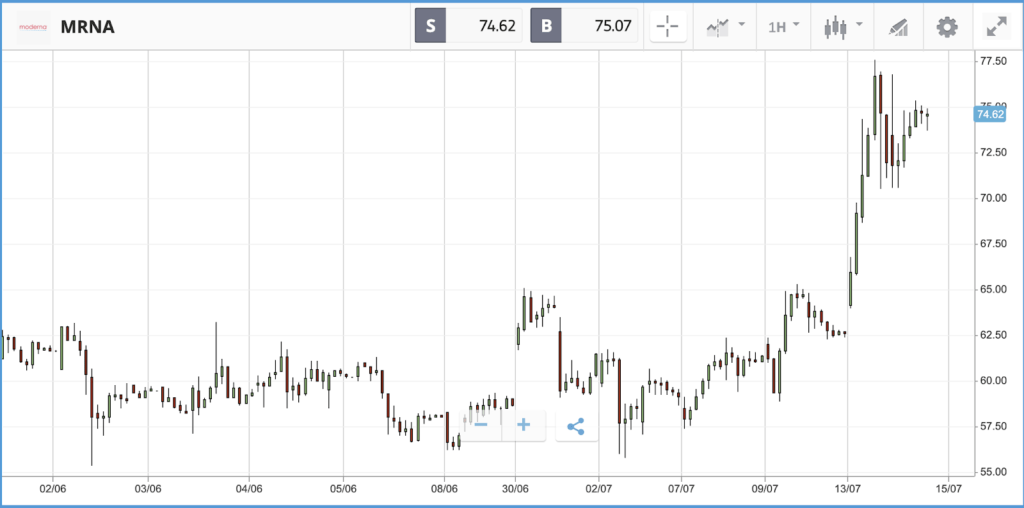

Positive vaccine news after hours in the US has boosted markets globally. Moderna, one of the frontrunners for producing a vaccine to the coronavirus, said yesterday that early-stage trials of its potential Covid-19 vaccine produced immune responses in all 45 participants and no safety issues that would derail further trials.

As well as lifting Moderna shares after hours, the news also sent Asian shares higher, with Japan’s Nikkei closing up 1.59% and heading closer to its peak set in January. European markets have also climbed higher with the FTSE and Dax both up 1% and US futures also signalling a positive open.

Second quarter earnings season kicked into gear in the US yesterday, with JPMorgan, Citigroup and Wells Fargo in the spotlight, plus Delta Airlines. The trio of banks announced enormous cash stockpiling in preparation for anticipated loan defaults caused by the pandemic. Between them, the banks set aside $28bn in Q2, with JPMorgan opting to add more than $10bn to its cash reserve. For investors, the action signals just how severe the banking giants are anticipating the coronavirus recession to be. Wells Fargo had a difficult quarter; the bank delivered its first quarterly loss in a decade, and set aside $9.6bn, with its share price falling 4.6% after delivering the results. The loan loss provisions were double what some analysts had expected Wells to announce, and the company also slashed its dividend. CEO Charles Scharf said that the bank now needs to cut $10bn in costs, equivalent to 17% of its noninterest expenses last year, in order to remain competitive with its peers.

As well as the banks, US airline Delta also announced its Q2 results – it was always destined to be a question of how bad the numbers were given decimated traveller numbers, but losses were greater than expected. Per Bloomberg consensus estimates, the loss per share was $4.43, versus the $4.22 expected. Delta CEO Ed Bastian said: “We continue to believe it will be more than two years before we see a sustainable recovery”. The firm’s stock closed the day down 2.7% but climbed sharply in late trading.

Stocks gain on bank positives while tech names pause

Despite the pessimistic picture painted by banks’ loan loss provisions, JPMorgan and Citigroup beat earnings expectations due to strong trading revenue. Although JPMorgan CEO Jamie Dimon warned there is still significant uncertainty and pain ahead, the better than anticipated numbers gave investor sentiment a boost.

The S&P 500 closed the day 1.3% higher, while the Dow Jones Industrial Average was up 2.1%. Construction machinery maker Caterpillar, insurance firm Travelers and oil behemoth Chevron led the way in the Dow, climbing 4.8%, 3.8% and 3.5% respectively. In the S&P, the energy and materials sectors led the way, with energy stocks gaining 3.6% overall.

Some of the largest tech stocks appeared to have broken their mammoth run up yesterday after falling sharply following the market open but recovered as the day wore on. Microsoft, for instance, was 1.5% down by 10am, but finished up 0.6% higher. Amazon was nearly 3% down at the 10am mark but ended the day just 0.6% lower.

S&P 500: +1.3% Tuesday, -1% YTD

Dow Jones Industrial Average: +2.1% Tuesday, -6.6% YTD

Nasdaq Composite: +0.9% Tuesday, +16.9% YTD

Ocado UK sales grow 27% on back of pandemic

The FTSE 100 was close to flat yesterday, while the FTSE 250 sank back 1.2% with its year-to-date loss now well past 20% again.

In earnings news, online grocer Ocado reported earnings for the six months ended May 31. The firm delivered a pretax loss of £41m pounds, versus a £157m loss in the six months to May 2019. UK sales rose 27% year-over-year, with total revenue of £1.1bn more than £200m higher. Ocado said it has more than a million people on the waiting list for its UK delivery service, with CEO and co-founder Tim Steiner predicting that demand will remain sticky post-Covid. “As a result of Covid-19 we have seen years of growth in the online grocery market condensed into a matter of months, and we won’t be going back,” he said. Ocado stock, which has surged more than 50% year-to-date, sank 2.2% after the earnings reveal.

In other corporate news, online clothing firm Asos has reportedly ended contracts with a number of clothing suppliers where it uncovered potential threats to workers’ health, safety or human rights, according to The Telegraph.

FTSE 100: +0.1% Tuesday, -18.1% YTD

FTSE 250: -1.2% Tuesday, -21.5% YTD

What to watch

UnitedHealth Group: Health insurance and services business UnitedHealth has added 5% to its share price year-to-date. For insurers, the pandemic has meant large volumes of claims, but has also offered an opportunity to increase their rates, while customers have cut back on routine medical treatments, which lowers what the insurers have to payout. The $293bn firm reports its Q2 earnings today, with analysts expecting an earnings per share figure of $5.28, versus the $4.56 they had been anticipating for the quarter three months ago. Currently, 21 analysts rate the stock a buy, one an overweight and five a hold.

IBM: IBM stock is down 10% year-to-date, with investors concerned IBM is lagging rivals in the cloud space amid the anticipated surge in cloud computing demand driven by the pandemic. However, the company — which reports quarterly earnings on Wednesday — bought RedHat for $34bn last year to position it for cloud growth. IBM also offers a dividend yield of more than 5%, which compares favorably to many of the other large tech firms. Wall Street analysts have 12-month target prices on the stock ranging from $90 to $165, with an average of $129, versus its $120.60 Tuesday closing price.

Goldman Sachs: Similar to JPMorgan, Citi and Wells, all eyes will be on loan loss provisions, the hit to profits, and the influence of trading revenues when Goldman Sachs reports Q2 earnings today. Goldman has also been on an acquisition streak over the past year, picking up wealth manager United Capital and broker-dealer/wealth tech company Folio Financial. Further appetite for dealmaking may also feature on the earnings call. Currently, 15 Wall Street analysts rate the stock as a buy and 11 as a hold.

Crypto corner: Leading exchange to launch Bitcoin options trading in Q3

Huobi, a leading Bitcoin futures and spot exchange, has announced its plans to launch Bitcoin options trading in the third quarter of 2020.

According to Finance Magnates, the Singapore-headquartered exchange is going to add the new derivatives instrument on its existing futures platform where it offers perpetual contracts.

Huobi is one of the largest Bitcoin futures exchanges, only behind Binance in terms of daily trading volume, according to Coinmarketcap.com.

The exchange said Bitcoin options would trade similarly to futures, but the contract holders do not have any obligation to buy the asset upon maturity, with the trader able to exit the trade by paying a pre-decided premium.

The price of Bitcoin has been relatively stable over the last month, range-bound between $9,000 and $9,600.

All data, figures & charts are valid as of 15/07/2020. All trading carries risk. Only risk capital you can afford to lose