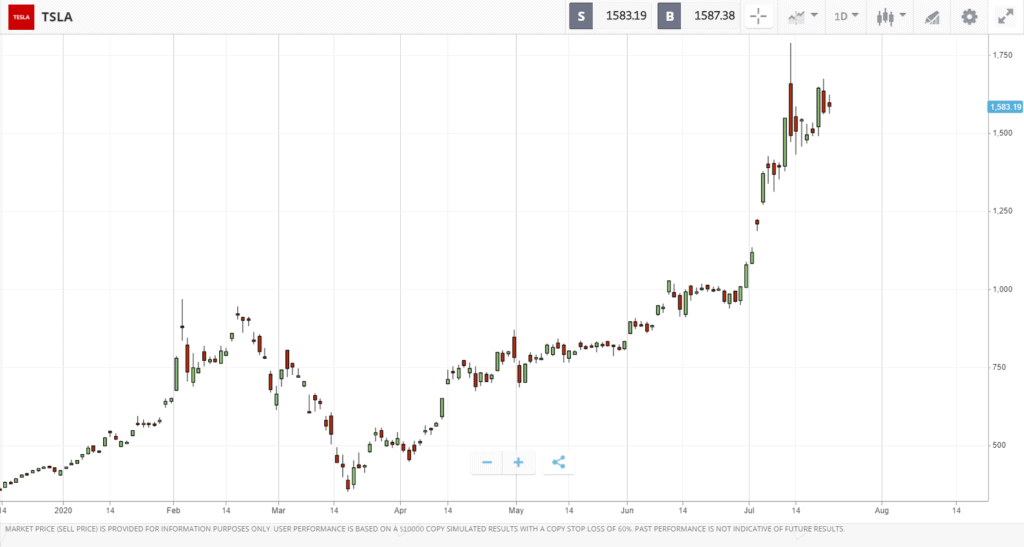

Electric car maker Tesla has posted four consecutive quarters of profit for the first time in its 17-year history. The record makes it eligible for inclusion in the S&P 500 index of US stocks. Despite the global pandemic, the car maker eked out a $104 million profit in Q2. Tesla shares have already been on a run ahead of this news. The share price hit a low of $361 on 18 March but have since soared to $1,592. Investors reacted mutedly to the profit news however, with the share price gaining 1.53% on the day.

Elsewhere the US dollar extended its losses, falling for the fourth session in a row. The weakening of the dollar highlights investor concerns around a second wave of coronavirus in the US. The falls are however spurring investments in areas of the market that become good value as the major world currency’s value declines. Precious metal stocks and Treasury bonds have all risen on the weakening dollar as foreign investors take advantage of the cheapening stocks. The gold price has risen to $1,865 a troy ounce, just 1.4% off its 2011 high from the last recession.

Healthcare and housebuilders on the up as energy stocks retreat

The three major stock indices in the US were all up modestly on Wednesday, led higher by a mixture of healthcare, tech and companies, benefiting from reopening. In the S&P 500, which closed 0.6% higher, HCA Healthcare led the way, gaining 12% while home construction firm NVR was up 10.7% and graphics card manufacturer AMD rose 8.4%. The rest of the top 10 were a mixed bag of healthcare, financial and manufacturing. In the Dow Jones, pharmaceutical maker Pfizer was up 5.1% while Dow Inc rose 3%. Energy stocks went into retreat however with several in the top 10 fallers in the S&P 500. FirstEnergy Corp lost most heavily, down 20.9% while financial firm Northern Trust Corp was down 5.3%. In the Dow Jones, the biggest fallers on the day were also financial and energy with Goldman Sachs retreating 2.8% and ExxonMobil down 2.3%.

In the Nasdaq Composite, energy firm U.S. Energy Corp rose 56% on the back of soaring oil prices. Coming in close behind was Kingold Jewelry, up 46.3%. Healthcare firms were among the biggest losers on the day, however, including Midatech Pharma, down 31.6% and Novan Inc, down 31.1%.

S&P 500: +0.6% Wednesday, +1.4% YTD

Nasdaq Composite: +-0.2% Wednesday, +19.3% YTD

Dow Jones Industrial Average: +0.6% Wednesday, -5.4% YTD

UK stocks cool on Brexit trade fear and China tensions

Both major UK stock indices fell on Wednesday on the back of rising China tensions and Brexit trade gloom, with the FTSE 100 down 1%. Both indices dipped on the news that the UK Government was close to ‘giving up hope’ of a Brexit trade deal as World Trade Organisation arrangements loomed. Similarly, fears of mounting tensions with China continue to weigh on the minds of investors. The best performer on the day for the FTSE 100 was Kingfisher plc, owner of the B&Q retail chain, which gained 14.6% on the back of better-than-expected outlook for profits. It was followed by mining firm Fresnillo, up 9.6% and packaging firm Smurfit Kappa, up 2.8%. Leading the FTSE 100 down, however, was turnaround specialist Melrose Industries, down 14.2%, as it announced job cuts and a halting of the dividend. It was followed by hotel and restaurant firm Whitbread and high-end fashion house Burberry Group, both down 4.1%. In the FTSE 250, which lost just 0.2%, the biggest rise was Mediclinic International, rising 15.6%, followed by Computacenter at 12.3% and Petropavlovsk up 8.7%.

FTSE 100: -1% Tuesday, -17.6% YTD

FTSE 250: -0.2% Tuesday, -20.1% YTD

What to watch

RBS: The Royal Bank of Scotland, or RBS, is no more and is now known as NatWest. It reports interim results amid a flurry of announcements to promote the name change. The bank’s bosses admitted the RBS brand had become ‘toxic’ and so settling on the familiar NatWest is an attempt to move away from the post-crisis image of a failed, nationalised bank. The lender reports interim results on Friday, with a tough outlook predicted as it weathers the storm of coronavirus, with withheld credit payments from borrowers affecting profits. The bank is well-capitalised, however, thanks to stringent stress-test measures in place. Investors don’t seem enamoured by this, as the share price has mostly flatlined in 2020.

Crypto corner: regulator clears the way for US banks to hold cryptocurrency

The Office of the Comptroller of the Currency (OCC) has announced, in a letter seen by Coindesk, it is now permitting US Banks to hold cryptoassets for their customers.

The announcement clears the way for mainstream regulated banks to hold unique cryptographic keys for cryptoasset wallets, essential for such providers to store digital wealth assets for clients. The measure paves the way not only for private clients to hold digital assets at banking providers, but also for cryptoasset firms to deal more easily in digital assets instead of relying on fiat currency.

The letter, addressed to an unidentified bank, stated: “The OCC recognizes that, as the financial markets become increasingly technological, there will likely be increasing need for banks and other service providers to leverage new technology and innovative ways to provide traditional services on behalf of customers.”

The current head of the OCC, Brian Brooks, is a former Coinbase executive who has begun introducing various technological reforms to help financial institutions better utilise modern financial technologies such as cryptoassets.