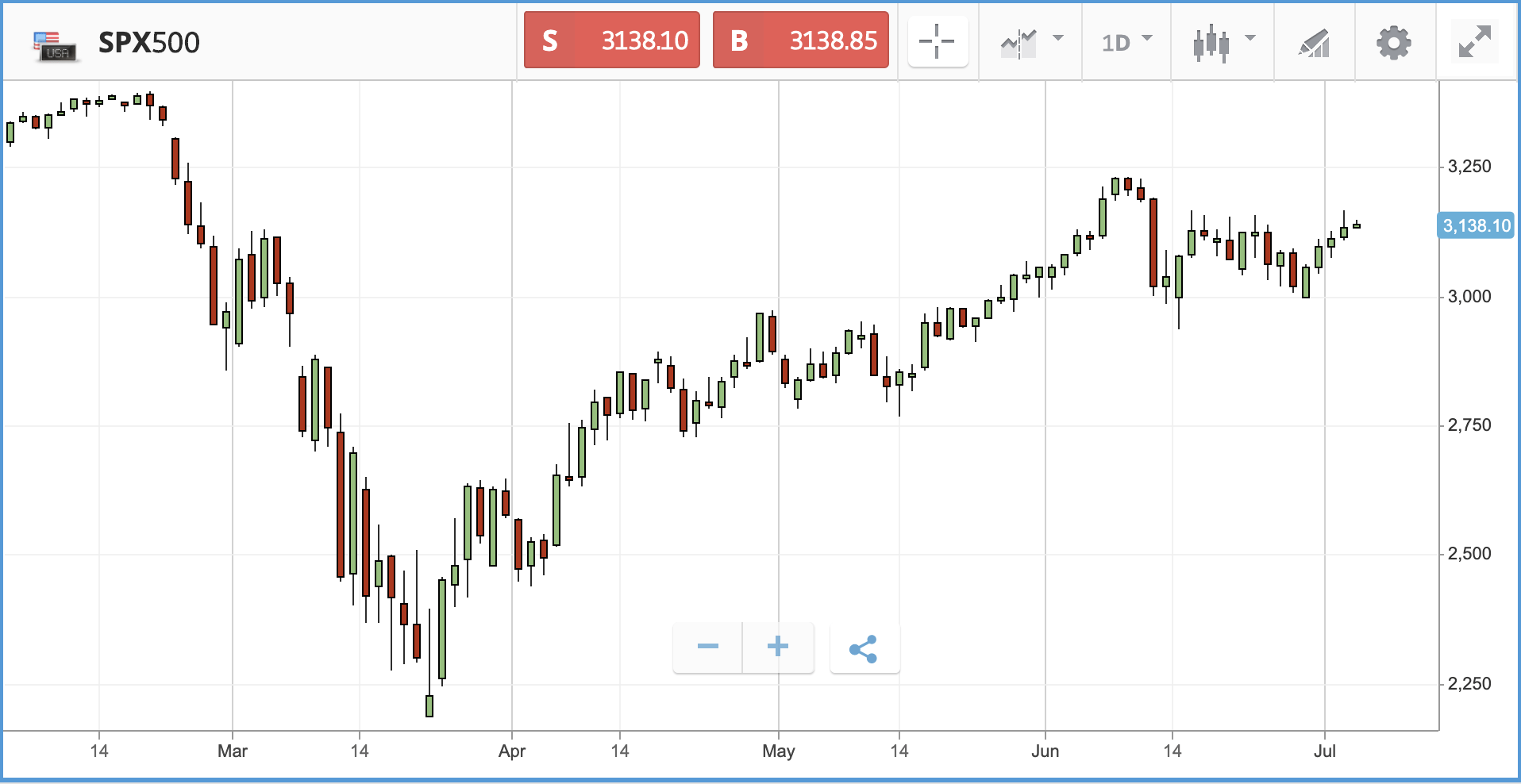

The S&P 500 continued its run up yesterday following an expectation-beating US jobs report, which showed 4.8 million nonfarm payrolls were added in June. The unemployment rate also fell to 11.1%, with both figures beating economists’ consensus expectation. Forecasts had been for 3.7 million new nonfarm payrolls and an unemployment rate of 12.5%. During the shortened four day trading week (the US is closed today for Independence Day), the S&P 500 has gained 4% and is now within 3% of where it started the year.

Asian shares continued the momentum overnight, hitting four month highs as optimism from the US jobs report spilled over, Chinese PMI data showing that consumer demand is beginning to return post lockdown is also encouraging.

American Airlines also made headlines yesterday, after announcing that it is currently overstaffed by 20,000 employees for its fall schedule. All of the major US airlines are looking at staff cuts in the face of reduced travel demand, but under the terms of a federal aid package are not able to lay off staff or reduce pay until the end of September. American Airlines said that during June, it reduced the amount of cash it has been burning through from $100m a day in April to sub-$35m a day in June. The firm’s stock sank 2.4% yesterday, and remains down more than 50% year-to-date, even after a 24.3% gain over the past three months.

Insurance startup Lemonade doubles share price after billion dollar IPO

All three major US stock indices performed almost identically on Thursday, with gains of 0.4% to 0.5%. In the S&P 500, the materials sector was out in front with a 1.9% gain, led by construction materials stocks. Real estate management and development stocks also jumped 1.5%, although real estate investment companies fell 0.4%.

In corporate news, online home insurance company Lemonade hit headlines on Thursday after making its public market debut. The firm raised $319m through an IPO on the New York Stock Exchange, valuing the company at $1.6bn. Yesterday, the first full day of trading, the company’s share price climbed by more than 100%. Similar to many of the billion dollar plus IPOs of recent years, the company is loss-making but has been posting rapid revenue growth. There have been several multi-billion dollar IPOs in the US so far this year, despite the disruption caused by Covid-19; they include business software firm ZoomInfo, Chinese cloud computing firm Kingsoft and health-tech company One Medical.

S&P 500: +0.5% Thursday, -3.1% YTD

Dow Jones Industrial Average: +0.4% Thursday, -9.5% YTD

Nasdaq Composite: +0.5% Thursday, +13.8% YTD

Banking stocks help FTSE 100 higher

London-listed shares were buoyed by positive employment figures in the US, as the UK’s biggest companies make a substantial portion of their revenues from the US.

The FTSE 100 jumped 1.3%, although it is still down 17.3% year-to-date, lagging far behind the major US indices. Banking, travel and retail stocks helped take the index higher. International Consolidated Airlines Group led the way with a 5.7% gain, followed by Royal Bank of Scotland on 4.7% and HSBC on 4.5%. RBS has been one of the hardest hit British banking stocks in 2020 so far and remains 48% down year-to-date. Rival HSBC is down 34.3%, Barclays is 34.4% down and Lloyds is 49% off. All of the banks have scrapped their dividends due to the coronavirus pandemic, so the depressed share prices are not translating into elevated income for new investors into the stocks.

The FTSE 250 climbed 1% on Thursday, led by aerospace firm Meggitt, Virgin Money UK and iron miner Ferrexpo, which all gained more than 5%.

FTSE 100: +1.3% Thursday, -17.3% YTD

FTSE 250: +1% Thursday, -20.6% YTD

What to watch

US markets are closed on Friday for a public holiday, so there are no earnings reports or economic data.

UK car sales: On Monday, June new car sales figures will be reported in the UK, following a disastrous May where car sales fell 89% versus the same month last year.

Micro Focus International: One London-listed stock to watch early next week is Micro Focus, which has lost 58% of its value year-to-date and is down 79.5% over the past 12 months. That has pushed the firm’s dividend yield past 10%, which is certain to be a focus for analysts when the company reports its latest set of earnings on Tuesday. Micro Focus is a FTSE 250 stock that offers software and consulting services to businesses. The company has been a rollercoaster ride for investors, and in the few years preceding the recent crisis has suffered multiple double-digit share price falls.

Crypto corner: Bitcoin supply to be outstripped by demand by 2028

The daily mined supply of Bitcoin will drop below the daily buyer demand by 2028, according to research from cryptocurrency derivatives exchange ZUBR.

ZUBR crunched numbers provided by blockchain analytics firm Chainalysis to forecast what demand for Bitcoin may look like over the next eight years.

According to the firm, when Bitcoin’s daily supply issuance drops to 450 BTC per day following the 2024 halving (it’s currently at 900 BTC per day), then retail investors “could potentially account for eating up over 50%” of this daily supply.

Extrapolating the number of new entrants coming into the market based on current data, ZUBR said by 2028 this trend will have exacerbated to the point where retail investors alone will take all the new daily supply. Overnight, Bitcoin held steady above $9,000, trading at $9,086 this morning.

All data, figures & charts are valid as of 03/07/2020. All trading carries risk. Only risk capital you can afford to lose.