Hi Everyone,

An apparent breakthrough has been achieved in the Brexit negotiations as Prime Minister Johnson and Irish Prime Minister Leo Varadkar were pictured smiling together.

The issue of the Irish border has by far been the main sticking point of Brexit over the last few years but now suddenly it seems that after a closed-door meeting, the two men feel that there is a clear path forward.

Of course, all the rest of us can only speculate what kind of miracle solution was suddenly concocted.

What’s important to note is that this particular issue has not been satisfactorily resolved in any Brexit proposals to date, but equally would not be resolved by a hard Brexit. So now the two men say they have a solution. Great!

Unsurprisingly, the Pound is a happy currency this morning and British Gilt Bonds have seen their largest single-day yield spike ever.

eToro, Senior Market Analyst

Due to local holidays, there will be no market update on Monday. Will squeeze one out for you on Tuesday before my flight. Excited to see so many readers will be joining me in Amsterdam. Can’t wait. 🙂

Today’s Highlights

- Excited about Trade

- Iran Tanker Hit

- Directionless Volatility

Please note: All data, figures & graphs are valid as of October 11th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

It seems that us Israeli’s aren’t the only ones who will be out on Monday. Japan will be offline in observance of Health and Sports Day, Canadian Thanksgiving and Columbus Day in the US will have markets down in several key areas so liquidity and trading are likely to be quite thin.

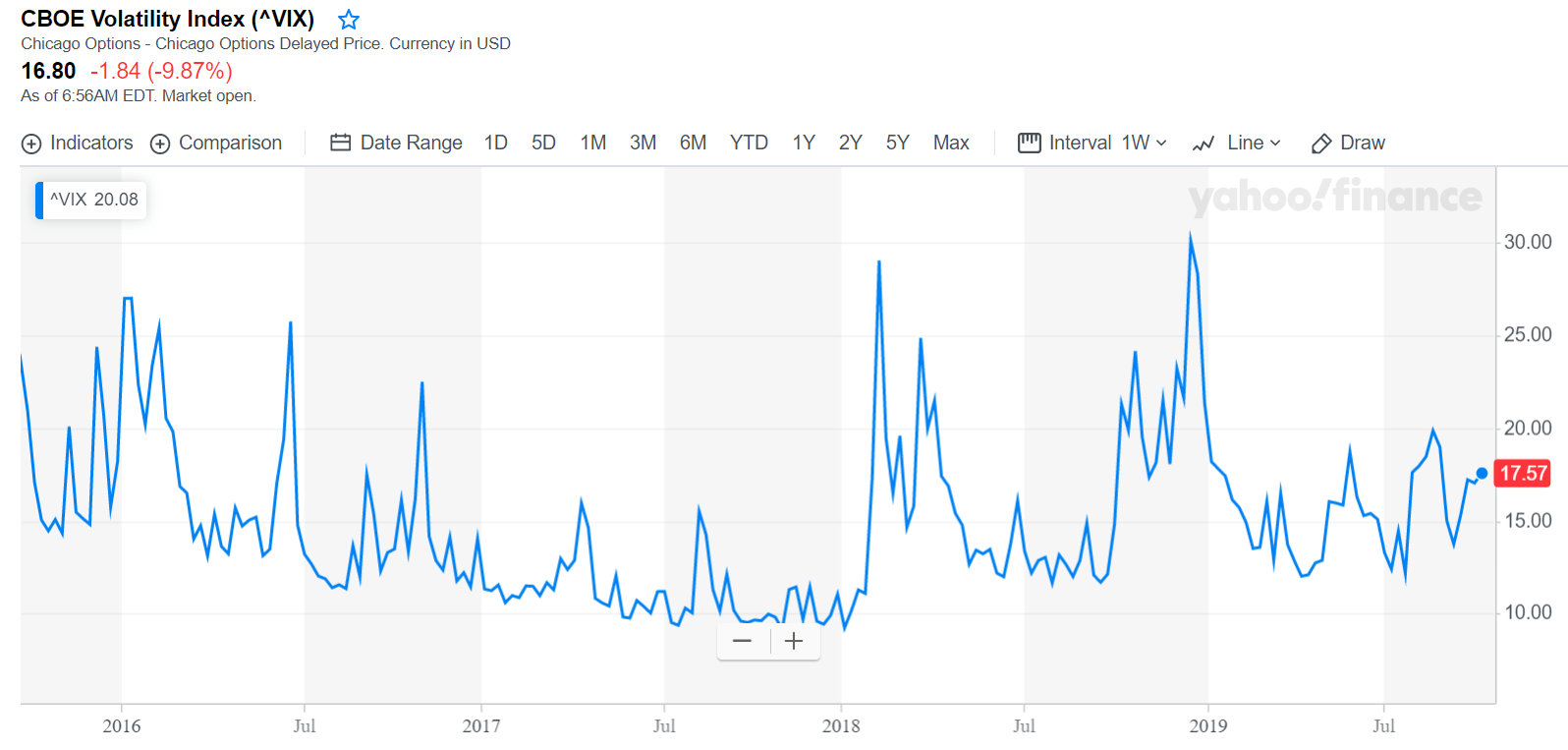

Overall, volatility has leveled off lately, though it hasn’t really calmed down. Here we can see the VIX volatility index is still pretty elevated.

The stock market gains today are brought to you by renewed hopes of both the Brexit negotiations, as mentioned above, but also the US-China trade deal.

Of course, similar to Brexit, we don’t know what’s being discussed and even if there is some sort of deal struck what it might look like. We’ve already seen several times where Trump and Xi delivered short term deals that served to buoy markets but whose real effects didn’t last long at all.

Iran Missile Attack

This time Iran was on the receiving end of the missile.

We still don’t know definitively who was behind the drone attack on Saudi Arabia and we may never know who was behind countless attacks in the Persian Gulf over the last few months. The only thing we do know is that just about all the targets are involved in the production and transportation of crude oil.

Prices were affected this morning but not by very much. The purple circle on this chart is the approximate time that the news broke.

Crypto Volatility

Volatility has returned to the crypto market with a vengeance. Unfortunately, direction has not.

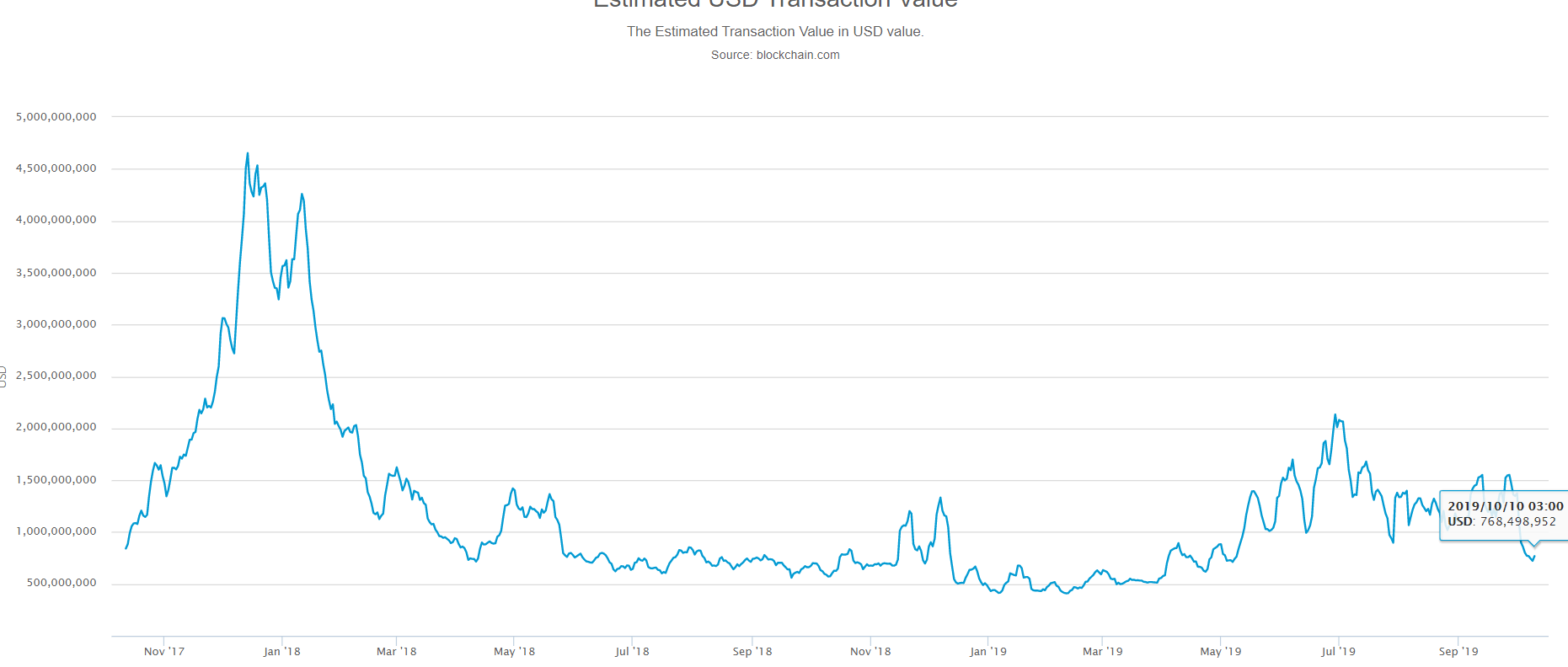

As far as volumes are concerned, we can see that there is some action happening on exchanges over the last few days however, the amount of money being sent on the bitcoin blockchain itself has dropped quite noticeably lately and for the first time since May is now firmly below $1 billion per day.

What’s funny is that the number of transactions hasn’t gone down at all and actually remains extremely stable around 3.75 transactions per second.

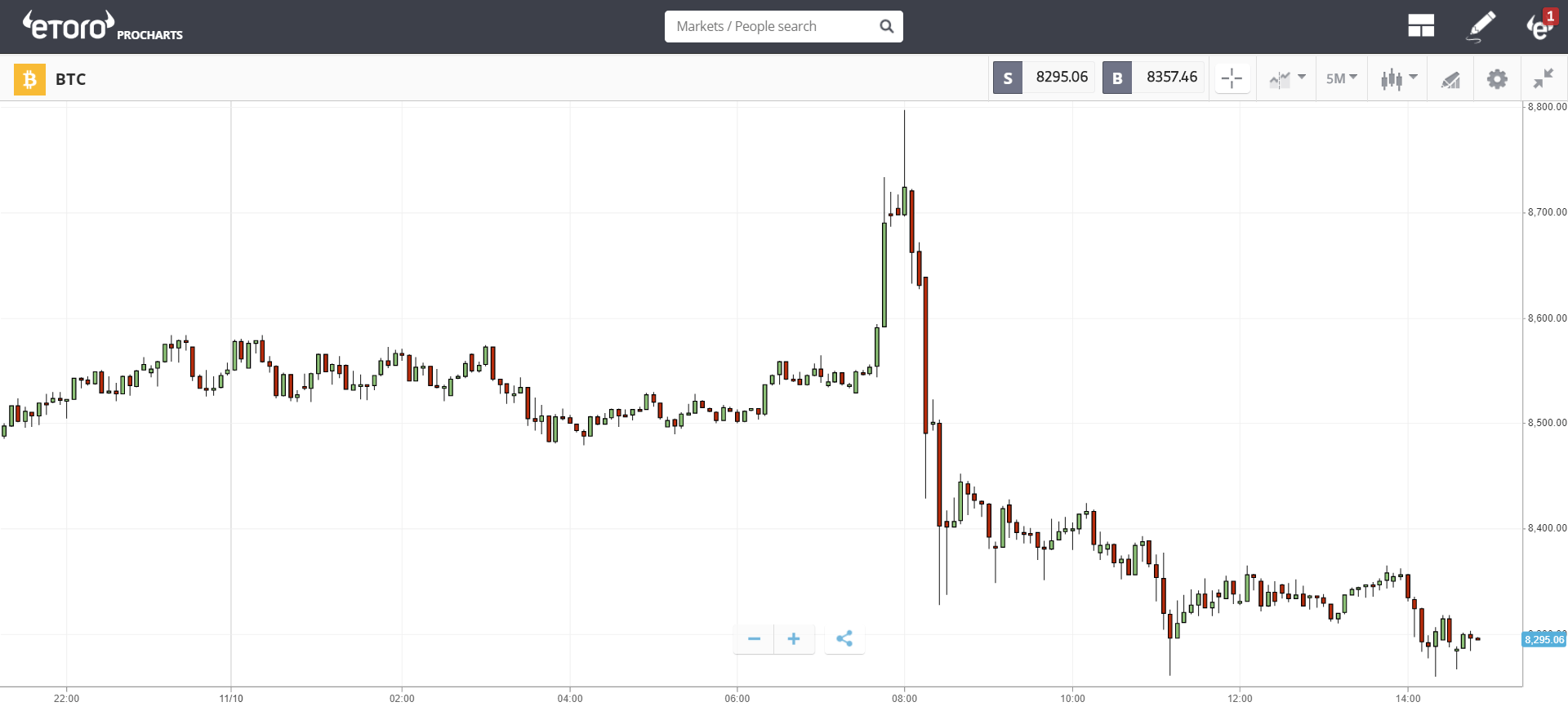

Many traders were pretty confused by this movement on the short term charts last night.

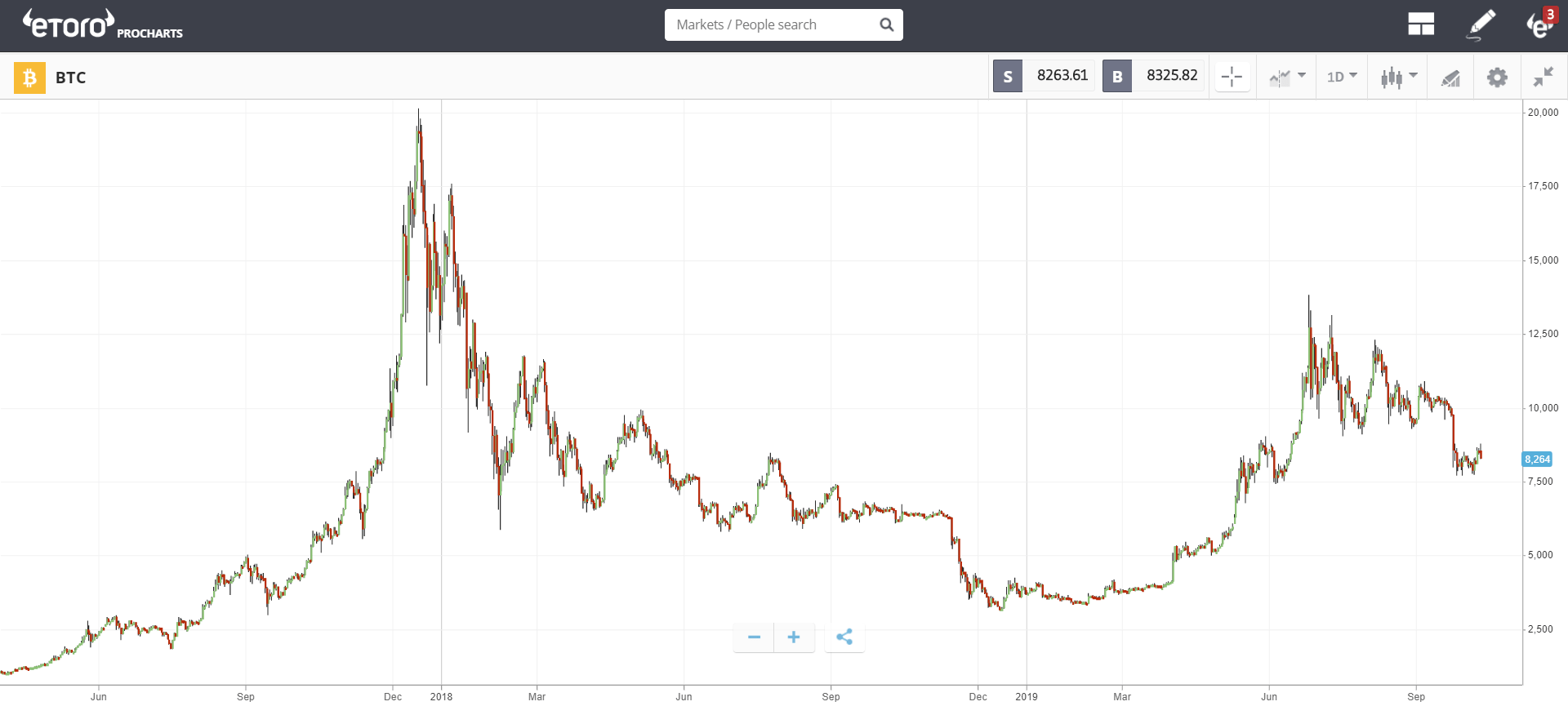

Of course, when you’re zoomed in that much it’s pretty easy to fall on this kind of bull trap. If we zoom out though, this is really just a minor blip, barely even noticeable on the long term graph.

For your entertainment pleasure this weekend. I dug out one of my favorite episodes of What Bitcoin Did, where Peter McCormick interviews crypto pioneer Eric Voorhees. The two discuss how much life would be better with less government. This is what it means to be a libertarian. Have a listen at this link.

Wishing you a fantastic weekend!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.