After years of anticipation, ride-hailing startup Uber is finally set to IPO.

Selecting the New York Stock Exchange for its listing destination, the technology group – whose shares will have the ticker ‘UBER’ – is seeking to raise up to US$9 billion through its initial public offering in a deal that will value the company at around US$92 billion.

Undoubtedly, this is a big IPO. This is likely to be the biggest IPO we see this year, and one of the largest stock market listings of all time. It will also be one of the largest-ever IPOs in the disruptive technology space.

An initial public offering of this size is certainly creating a lot of hype within the investment community and Uber shares appear to be in high demand. Yet at the same time, Uber’s business model and the company’s growth potential are generally not well understood by many investors. One of the most disruptive companies in the world today, Uber is a lot more than just a ride-hailing company.

So, let’s take a closer look at Uber. Here’s a look at what the company has achieved up to now, and more importantly, what it plans to achieve in the years ahead.

A game-changer for urban travel

To say that Uber has had an impact on the transportation industry would be a huge understatement.

Starting out in 2009 as a simple app that enabled San Francisco residents to book a ride in a luxury private car through their smartphones, the company has grown at an unbelievable pace over the last decade to become one of the biggest taxi/ride-hailing companies in the world today, and it now offers a broad range of innovative transportation options in over 700 cities worldwide.

Whether you’re in London, New York, Sydney, or Singapore, you’ll find people relying on Uber for transportation, and far more people use Uber than its competitors. For example, Uber currently has over 90 million users, whereas rival Lyft only has around 20 million users. One of the most successful startups of all time, Uber has had a significant impact on the way we get around.

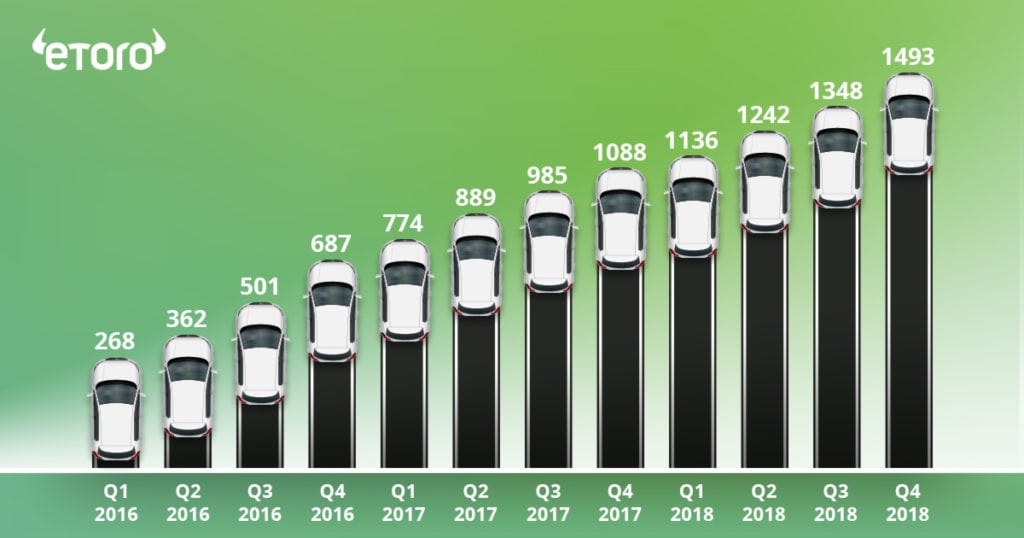

Uber: Number of trips (in millions) –

*Uber Prospectus, page 102

One of the most innovative companies in the world

While Uber’s growth has no doubt been impressive, what has been even more impressive is the company’s innovation.

While Uber originally only allowed users to take a ride in a luxury car, today, the company offers users a broad range of transportation options. Whether you’re looking for budget transportation or a luxury ride, Uber has something for everyone. Additionally, Uber has launched a number of other innovative ventures across the world in recent years, further diversifying its business model.

| Different Verticals | Product | Description |

| Ride-hailing | Lux, Black, Exec, UberX, UberXL, Assist, Access, Van | Allows users to select a transportation option that meets their lifestyle requirements and budget |

| Ridesharing | Uber Pool | Allows uses to ride-share with other passengers for a fraction of the price of a regular taxi |

| Micromobility | Uber JUMP | Allows users to take short trips using scooters and electric bikes |

| Air transportation | UberCHOPPER | Allows users to fly around tourist hotspots such as Dubai and the South of France |

| Food delivery | Uber Eats | Allows users to get takeaway food delivered to their door |

| Shipping | Uber Freight | Allows businesses to transport goods efficiently |

| Healthcare | Uber Health | Provides a transportation service for healthcare providers |

What the company has achieved in the space of just 10 years is quite incredible. Already, Uber is much more than a ride-hailing company.

Your Capital is at Risk

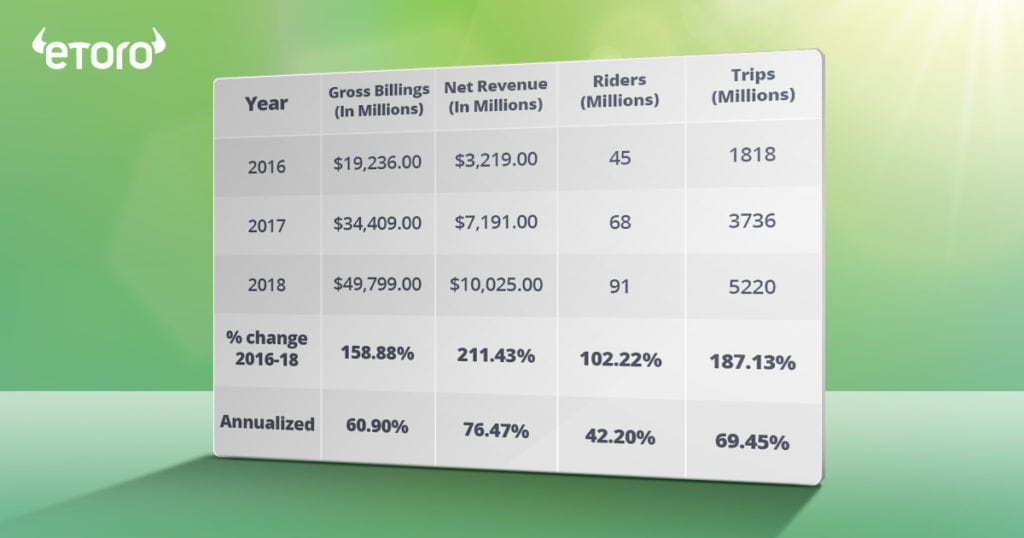

Uber: the key numbers

*Uber Prospectus, page 21

Autonomous driving – a major player

Yet it’s what lies ahead for Uber that we think looks really interesting. As one of the most innovative companies in the entire world today, Uber has its sights set on a lot more than just basic transportation.

You see, Uber believes that the future of mobility is increasingly shared, sustainable and, most importantly, automated. As such, the company is placing a strong focus on the development of self-driving cars – technology that founder and ex-CEO Travis Kalanick called ‘existential’ to Uber’s future.

Take a look at Uber’s ‘Advanced Technology Group’ and you’ll see that the company is already making big strides within the autonomous car space by using state-of-the-art Internet of Things (IoT) technology to develop advanced self-driving systems. For example, after acquiring self-driving truck startup Otto in 2016, Uber incorporated its hardware and software systems into an autonomous truck, and successfully demonstrated the viability of autonomous trucking. This could potentially be a huge revenue driver for the company in the future as the US trucking freight market alone is worth over US$700 billion. More recently, the group has been testing its new range of autonomous Volvo SUVs and it is aiming to have these cars on public streets very soon.

Of course, self-driving car technology is still in its early days of development and there are other companies that are working on this technology, including Google’s Waymo, Nvidia, Volvo, Mercedes-Benz and BMW. Yet few other companies have embraced this initiative with as much effort and resources as Uber – which is considered to be one of the industry leaders – and many other multinational companies, including Toyota and SoftBank, have backed Uber to succeed in this space by investing millions with the company. Self-driving cars are very much a reality, and for this reason, we think the long-term investment potential here is significant. At eToro, we’re bullish on the self-driving car investment theme (we have launched our own Driverless Smart Portfolio which enables investors to profit from the growth of this exciting technology) and we think that Uber could end up being a major player in this industry.

Further innovation

Additionally, on top of its focus on autonomous driving, Uber is also looking to expand out its alternative forms of transport including its electric scooters and its bikes. Profits on scooters and bikes may not be as high as profits on vehicle rides but these forms of transport offer a way for Uber to maintain users’ engagement with the company. Moreover, the group is also looking at other innovative transportation ideas and is keen to boost its presence in the business market by developing tools that allow businesses to arrange transportation for employees, and it is also keen to expand its freight business as this is an enormous market.

It’s also looking to grow its Uber Eats division as this is currently the most profitable part of Uber. Uber Eats today is the fastest-growing meal delivery service in the US, but it’s likely we’ll see a lot more from this segment of the company in the years ahead.

Substantial growth potential

Interestingly, while Uber has already come a long way, it is still in the very early stages of capturing what it estimates to be a US$12 trillion total addressable market that includes personal mobility, food delivery, and freight shipping. That’s an enormous potential market size – to put that number into perspective, global GDP in 2018 was around US$85 trillion meaning Uber believes that it can potentially capture around 14% of global economic activity.

Uber also believes that of the 60+ countries it currently operates in, only around 2% of people who live in these countries have actually tried the company’s services. This suggests that there is still massive potential for growth and perhaps explains why the company has been able to raise over US$24 billion in capital already from technology companies such as Google and SoftBank and Wall Street banks such as Goldman Sachs and Morgan Stanley despite the fact that it is not yet making a profit.

Uber is already consistently ranked as one of the most disruptive companies in the world today, having not only changed the game completely for urban transportation over the last decade but also having changed the way the world looks at employment due to the way that it employs its drivers. Yet looking at what Uber has in its pipeline, including its development of autonomous cars and its plans to revolutionise the freight market, we feel that this could be just the beginning of the growth story. According to Chief Executive Dara Khosrowshahi, Uber is a “once-in-a-generation company” that isn’t “even one percent done” with its work. Looking at the big picture, we believe there’s a lot more to come from this disruptive technology giant.

Your Capital is at Risk

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.