Hi Everyone,

Huge congratulations to our CEO at eToro Yoni Assia who is set to join some of the most influential people in the crypto world at a unique lunch with the most influential investor in the traditional markets, the Oracle of Omaha, Warren Buffett.

The event will take place this Thursday at Quince Restaurant in San Fransisco. Justin Sun, the Founder of the Tron Foundation who donated $4.57 million to charity in order to organize this event has the option to bring up to seven people with him.

Yoni will be joining Sun, along with Charlie Lee the founder of Litecoin, the CEO of Circle the crypto exchange owned by Goldman Sachs, and Helen Hai the head of the Binance Charity Fund. By this count, there may be another three announcements coming in the next 48 hours.

Would like to wish them all the best of luck and success. This will undoubtedly be the most difficult sale you’ve ever had to make but could possibly be the most rewarding if you’re able to bring the sage around.

Today’s Highlights

- New UK PM

- Libra Sentiment

- Crypto Volumes Lagging

Traditional Markets

As the Fed is now in blackout mode ahead of their July 31st meeting and the markets quite certain that they will cut their interest rates on that date, there’s little in the way of market drivers at the moment.

There’s also a lull in earnings announcements today with very few major companies reporting. So it may be a good day to hit the beach really.

Global stock indexes are pretty flat at the moment, as are commodities and currencies across the board. Even crude oil has barely reacted to the news that a British Oil Tanker was hijacked in the Persian Gulf.

One catalyst that has been moving the markets for a few weeks is set to come to a head tomorrow morning when the new Prime Minister of the UK is announced.

The British Pound has been struggling to hold the lows on the anticipation that Boris Johnson, a hard-line Brexiteer who has vowed to leave the EU by the end of October with or without a deal, is set to win the top spot. However, Parliament has already taken measures to deter him from taking such a drastic step once he’s in power. So we can see the GBPUSD is holding for now.

Libra Sentiment

It seems like everyone is weighing in on project Libra and there are so many opinions floating around out there. So, in true eToro fashion, we decided to crowdsource it. Last week we ran a poll of 600 internet users that was designed to be a rough representation of the population of the United States and asked them what they think about project Libra.

Even just finding out how many Americans are familiar with the project is quite interesting and made for some splashing headlines.

Yup, that’s right. In just one month since being announced already 16% of Americans have heard of Libra, which is more than the 12% who know what Ethereum is. Bitcoin is still king of course, with 58% brand name recognition, which still seems pretty low if you ask me.

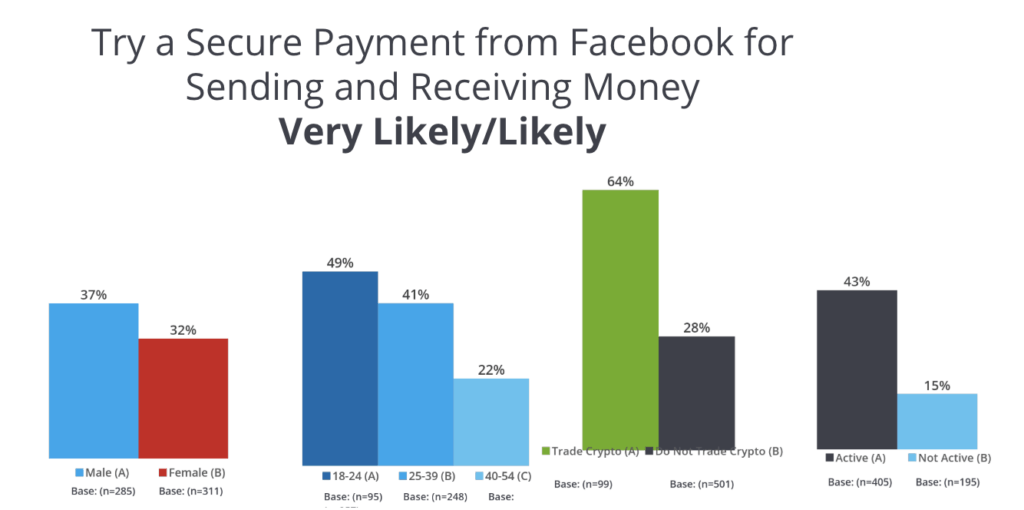

Things get even more interesting when you break it down into demographics. Here we can see the various responses to the question “How likely are you to try a secure payment service from Facebook”?

As you can see the responses are broken down by gender, age, familiarity with crypto, and if they’re active on Facebook. From this, it’s quite clear that people who have already used crypto and people who already use Facebook are much more likely to try it.

Bitcoin Volumes Lagging

There’s been some very positive news regarding the coming institutional adoption of bitcoin recently, but it doesn’t seem to be inspiring much excitment among cryptotraders today.

Number one is an application from the global asset management firm Fidelity, which if approved will give them a far greater reach into the digital assets market.

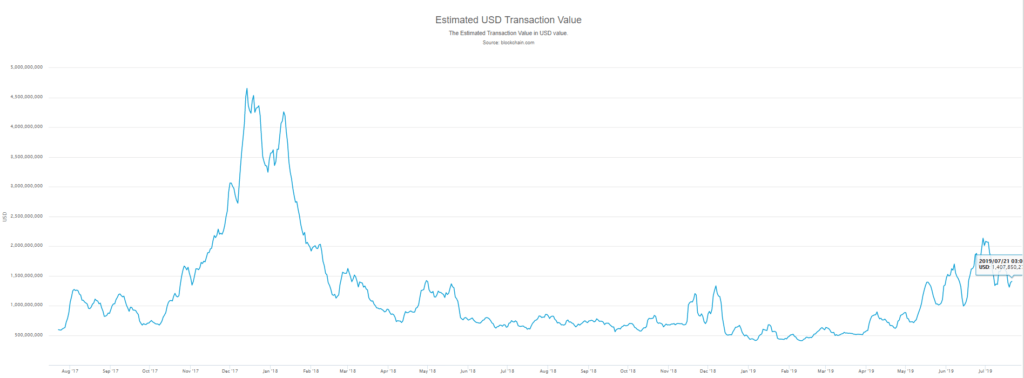

Still, volumes and price action today is lackluster to say the least. Messari’s real 10 bitcoin volume is giving a sluggish reading of less than $1 billion. Volumes on the CME Group’s bitcoin futures have been in steady decline lately as well. But the kicker is coming from the blockchain itself where the transaction rate has plunged to 3.65 TPS and the estimated volume at $1.4 billion is the lowest it’s been in more than a month.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.