225,000 more jobs were created during the month, with education, health services, construction and leisure the biggest contributing sectors. Manufacturing was the biggest loser, shedding 12,000 jobs. However, the Purchasing Managers’ Index – which measures manufacturing activity – had already unexpectedly jumped in January to its highest level since July. China also added to the economic good news last week, with the announcement that it plans to cut tariffs on $75bn of US imports.

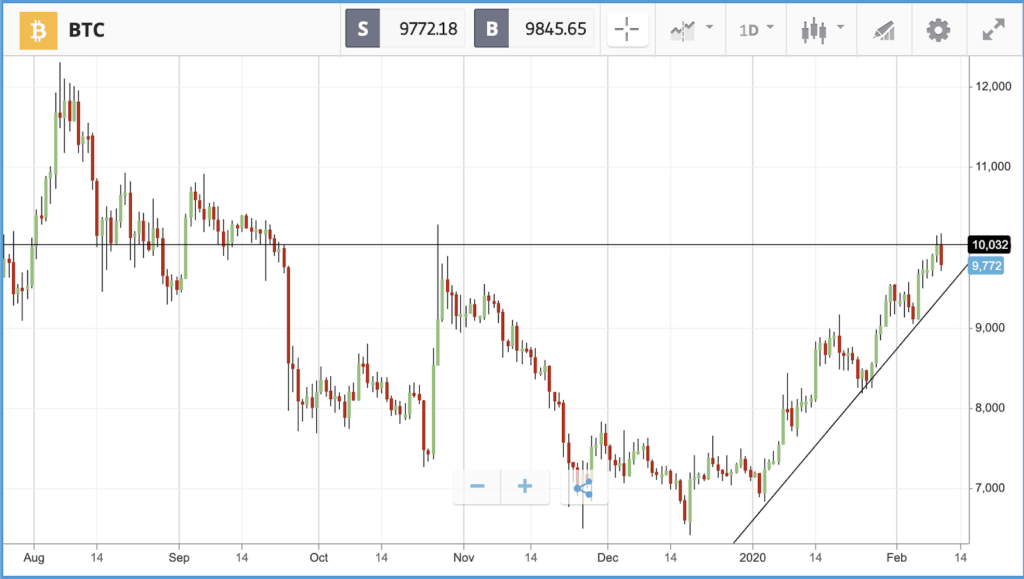

Nonetheless, the virus in China is likely to steal the headlines this week, and it is prompting investors to look for alternatives to stocks. Over the weekend Bitcoin went through the $10,000 mark, a level not seen since last September. Although it has now retraced slightly, the $10k mark is an important psychological level.

Nasdaq Composite up 6.1% in 2020

All three major US indices delivered gains of more than 3% last week, despite a sell-off on Friday after it was reported that the number of coronavirus cases had climbed past 31,000. There is a torrent of information competing for investors’ attention at present, with the epidemic, corporate earnings season, and significant economic data points all fighting for the spotlight. In earnings news, two-thirds of S&P 500 companies have now delivered their fourth quarter updates. Whether or not America’s largest companies have grown earnings overall versus the same quarter last year is currently teetering on the edge, according to investment firm John Hancock. It said that as things stand the earnings growth rate was 0.7%. In 2020 so far, growth stocks (in particular technology firms) have continued to outperform. T. Rowe Price highlighted that the Russell 1000 Growth Index is now up 6% year-to-date, while the Russell 1000 Value Index is flat so far in 2020. On Friday, T-Mobile was one of the biggest winners, with its share price popping by 3.2% after beating both revenue and earnings expectations in its Q4 results. The mobile network is currently waiting on a judge’s decision as to whether its $27bn merger with rival Sprint can move forward.

S&P 500: -0.5% Friday, +3% YTD

Dow Jones Industrial Average: -0.9% Friday, +2% YTD

Nasdaq Composite: -0.5% Friday, +6.1% YTD

UK markets post gains despite Friday sell-off

Mirroring their US counterparts, both the FTSE 100 and FTSE 250 indices delivered a positive week despite a mild sell-off on Friday. Both indices remain in negative territory for 2020 so far but gained 2.5% and 1.7% last week respectively. In addition to new figures on the spread of coronavirus on Friday, investors also had to digest the news that the chances of Germany – Europe’s largest economy – entering a recession have increased markedly thanks to a poor set of industrial production numbers. NMC Health investors took another bath on Friday, to the tune of 23%, but the Financial Times has reported that the short sellers betting against the firm appear to have been taking their profits. Brokerage Hargreaves Lansdown also sank heavily on Friday, losing 6.1%, after it was reported that founder Peter Hargreaves sold £550m worth of shares. Hargreaves said that the move is part of a long-term plan to diversify his assets. However, the firm also reported a decline in new business and has been in the spotlight due to its role in promoting the now infamous fund manager Neil Woodford.

FTSE 100: -0.5% Friday, -1% YTD

FTSE 250: -0.3% Friday, -1.8% YTD

Stocks to watch

Restaurant Brands International: After 12 months that saw its stock gain around 30% before sinking, Restaurant Brands International’s share price is essentially flat – well behind the broader market. The company, which includes the Burger King, Tim Hortons and Popeyes brands, is owned by Brazilian private equity firm 3G Capital, which sold billions of dollars’ worth of shares in the latter half of 2019. RBI has major expansion plans, which will almost certainly be probed by analysts on its earnings call today. At present, analysts have an average 12-month price target of $76.30, versus its $63.86 Friday close, with a range between $62 and $88.

MercadoLibre: Argentinian e-commerce website MercadoLibre is listed on the Nasdaq exchange, and reports its latest set of quarterly earnings at market close New York time today. The firm has repeatedly been compared to Amazon, and the ability of the $32bn market cap firm to fend off the American giant is a key factor for investors to consider. MercadoLibre stock has climbed more than 80% over the past year, and analysts think it has further to run, with an average 12-month price target that is 10% higher than its $646.02 Friday close. Among Wall Street analysts, 14 rate the stock as a buy, eight as a hold and one as a sell.

Loews Corp: Not to be confused with DIY chain Lowes, Loews is a $16bn market cap conglomerate that has majority stakes in firms including CNA Financial, Diamond Offshore, Boardwalk Pipelines and Loews Hotels. Of those, CNA Financial, which provides insurance to businesses, is by far the biggest, delivering $2.7bn of the firm’s $3.7bn in revenue for Q3 2019. Loews has minimal analyst coverage, with Deutsche Bank’s Josh Shanker the only analyst who took part in its last earnings call (he rates the stock as a hold). On that call, CEO Jim Tisch said that he believes CNA is undervalued, and that he is “frustrated” about the valuation of Loews’ stock. Loews is holding its Q4 earnings call at 11am New York time today.

Oil is officially in a bear market

Oil prices have entered bear market territory, with the price of WTI crude having dropped more than 20% over the past month, sinking below $50 a barrel last week. History suggests that drops of this magnitude tend to be followed by further falls rather than a sharp recovery. Coronavirus has a role to play here, as investors are speculating about the potential impact the virus will have on oil demand in China, the world’s largest importer of the commodity. Many oil slumps in recent years have been caused by oversupply, rather than a demand issue, and all eyes are now on whether oil cartel Opec can and will deepen production cuts to sustain prices.

Crypto corner

Bitcoin shot through the $10,000 mark in the last 24 hours and currently sits just marginally below that level at $9,956 this morning. Peers Ethereum and XRP have followed suit, hitting highs of $228 and $0.2824. These peaks have also coincided with record highs on Wall Street last week.

The jump in the bitcoin price comes as bitcoin traders and investors prepare for the looming May bitcoin halving event, which will see the number of bitcoin rewarded to miners cut by half, limiting supply significantly. The last time it cut supply in this way, Bitcoin prices doubled.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.