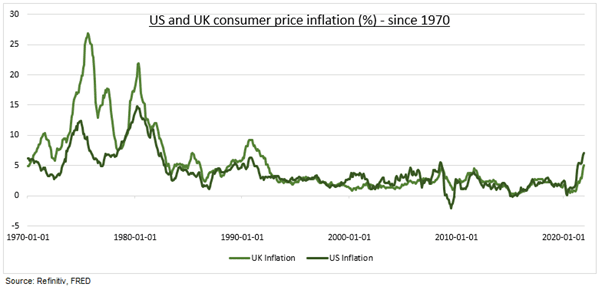

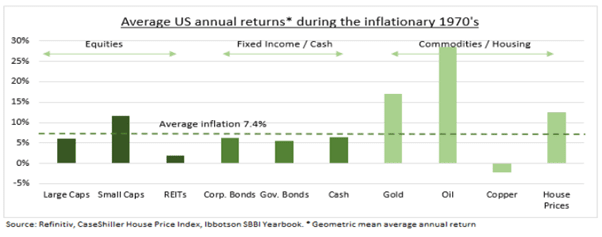

Highest inflation in 40-years. The last time US inflation was at 7% Ronald Reagan was President, interest rates were 11.5%, the CD player was being launched, and E.T. was showing in the cinema.

Past performance is not an indication of future results.

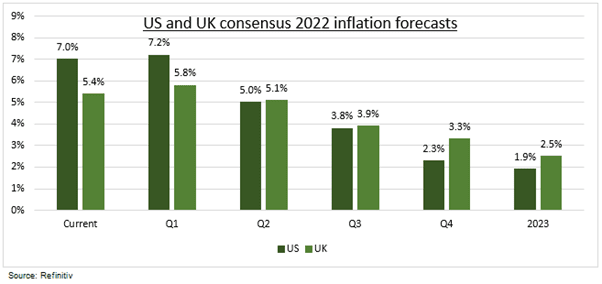

Near the peak. First quarter 2022 likely see’s the inflation peak in major economies. Supply chains are adjusting, demand to switch to services after omicron, and economies slowing after 2021 boom.

Forecasts are not a reliable indicator of future performance

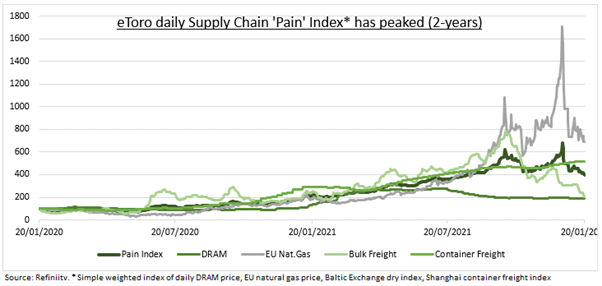

Supply chains are leading. Our supply-chain ‘pain’ index is down by 1/3 from its highs. We are seeing easing DRAM computer chips (see SOXX), shipping (MAERSKB, ZIM), and European nat gas prices.

Past performance is not an indication of future results.

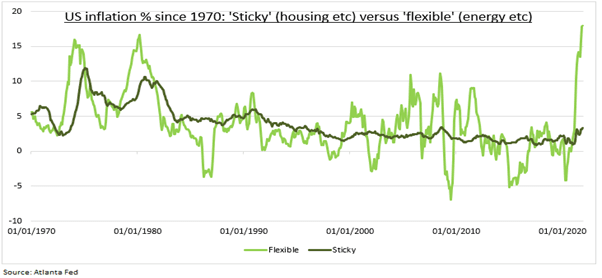

But prices to stay high-for-longer. ‘Sticky’ inflation components like housing and wages are now moving higher and need central banks to tighten interest rates from extraordinarily low levels.

Past performance is not an indication of future results.

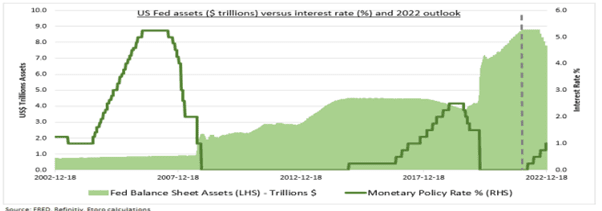

Central Banks already hawkish. Markets pricing four Fed and Bank of England interest rate hikes this year. Also, a shrinking of the Fed’s massive $8.7 trillion balance sheet to push bond yields higher.

Past performance is not an indication of future results.

Hard assets the 1970’s winners. US inflation averaged 7.4% in the 1970’s. ‘Hard assets’ commodities and housing led performance, alongside some equities. Fixed interest and cash could not keep up.

Past performance is not an indication of future results.

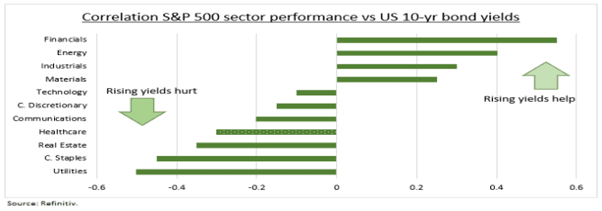

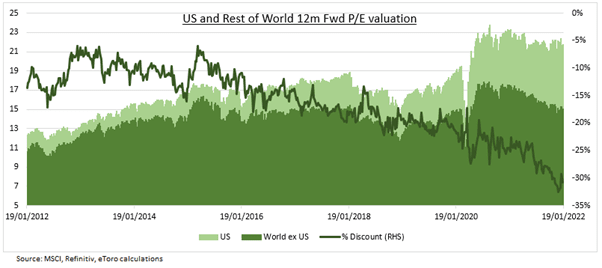

Drives big sector rotation. Higher rates and bond yields hurt those with highest valuations or cash flows furthest in the future, like tech (XLK). Cheap sectors financials (XLF) and energy (XLE) do better.

Past performance is not an indication of future results.

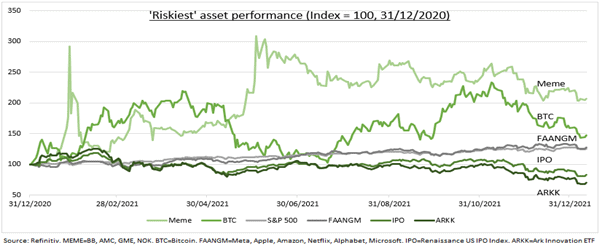

Riskiest segments the biggest losers. Disruptive tech (like ARKK), bitcoin (BTC), meme stocks (GME, AMC etc), and recent IPO’s the worst hit, with big-tech FAANGM’s relatively defensive.

Past performance is not an indication of future results.

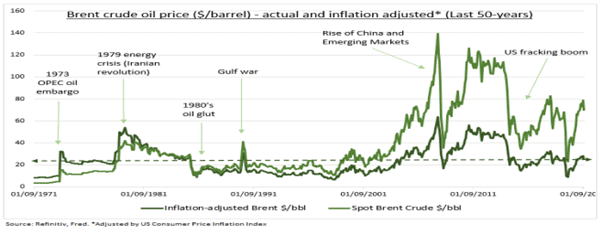

Oil a risk. Oil over $100/bbl., like 2011-2014, could worsen inflation, even though economies have ‘de-commoditised’ in recent decades. Oil demand is strong and supply tight. See OIL and XLE.

Past performance is not an indication of future results.

Road to a double-digit equity return. High inflation and rising bond yields will depress high US valuations. But be more than offset by still strong earnings growth, with GDP twice average levels.

Past performance is not an indication of future results.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.