CATALYST: It’s a big summer of sports, from the Olympics to Euro 2024 football. This is a key potential catalyst to end the post-pandemic performance hangover for our basket of the world’s largest sports stocks, from Nike (NKE) to Lululemon (LULU). This has seen the group lag global stocks as consumer slowdown fears have risen. Despite their derated valuations, accelerating earnings outlook, and exposure to the huge and still fast-growing global sports industry. With sports sales estimated at up to $1.4 trillion across fan engagement (events, media) products (apparel, equipment), and participation (fitness, exercise), and growing at near 10% rates.

MEGA-EVENTS: Germany hosts the Euro 2024 football tournament (June 14 – July 14) and France the Olympics (July 26 – August 11). Adding to the ‘usual’ events from cycling’s Tour de France to tennis’s Wimbledon Championship. The last Olympics had an est. 3 billion global TV audience and the Euro’s was as high as 5 billion. Long standing Olympic sponsors, Coke (KO) to Visa (V), and Euro’s sponsors, Alibaba (BABA) to Booking (BKNG), will benefit. Whilst the commercial impact has been globalised and further boosted by technology and new business models. From sports gaming, like Electronic Arts (EA), to sports betting, like Flutter (FLTR.L).

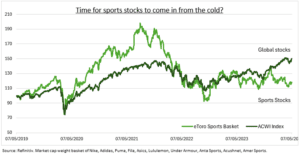

BASKET: We constructed a market cap-weighted basket of ten of the world’s largest sports good stocks as a proxy. From Nike (NKE), Adidas (ADS.DE) and Puma (PUM.DE) to Lululemon (LULU), Under Armour (UA), and recently listed Amer Sports (AS),. It has a total $250 billion market cap. It’s lagged global stocks (see chart) over the past five years. Booming during the pandemic and giving back all of those gains since. The basket trades at a premium forward price/earnings valuation of 25x. But this is near the cheapest of the past five years, and despite the looming ‘summer of sports’. Whilst profits forecasts have risen by 20% over the past year.

All data, figures & charts are valid as of 08/05/2024.