Good morning everyone,

As Premier League clubs scramble to make all important reinforcements while the transfer market is open this month, a much bigger deal is afoot and should finally be signed today in the White House. The phase one agreement between the US and China sees the latter pledge $200 billion in additional purchases of US goods over a two year period. Off the back of an 18-month long trade war, President Trump will undoubtedly carry this as a trophy into his re-election campaign. However, markets are not fully convinced. Asian stocks closed lower and Europe has had a subdued open this morning after US Secretary of the Treasury, Steven Mnuchin said US tariffs would remain intact until phase two of the agreement. Some key issues were not resolved in phase one including China’s subsidies for its state-owned enterprises as well as their cumbersome cybersecurity regulations which have hampered progress for US tech firms in the country.

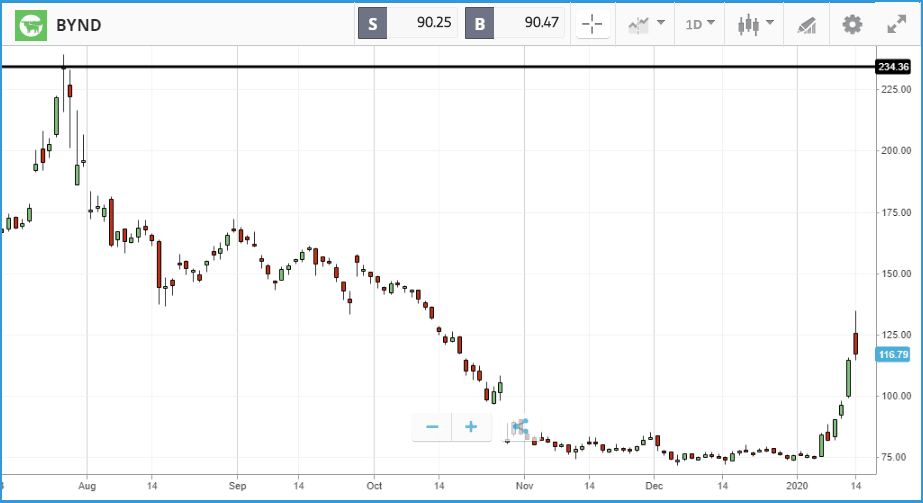

Plant aficionado Snoop Dogg helps Beyond Meat rally

Beyond Meat extended its 2020 gains yesterday after news broke that via Snoop Dogg’s Dunkin’ partnership, there will be a plant-based Beyond D-O-Double G sandwich featuring a Beyond patty. This year’s 58% rise in the share price is a welcome reprieve for investors who had seen the stock capitulate 68% since July in a post IPO crash. Whilst there is still a long way to go to get back to 2019 highs, partnerships with McDonalds and Subway among others will give shareholders some hope that a turnaround is on its way.

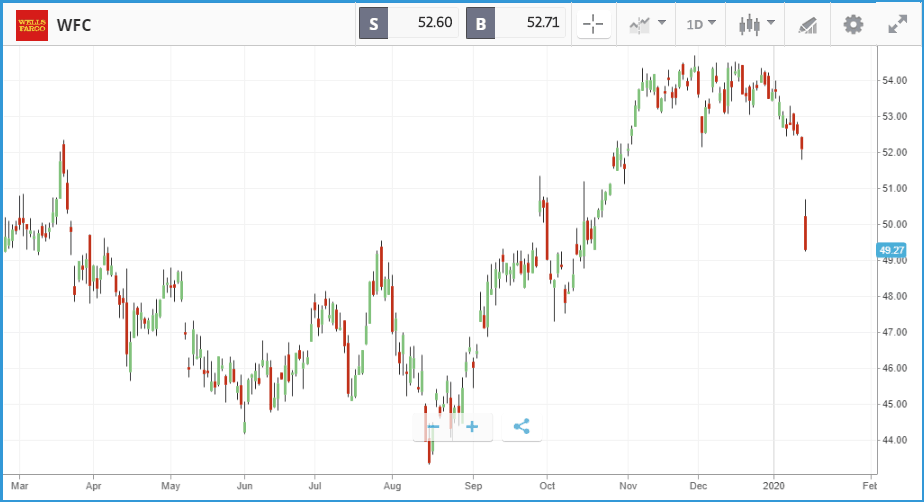

Feast and famine in first set of big bank earnings

Three major banks – JPMorgan Chase, Citigroup and Wells Fargo – reported Q4 earnings on Tuesday. JPMorgan posted post-financial crisis profits of $8.5bn, with earnings per share of $2.57 comfortably ahead of analysts’ $2.35 estimate. The profits were driven by positive consumer sentiment underpinned by a strong US economy, which overcame interest rate cuts last year that typically hamstring bank margins. Citigroup also posted double-digit earnings growth, propelled by similar trends. JPMorgan’s stock closed the day 1.2% higher, and Citi finished 1.6% higher. At the other end of the spectrum, it was another painful quarter for Wells Fargo, which is still dealing with the hangover of its fake account scandal. Profits halved, in part due to a $1.5bn litigation bill for the quarter. The banking giant’s share price closed 5.4% lower, and at $49.30 is around 25% lower than its peak over the past five years. This setback comes after a 25% gain since August 2019.

Elon Musk closes in on mammoth payday as Tesla soars

Tuesday on the whole was a mixed day for US stocks, with the S&P 500 and Nasdaq Composite both posting negative sessions and the Dow Jones Industrial Average eking out a 0.1% gain. Delta Airlines rose 3.3% after beating earnings estimates, with its earnings per share figure coming in 21% above consensus estimates. Lower fuel prices, increased revenue per mile, and increased demand all contributed to the earnings beat. Under Armour also had a big day, boosted by the news that hedge fund Lone Pine Capital had taken a 6.7% stake in the firm. Tesla’s run up continued, with a 2.5% gain, taking its market cap close to the $100bn mark where Elon Musk’s mammoth share-based pay package begins to kick in. Among the 100 largest Nasdaq stocks, it was medical devices firm Boston Scientific that brought up the rear, with a 6.2% share price drop after posting a disappointing sales update.

S&P 500: -0.2% Tuesday, +1.6% YTD

Dow Jones Industrial Average: +0.1% Tuesday, +1.4% YTD

Nasdaq Composite: -0.2% Tuesday, +3.1% YTD

Under fire housebuilder Persimmon sees revenues dip

In a busy day for UK markets there have been a score of updates this morning from names including housebuilder Persimmon and FTSE 250 energy group Tullow Oil.

Persimmon, which has come under fire for building sub-par homes, has reported a fall in group revenues of 2.4%, but said this is down to its “customer care improvement plan” which has been implemented to improve building standards.

Looking ahead to the 2020 spring season, Persimmon – which also announced a board member was stepping down – said it is in a strong market position. “The Group has a nationwide outlet network and a range of attractive house types available at affordable prices across the UK regions, supported by high quality land holdings and a conservative balance sheet,” it said. With shares up 40% in the last six months, Persimmon’s update will be watched closely by investors.

Meanwhile Tullow reported its strategic review is now taking place, with the group trying to “improve operational efficiency”. Shares are up over 4% at the time of writing which will be little consolation to investors who have held the stock since September last year, who have suffered a decline in excess of 70%

Games Workshop earnings boost takes five year return past 1,300%

UK stocks edged out a positive day on Tuesday, as investors wait and see how today’s signing of the phase one US-China trade deal in Washington pans out. NMC Health’s short-seller related rollercoaster continued, with its share price increasing 6.5%, however, the company’s stock is still down close to 50% over the past month. Housebuilder Taylor Wimpey, Vodafone and energy firm Centrica were three of the FTSE 100’s other biggest risers, with gains of 3.9%, 3.4% and 2.5% respectively. In the FTSE 250, Games Workshop led the way with a 9.2% share price pop after reporting that pre-tax profits for the first half of its financial year had jumped by 44%. Over five years, the firm has now delivered a share price increase of more than 1,300%.

FTSE 100: +0.1% Tuesday, +1.1% YTD

FTSE 250: +0.2% Tuesday, -0.6% YTD

What to watch

Bank of America: Following rivals JPMorgan, Citi and Wells Fargo, Bank of America will report its Q4 earnings on Wednesday. Wall Street expects BofA earnings to come in marginally below the same quarter a year ago. The firm has been pushing to integrate its consumer banking, robo-adviser and wealth management services in recent years, encouraging referrals between business lines. Analysts will be watching closely for the influence of BofA’s investment banking arm on the numbers in the quarter, which were a major support in its last quarterly report as they came in well above expectations.

Goldman Sachs: Goldman Sachs had a big 2019, outpacing the S&P 500 with a 40% plus share price rise. This week, JMP Securities analyst Devin Ryan raised his rating on the firm to an “outperform” due to the transformation it is currently going through. “Goldman Sachs is in the early stages of one of the most meaningful transformations within financial services,” he said. Goldman’s turnaround has included a push into consumer banking, increased transparency and a new focus on technology. The average 12-month price target on Goldman Sachs stock is $259, versus its $245.66 Tuesday close price, they will update the market today.

Associated British Foods (ABF.L): Most notably known for being the owner of high street giant Primark, ABF will release their Christmas trading figures tomorrow. Some retailers such as M&S disappointed with their updates last week, can Primark buck the trend? There is also the other side of ABF’s business in food and sugar which in the past have disappointed but were offset by strong Primark performance.

Others to watch: Charles Schwab, BlackRock, US Bancorp, Kinder Morgan, Pnc Financial Services

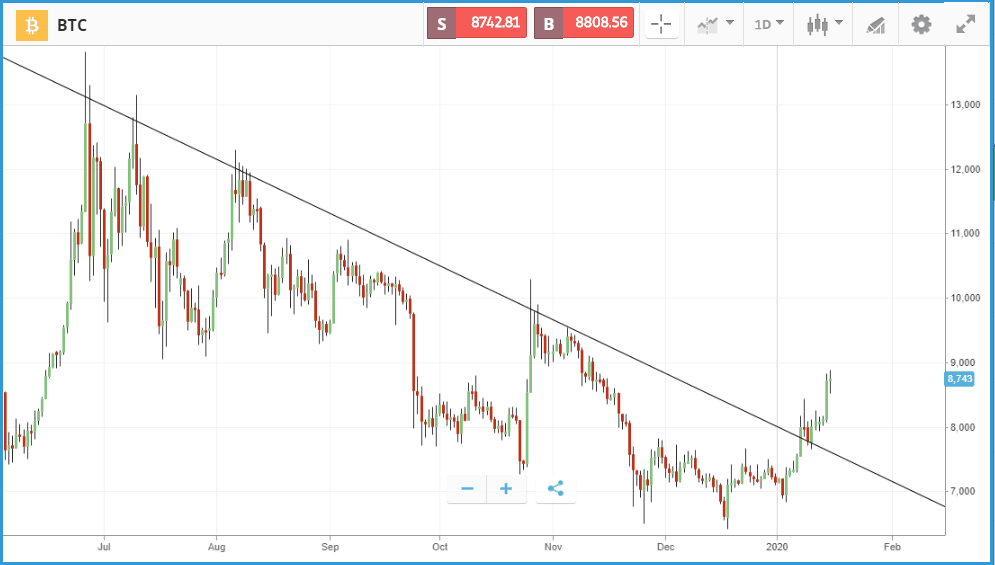

Crypto corner:

A near 10% gain for Bitcoin yesterday pushed the price up to a peak of $8,800, continuing its breakout from the 6 month downward channel. We would now want to see some higher lows for the move higher to be convincing

SEC issues IEO warning

The SEC released an alert, warning investors about the risks of initial exchange offerings (IEOs). The report urges investors to approach with caution as they may involve false promises of high returns. They also point towards the fact that the offering could be considered a security, drawing parallels with their assessment of initial coin offerings (ICOs).

Bitcoin SV rockets on Craig Wright claims

Craig Wright has claimed he has received the keys to access an $8.9 billion crypto fortune known as the Tulip Trust. This consists of the bitcoin that Wright and his partner David Kleiman mined together. Kleiman passed away in 2013 and since then there has been a legal challenge from Kleiman’s estate for half of the trust. Now with access to the trust, many are speculating that the case with the Kleiman estate will be settled, and that Wright’s share could make it’s way into Bitcoin SV which he is an advocate of.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.