Good morning everyone,

The major US stock indices hit new highs on Wednesday, with the Dow Jones Industrial Average passing 29,000 points, after the US and China signed a phase one trade deal. A trade war between the two countries has raged for more than a year, but the reaction from markets was somewhat muted on Wednesday as the approval of the deal has been long anticipated. In addition to this, there are several issues as yet unresolved but undoubtedly this is a step in the right direction. A phase two deal will be some distance away, and in the meantime the Q4 corporate earnings continue to be released. Results from the major banks have been mixed so far, with JPMorgan posting blockbuster results and Wells Fargo struggling. Goldman Sachs also had a difficult quarter, with its profits dropping sharply after it set aside money for an expected government settlement. Bank of New York Mellon and Morgan Stanley will give their updates today.

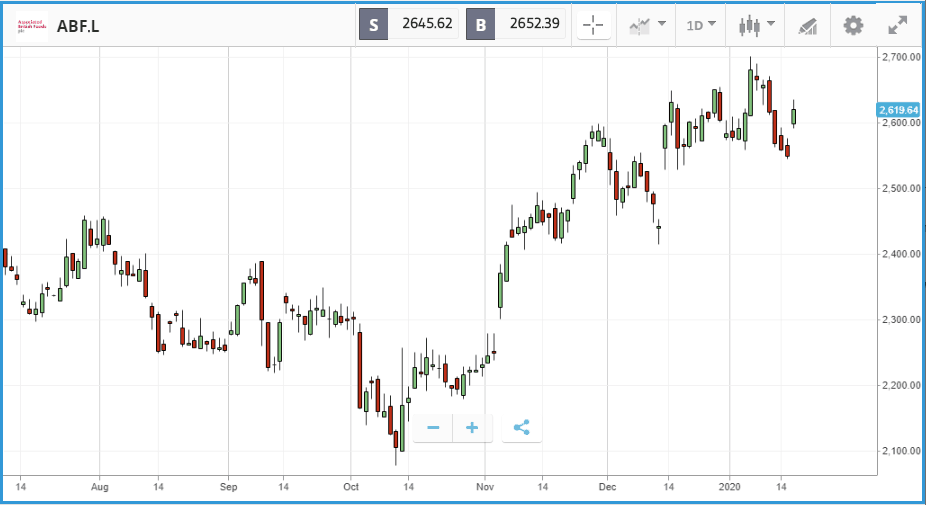

Primark performance sees Associated British Foods top the FTSE

Associated British Foods (ABF), owners of Primark, the low-cost fashion retailer has seen shares get a boost this morning off the back of a robust update. Primark’s Christmas sales impressed as well as improved performance from ABF’s other businesses such as its sugar division. Looking forward, Primark will push into Eastern Europe in 2020 bringing its presence up to 15 countries.

Elsewhere, educational publisher Pearson delivered a year of flat revenues and rising debt following an overhaul of its business. Reporting its numbers this morning in a January trading update, the company said a decline in its North America revenues had been offset by gains elsewhere in its business, with the outcome leaving the company flat in terms of growth. Shares have slumped over the last year, falling from a peak above 920p to a low of 605p. They closed at 618.4p prior to the release of today’s results.

UnitedHealth Group helps push Dow past 29,000

All three indices had a positive day on Wednesday, but it was the Dow Jones Industrial Average that edged out the S&P 500 and Nasdaq Composite. The Nasdaq is still well ahead in 2020 so far, with a 3.2% year-to-date gain. Of the 30 stocks in the Dow, UnitedHealthcare led the way with a 2.8% share price pop, after beating expectations for its Q4 earnings. It was followed by Visa with a 1.9% gain, and pharmacy giant Merck on 1.8%. At the bottom of the S&P 500 was retailer Target, which fell by 6.6% after announcing that its Christmas holiday sales missed its forecasts. The poor set of figures was driven by weakness in sales of toys and electronics, which may give some investors pause for thought about just how well consumer confidence is holding up.

S&P 500: +0.2% Wednesday, +1.8% YTD

Dow Jones Industrial Average: +0.3% Wednesday, +1.7% YTD

Nasdaq Composite: +0.1% Wednesday, +3.2% YTD

Ocado continues to deliver

Large beat small on Wednesday, with the FTSE 100 delivering a positive return to take its year-to-date gain to 1.3%. The FTSE 100 was led by online supermarket Ocado Group which gained 2.7%. In the FTSE 250, it was Tullow Oil and Just Group who faced the worst days. Tullow sunk by 15.7% after lowering its oil price forecast, while Just Group lost 9.1% after Credit Suisse downgraded its rating. After losing more than 60% of its value from March to August 2019, retirement specialist Just had been recovering strongly in the latter half of the year. Additionally, it was a poor day for banks, with RBS, Lloyds Banking Group and Barclays all losing more than 1%.

FTSE 100: +0.3% Wednesday, +1.3% YTD

FTSE 250: -0.2% Wednesday, -0.8% YTD

Stocks to watch

Morgan Stanley: Following key rival Bank of America’s middling Q4 earnings report on Wednesday, Morgan Stanley will report quarterly earnings today. The pair compete heavily on wealth management, investment banking and more. Big US banks have delivered a mixed set of results so far this week, and after beating expectations for three straight quarters with earnings per share figures above $1.20, the bar is set fairly high for Morgan Stanley. Analysts are predicting an earnings per share figure of $1.02 for Q4 2019, versus the $0.73 the firm posted a year prior when it came in well below expectations.

Csx Corporation: $58bn market cap Csx is a railway freight firm headquartered in Florida. The company’s share price has been recovering since a 20% plus price fall in July, and investors will be watching for signs of continued momentum. Csx’s recent earnings history is a mixed bag, with an earnings miss in Q2 last year bookended by significant earnings beats. Analysts overwhelmingly favor a hold rating on the stock, with an average price target marginally above its $74.99 Wednesday close. The company reports earnings today.

BNY Mellon: BNY encompasses a large number of services, including banking, investment management, financial platform technology and more. The firm’s shares posted a positive price return in 2019 but lagged both the broader market and the financials sector. As with all banks, the impact of lower interest rates on margins will be scrutinised carefully when the company reports its Q4 earnings today. Over the past four quarters the firm has shown a steady improvement in its earnings versus expectations – the majority of Wall Street rates the stock as a hold.

Crypto corner:

Bitwise withdraws ETF application

It looks like the long wait for the first ever bitcoin ETF might just have got a little longer with the withdrawal of the filing posted with the SEC by Bitwise Asset Management yesterday. The proposal was previously rejected due to doubts around preventing market manipulation although this was being reviewed. While disappointing it is hardly a big surprise as the SEC has rejected every crypto ETF that it has been presented with thus far.

DASH

Fast-food chain Burger King has announced it will be accepting DASH as part of a 40-location pilot scheme with Cryptobuyer, a leading platform in Latin America for buying and selling cryptoassets.

DASH rallied over 50% yesterday. At the start of 2020 DASH was down nearly 97% from its all-time high, but its value has now soared by 191% since the start of the year.

DASH has also benefited from a range of improvements that are attracting investors. The network has released some long-awaited changes which will soon make it easier to send money, using usernames rather than wallet addresses, as well as instantly confirming transactions.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.