Good morning everyone,

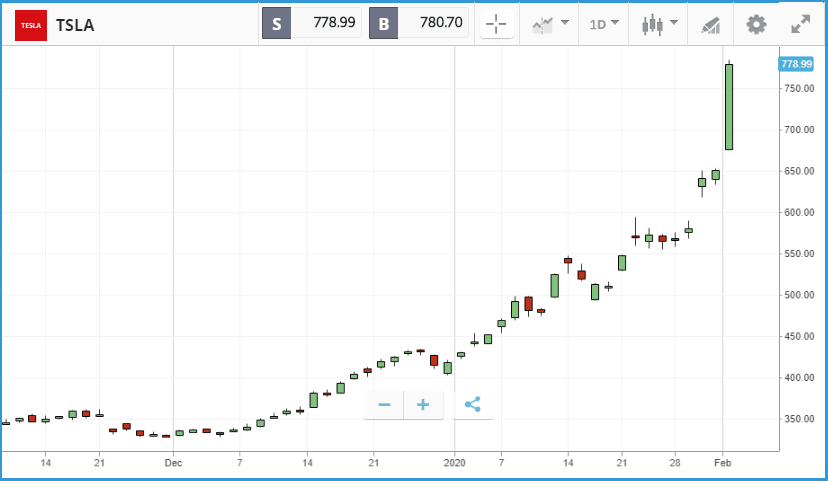

Tesla posted its biggest one day move since 2013, jumping to 20% by market close after analysts at Argus Research raised their target price on the stock to $808 from $556.

Tesla’s share price is now up 73% over the past month and 146% over the past three months, taking its market cap north of $140bn. Argus said that its positive view on the firm assumes revenue growth from the Model S and Model X will continue to grow, in addition to “strong demand for the new Model 3, which accounted for more than 80% of 4Q19 production.”

Last week Tesla set a goal to sell more than 500,000 vehicles this year. The electric carmaker is one of the most heavily shorted stocks out there and those who have bet against it suffered losses of $2.5bn on Monday alone.

Early indicators in pre market point towards another positive open for the stock today.

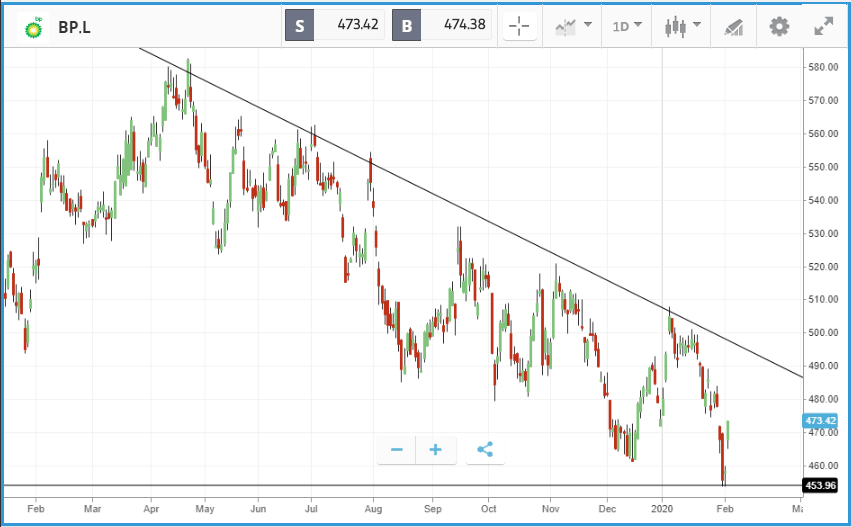

BP ups its dividend after profits beat forecasts while

BP said this morning it was raising its dividend payout despite a 26% drop in fourth-quarter profits, which still beat forecasts. On Chief Executive’s Bob Dudley last day in office, the UK oil major increased its dividend by 2.4% to 10.5 cents per share. This came off the back of a $2.57 billion fourth-quarter underlying replacement cost profit – the company’s key metric. This was ahead of analyst forecasts of $2.1 billion, albeit down from $3.5 billion a year earlier, and comes despite a huge slump in the price of oil in the fourth quarter. Whilst there will be challenges ahead, particularly with Chinese demand for oil being dented by the coronavirus outbreak, the dividend yield remains among the very best within the FTSE100 and as such explains why BP is often a cornerstone of many portfolios.

Shares have been in a downtrend since April last year and investors will be hoping that these results may be a catalyst for a reversal.

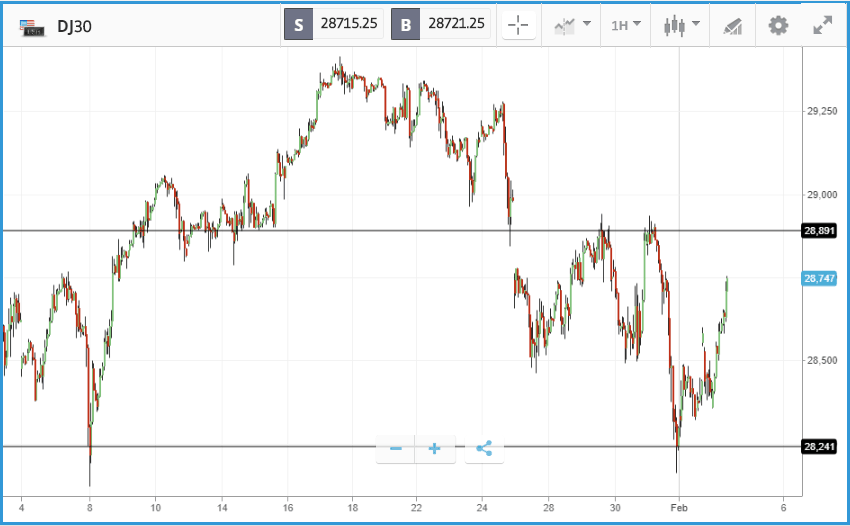

Stocks bounce back as virus fear eases

Asian markets had a positive session, including the Shanghai composite paring some of the losses from yesterday. It appears Beijing’s action has helped to ease market jitters. However, we definitely haven’t heard the last of the coronavirus outbreak with Hong Kong reporting its first death, bringing the total number of fatalities to 427. European markets have opened firmer, with the FTSE and the DAX up over 1.1% each and US futures pointing to a similar move at the time of writing.

US stocks rally, Google tumbles after disappointing earnings

In a rerun of last week when US markets rallied on Wednesday after a substantial coronavirus-linked selloff on Tuesday, the major US indices all gained on Monday after a selloff on Friday, due to the continued march of the epidemic. It was the Nasdaq Composite that led the way with a 1.3% gain, while the S&P 500’s 0.7% gain returned it to positive territory for 2020. The US stock rally happened despite being preceded by huge selloffs in Asia. After gaining 3.5% in the day running up to its post-market close earnings release, Google shares tumbled in after-hours trading, after revenues and profits fell short of analyst expectations. The search giant revealed detailed financial information on some of its business lines for the first time, including ad revenue from YouTube and revenue from its cloud business. Netflix sat close to the top of the S&P 500 on Monday with a 3.7% gain, while food distribution firm Sysco fell 6.7% after delivering a mixed set of earnings.

S&P 500: +0.7% Monday, +0.6% YTD

Dow Jones Industrial Average: +0.5% Monday, -0.5% YTD

Nasdaq Composite: +1.3% Monday, +3.4% YTD

UK shares rise as pound tumbles following Johnson’s trade deal speech

UK shares posted a modest rally on Monday, after Prime Minister Boris Johnson gave a speech in which he claimed that there will be no need for the United Kingdom to sign up to EU rules in exchange for access to European markets. The FTSE 100 gained 0.6%, in part due to the pound falling as Johnson’s speech and one made by the EU’s top negotiator Michel Barnier were some way apart. Budget airline EasyJet and online car market Autotrader led the FTSE with gains of 3.8% and 3.1% respectively. NMC Health once again found itself as the bottom performer, sinking by 16.2% as high trading volumes led to speculation that a large shareholder was liquidating their holding. The FTSE 250 was marginally higher, led by Watches of Switzerland Group, antivirus firm Avast and media company Future, which all rose more than 4%.

FTSE 100: +0.6% Monday, -2.9% YTD

FTSE 250: +0.1% Monday, -3.3% YTD

Stocks to watch

Walt Disney Co: Walt Disney stock has gained 26% over the past 12 months, with all the gains coming from two jumps caused by the launch date announcement and subsequent launch itself of the firm’s own streaming service to take on Netflix. The company’s quarterly earnings announcement on Tuesday will be closely watched for early signs of how the Disney+ service is doing, after it revealed it had secured 10 million subscribers in one day. On Wall Street 20 analysts rate the stock as a buy and seven as a hold, with an average price target of $158.33 versus its $141.32 Monday close.

Ford: Ford’s share price has been on the decline for the past five years, with its price-to-earnings sitting below seven and a dividend yield of more than 6%. The carmaker reports earnings on Tuesday after market close, with truck sales, the firm’s China business, and its ongoing restructuring costs all likely to be in focus. Analysts are predicting an earnings per share figure of $0.17 and currently have 12-month price targets ranging from $8 to $13 on the stock. The company’s progress on electric vehicles after Tesla’s mammoth rally will also likely be a feature of the earnings call.

Snap: Snapchat’s share price has risen 163% over the past 12 months, but its $18.23 Monday closing price is only marginally higher than the firm’s $17 IPO price in 2017. Last quarter the company beat expectations, adding seven million active users during the period and adding 50% to its revenue year-over-year, although the firm is still yet to turn a profit. Among Wall Street analysts, 20 rate Snap as a buy or overweight, 18 as a hold and two as an underweight.

Royal Caribbean: Cruise line Royal Caribbean is one of the firms that has found itself in the middle of the coronavirus epidemic and has been forced to cancel multiple sailings. The company reports its Q4 results on Tuesday, and while the period covered doesn’t include the epidemic, that is likely to be a major focus of analysts on its earnings call. Wall Street analysts have an average 12-month share price target of $142.59 on the stock, versus its $116.45 Monday close.

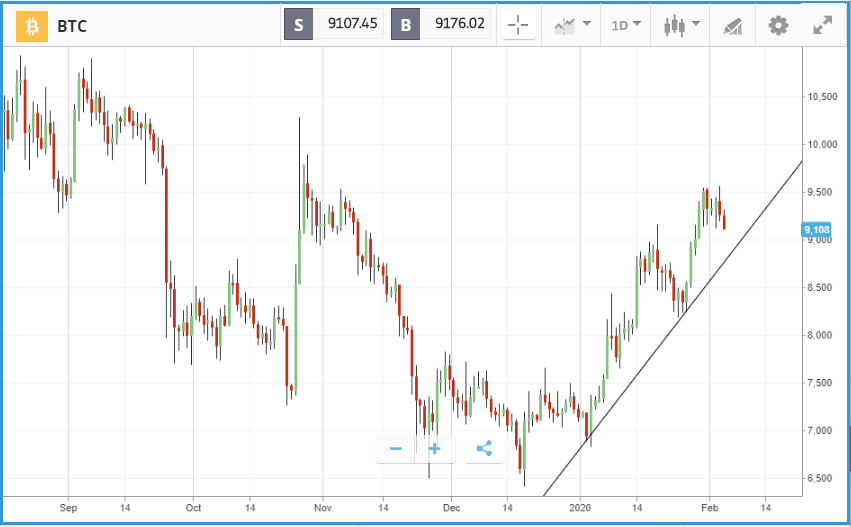

Crypto corner:

Cryptoassets are holding their ground but are off their recent highs, bitcoin was trading at $9,118 this morning and so is still within in range to maintain the higher lows we have seen since the start of the year. So long as the trend is maintained, we could see a fresh push to challenge important resistance at $9,500.

Ethereum was also close to multi-month highs, trading at $186.7. Meanwhile XRP was narrowly off its peak in the last week above $0.25, trading at $0.2486 this morning.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.