Good morning everyone,

UK housebuilder Taylor Wimpey said this morning its full year 2019 results would meet expectations “despite ongoing economic and political uncertainty.”

The UK housing market has been seen as a barometer of Brexit sentiment in recent months, with uncertainty over the makeup of the government and the exit from Europe creating headwinds for buyers and sellers alike. However, Taylor Wimpey said this morning that the housing market remained stable throughout 2019 and in fact grew its order book by 22%, which was aided by increased demand through low interest rates and the government “Help to Buy” scheme. They highlight that 2020 will continue to be a year of change but welcomed the political stability following the Conservative majority result in December’s election.

Tomorrow sees sector peer Persimmon give their update – can they follow suit?

Visa picks up fintech Plaid for $5.3bn

In US stocks, payments giant Visa made waves late yesterday after announcing that it is buying Plaid for $5.3bn. Plaid enables applications to connect to people’s bank accounts and counts PayPal’s Venmo transfer service among its customers. Visa took a stake in Plaid early on, alongside firms including Mastercard and Goldman Sachs. Announcing the deal with Visa, the firm’s CEO, Al Kelly, said he is aware some financial institutions have concerns over how Plaid operates, which would be looked at. Fintech firms have come under increasing scrutiny regarding data security, and JPMorgan recently announced plans to ban fintech apps from using customer passwords. Visa’s share price closed 0.83% higher on the news of the acquisition, taking its market cap past $421bn.

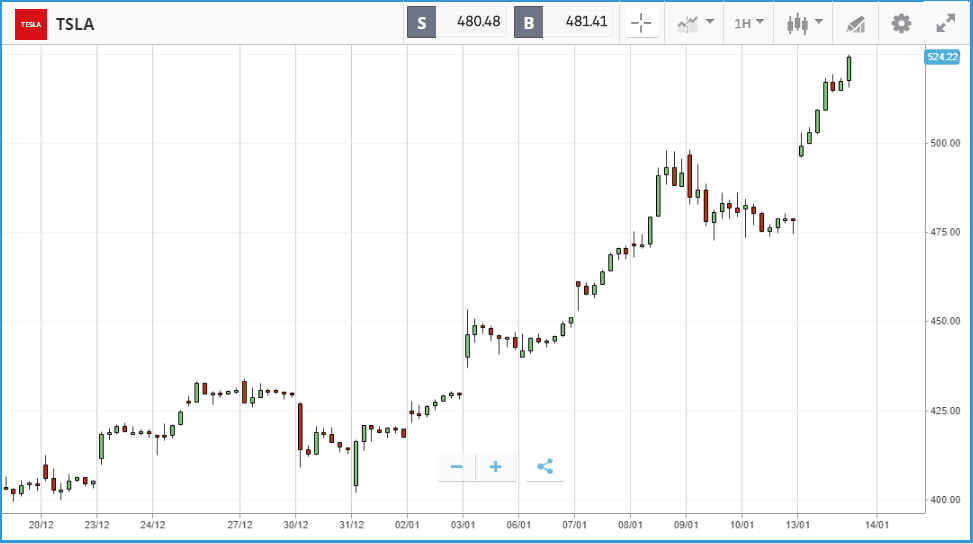

Tesla rapidly closing in on $100bn market cap

It was another record setting day for US markets with the Nasdaq Composite once again outpacing the S&P 500 and Dow Jones Industrial Average with a 1% gain, taking its year-to-date gain to 3.4%. Nasdaq constituent Tesla led the way, climbing by close to 10% on Monday after Oppenheimer analysts increased their price target on the stock. The electric carmaker has now added more than 25% to its share price in 2020 and is rapidly approaching a $100bn market cap. For context, the market cap of General Motors, which sold close to three million vehicles in the US alone last year, is $50bn. Apple, Netflix and Paypal were some of the other Nasdaq firms that enjoyed a share price bump to start the week, all closing more than 2% higher. In the Dow Jones Industrial Average, which lagged the other two indices, UnitedHealth was the only firm to fall by more than 1% – it closed 3.1% lower ahead of its Q4 results on Wednesday.

S&P 500: +0.7% Monday, +1.8% YTD

Dow Jones Industrial Average: +0.3% Monday, +1.3% YTD

Nasdaq Composite: +1% Monday, +3.4% YTD

UK markets

After a tough start to the year, the FTSE 250 made back some ground on Monday, climbing by 0.7%, while the FTSE 100 rose 0.4%. Markets climbed despite economic data showing that the UK economy shrank by 0.3% in November, as the subsequent fall in the value of the pound provided a cushion for firms that make their money overseas. The FTSE 250 was led by firms including estate agent Savills, IT firm Softcat and Tullow Oil, while defense giant BAE Systems, mining firm, Antofagasta, and United Utilities Group helped take the FTSE 100 higher. Wizz Air Holdings was another winner, climbing by 4%, after the news broke that rival airline Flybe is in rescue talks with the UK government.

FTSE 100: +0.4% Monday, +1% YTD

FTSE 250: 0.7% Monday, -0.8% YTD

Stocks to watch

JPMorgan Chase: Banking giant JPMorgan has more than 60 million retail customers, and outpaced gains made by the S&P 500 last year with a 40% plus share price gain. Big banks in the US are increasingly fighting to handle their clients’ entire financial lives, and JPM has been making moves to that end recently. The company has been building out its asset management division through its ETF brand and new robo adviser service, and the firm recently reorganised four of its divisions into a single wealth management unit. JPMorgan beat earnings expectations in the past three quarters, and analysts are predicting an earnings per share figure of $2.35, versus $1.98 in the same quarter last year, when the firm reports Q4 earnings on Tuesday.

Wells Fargo: Another of America’s biggest banks, with a market cap north of $200bn, Wells Fargo had a rockier 2019. Although its share price was positive for the year, it lagged well behind many of its rivals and the broader market. As with all banks this quarter, the impact of interest rate cuts last year will be front and centre when Wells reports on Tuesday, as bank margins suffer when interest rates are lower. The firm is still working to rehabilitate its image after a major scandal related to fake accounts in 2016, and after it missed earnings estimates in a big way last quarter due to a $1.6bn bill for litigation

Delta Airlines: Delta stock fell by 10% on multiple occasions last year, but its share price outpaced rivals United Airlines and American Airlines with an 18% gain overall. The airline trades at a p/e ratio of less than nine according to Zacks, and Wall Street analysts have an average 12-month price target of $67.05, versus its current $59.49. One advantage that Delta has had over some rivals is that it has none of Boeing’s troubled 737 Max airliners in its fleet, as it opted for Airbus’ competing A321neo.

Crypto corner:

Bitcoin has jumped over 4% in overnight trading to hit $8,473, its highest level since mid-November, following the launch of bitcoin futures options by CME group.

Volumes exceeded $2.3 million in the first day of trading which is 55 contracts worth 5 BTC each. There is still some way to go to rival the volumes of top player, Deribit, but competition is certainly heating up in the space with Bakkt and Binance-backed FTX all now offering the product.

It has also been reported that Deribit will sell 10% of its equity, giving the company a 9 figure valuation.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.