Hi Everyone,

It seems that according to the procedures, anybody can file for a US copyright on any piece of writing or code and it is not legally binding in any way. Still, the price of Bitcoin SV shot up by about 100% following the announcement.

The recent campaign to delist BSV from the major exchanges may have had some unintended consequences. Now that there is drastically reduced liquidity, the coin is acting like a penny stock, where even a small amount of volume can push the price drastically in either direction.

Previously we’ve shared a link to some overwhelming evidence that Craig S Wright has on many occasions provided fake and forged evidence of his claim to be Satoshi Nakamoto. Several have pointed out that lawsuits and patents are very un-Satoshi-like. What gets me though is that the real Satoshi was very clear about how network splits should be resolved.

Today’s Highlights

- Brexit Again

- BNB Mooning

- Name the BTC Pattern

Traditional Markets

The funny thing about kicking the can down the road is that eventually you get down the road and catch up with it.

It seems that Prime Minister Theresa May is getting ready to put her Brexit plan before a Parliamentary vote once again, but this time with a twist. The “new” plan includes the option of a second Brexit referendum.

With all the calls for May to resign, pundits have currently skipped ahead and begun speculating on who will be her successor. Many of them that I’ve heard so far are pointing to someone whose name rhymes with Morris Swanson.

The Pound Sterling has been in a steep decline since the beginning of May.

BNB To the Moon

What’s most fascinating is the incredible bullishness from investors despite the recent hack of 7000 BTC on the Binance exchange.

As BNB is often traded as a reflection of how Binance is doing as an exchange, it’s interesting to see this sort of resilience in the face of such a large scale hack. Perhaps this is a reflection of the way that CEO CZ and his team dealt with the hack and responded in real time with full transparency and not only fixed the issues but also strengthened the entire ecosystem in the process.

Here’s an excellent article summarizing CZ’s responses to the hack and how it played out in real time.

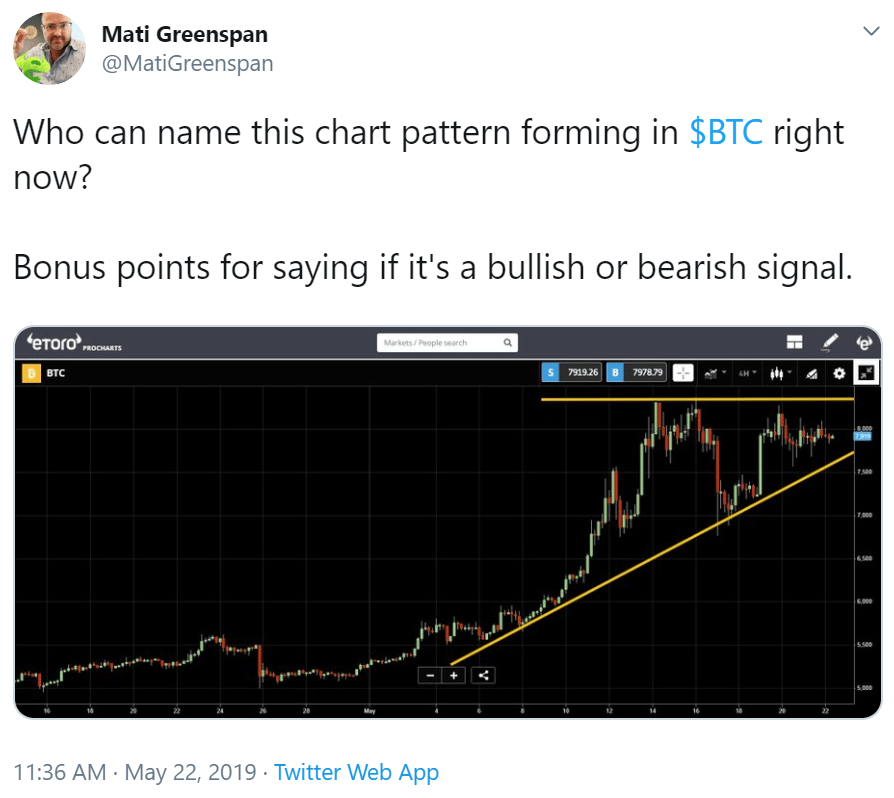

Name the Pattern

In my mind, this is a classic ascending triangle, which, even though past performance is not an indication of future results, is often seen as a bullish signal. Yes, several people answered this right off the bat, but three were a few other responses that were no less correct than mine.

Double top. Yes, if we fail to make a new high and continue into a bear market, that’s exactly what this will be.

Reverse head and shoulders. Yeah, kind of. Right in the middle of the yellow lines. In this case though, the shoulders are a bit flat. So in true bitcoin form, it’s more like an “inverted Bart.”

What truly blew my mind though was when someone told me to zoom out. So I did, and this is the result.

As stated before, a strong breakout to the upside would be insanely bullish. But even within our rising triangle, there’s clearly room for an extended pullback to test the historically significant level of $6,400. Let’s see how it plays out.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.