Good morning everyone,

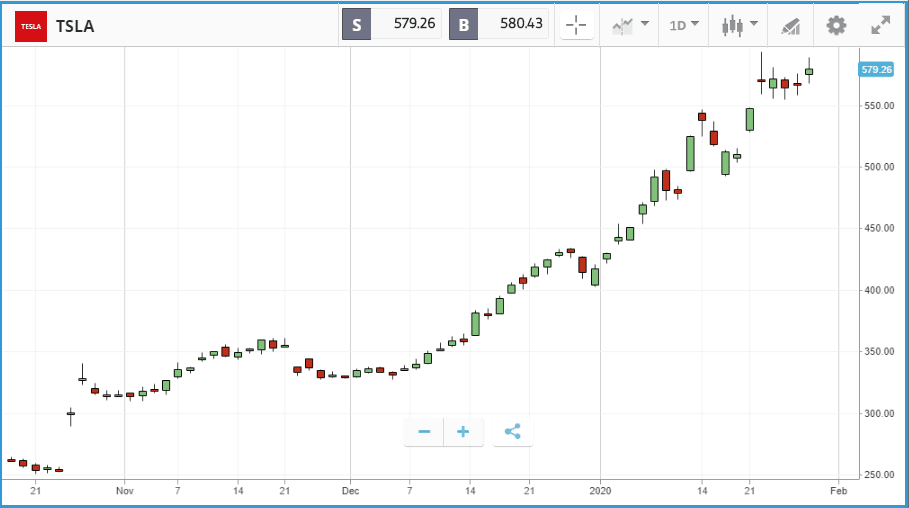

In the US, it was a huge day for corporate earnings, with Facebook and Tesla among the highlights. Facebook beat expectations on revenues and profits for the final quarter of 2019, with daily users of its core Facebook platform increasing 9% to 1.66 billion. The social media giant’s share price had risen 2.5% in the day running up to its latest earnings report but fell sharply in after-hours trading after the results revealed a huge rise in expenses during 2019. Tesla posted double digit gains in after-hours trading following its earnings report, as it delivered a profitable quarter and said it will “comfortably” sell over half a million vehicles in 2020. It also revealed that it is ramping up production of its Model Y crossover SUV.

Double digit share price moves in flat day for markets overall

Although it was a fairly flat day for all three major US indices, there were double digit share price moves at both ends of the market. Victoria’s Secret’s parent L Brands gained 12.9% after it was reported that Leslie Wexner, the billionaire behind the brand, might vacate the CEO seat, with a potential private equity deal on the cards. General Electric gained 10.3% after beating profit and revenue expectations, with CEO Larry Culp saying that the firm has a “positive trajectory in 2020” after a multi-year share price decline that has seen the firm more than half in value. Xilinx was another heavy faller, losing 10.7% after a post-market earnings update on Tuesday that included an announcement that the company is cutting 7% of its staff. Boeing also reported earnings, and while it doubled its estimate of the cost of grounding the 737 Max and halting production, its share price rose 1.71% as the expectations had been even worse.

S&P 500: -0.1% Wednesday, +1.3% YTD

Dow Jones Industrial Average: 0% Wednesday, +0.7% YTD

Nasdaq Composite: +0.1% Wednesday, +3.4% YTD

Crest Nicholson climbs 4.6% despite sales and profits falling

British markets also took pause on Wednesday, with the FTSE 250 posting a marginal gain. Rolls Royce led the FTSE 100 with a 3.4% share price gain, followed by turnaround specialist Melrose Industries at 3.3% and hotel and restaurant operator Whitbread at 2.8%. Wealth management firm Quilter, formerly part of Old Mutual, rose 8.9% after reporting strong asset flows from clients and gave a promising update on its platform transformation. In the FTSE 250, housebuilder Crest Nicholson gained 4.6%, as although sales and profits fell Chief Executive Peter Truscott gave an upbeat outlook on the impact of increased certainty around Brexit.

FTSE 100: 0% Wednesday, -0.8% YTD

FTSE 250: +0.2% Wednesday, -1.9% YTD

Stocks to watch

Amazon: Amazon has lagged the broader market over the past year, gaining 11.2% over the period while other tech giants such as Apple posted huge gains. The firm is likely to find itself center stage in the run up to November’s presidential election, as it is a focal point of antitrust rhetoric. The company is already in a political battle, having blamed President Trump for losing a large Pentagon contract, which it filed a lawsuit over. Expect that suit to be a feature of its earnings call today after the market closes. At present, the average 12-month analyst price target on Amazon is $2,202, versus its $1,860 Wednesday close.

Visa: Visa’s share price rise of 48.9% over the past 12 months has been impressive but has lagged key rival Mastercard which has gained 57%. The company’s $5.3bn acquisition of fintech firm Plaid, and other efforts to partner with newer technology players, will certainly be a feature of interest on Visa’s earnings call today. Wall Street analysts favour a buy rating on the stock, with 33 rating it as a buy or overweight, and three as a hold or underweight. Expectations are for the firm to report an earnings per share figure of $1.46 for the last quarter of 2019.

Coca Cola: Coca Cola is another large name that has delivered double digit gains but lagged the broader market and rival PepsiCo over the past 12 months, with a 19% share price gain. The firm is a steady dividend payer, having raised its dividend annually for more than a century. Barclays equity analyst Laura Lieberman said that the firm expects North American sales growth to accelerate this year. Consumers are continuing to favour less sugary drink options, and Coca Cola’s growth in those categories will be watched closely. Among Wall Street analysts, eight rank it as a buy, one as an overweight and three as a hold.

Big Biotech: There are several key biotechnology firms reporting earnings on Thursday, including Eli Lilly and Company, Thermo Fisher Scientific, Biogen, Vertex Pharmaceuticals and Amgen. The iShares Nasdaq Biotechnology Index ETF – which tracks the sector – has gained close to 20% since the start of October, after a mixed 2019.

Other large US names reporting: Verizon Communications, United Parcel Service, Altira, Northrop Grumman, Raytheon Company.

Crypto corner

Bakkt volumes dry up

Demand for Bakkt’s bitcoin options has severely dwindled since the arrival of the product from rival CME Group earlier this month. Bakkt saw no activity at all last week while CME traded 59 lots. This is a clear sign institutional investors are favouring CME, not hugely surprising as their bitcoin futures, launched 2 years ago are among the most liquid crypto derivatives out there.

Presidential candidate talks crypto

Democratic presidential candidate, Andrew Yang spoke about the regulation of crypto ahead of the Iowa caucuses. He indicated that state by state treatment of crypto is not the best way forward and that a clear and transparent set of rules is needed. He also added that blockchain technology is of “very high potential and we should be investing in it.”

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.