Good morning everyone,

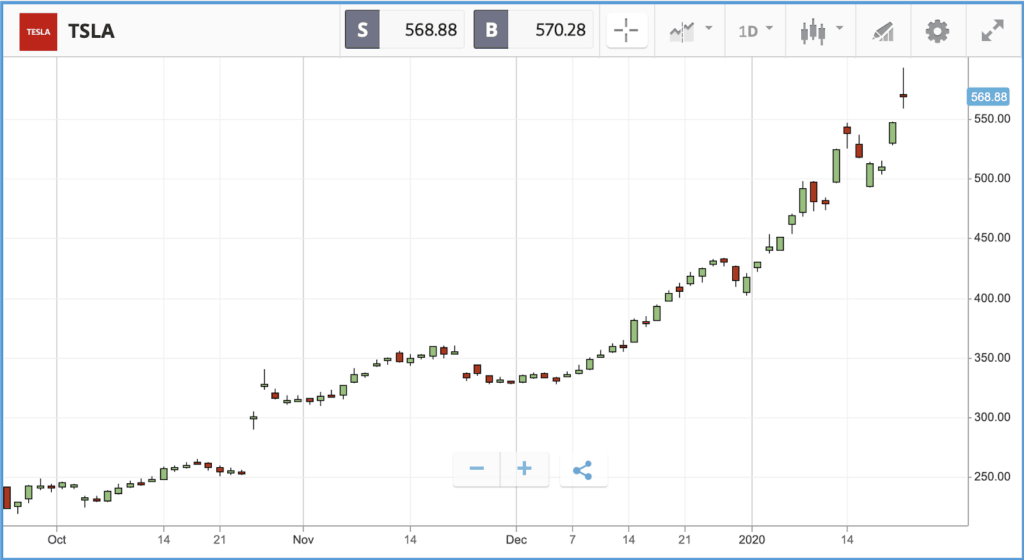

In US stocks, on the back of a 4.1% share price pop, Tesla raced through the $100bn market cap milestone. The electric car firm’s share price has more than doubled over the past three months, and the company is now worth twice what General Motors is, despite delivering a fraction of the vehicles, revenues and profits (Tesla has yet to post an annual profit). In Q3 2019, GM delivered net income of $2.4bn on revenues of $36bn. Tesla, by comparison, delivered net income of $143m on revenues of $6.8bn – although it posted a net income figure of $516m a year prior. The firm’s Q4 earnings release on Jan. 29 will be one of the highlights of the quarter, as investors who have piled in on the recent run up look for signs that growth is coming down the pipeline to satisfy the enormous valuation. In particular, margins will be scrutinised; Tesla hit its 2019 sales goals, but investors will be watching for whether it is benefiting from economies of scale.

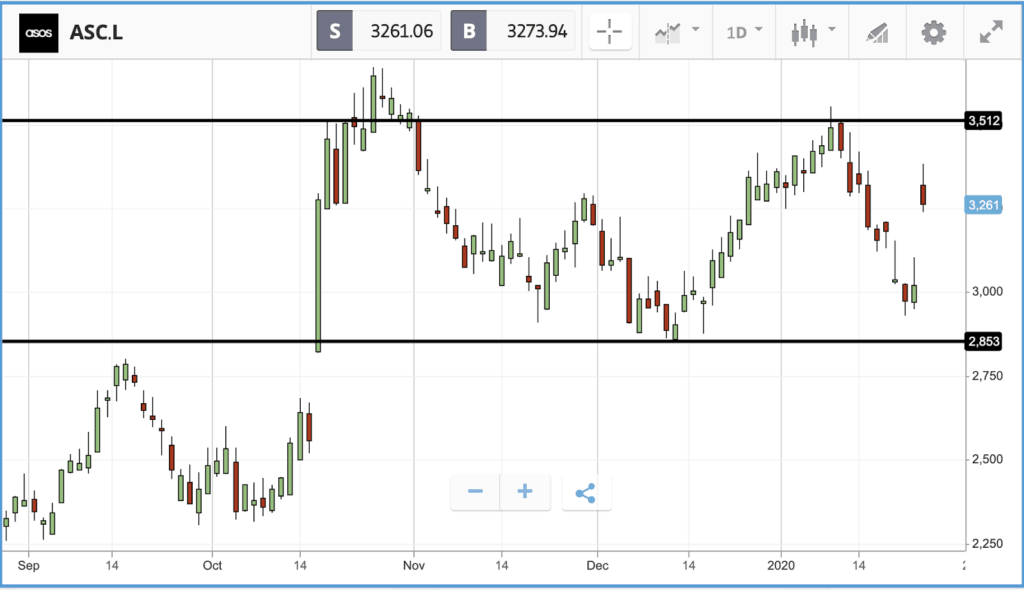

Happy holidays for ASOS

Online fashion retailer ASOS seems to have left its well documented troubles in 2019 with a strong update this morning. Retail sales grew by 20%, comfortably beating analysts estimates of 15%. Q4 really saved a terrible year for the company, plagued by operational problems and as such issued profit warnings, the latest coming back in July. The Christmas period was vital in helping make up the shortfall and the company also had a record breaking Black Friday. With shares are still less than half of what they were at their 2018 peak, investors will undoubtedly be hoping this progress can continue gathering momentum.

Netflix reverses despite beating earnings estimates

US markets were essentially flat Wednesday on a busy day for corporate earnings, although the Nasdaq Composite made a small move upwards led by Tesla and Intel. Netflix was one of the biggest losers on the day, slipping 3.6% after posting gains after hours following their update. Internationally the company delivered over a million more new subscribers than anticipated, taking the total number of paying subscribers globally to 167 million. The share price move demonstrated the value investors are placing on home-market customers with subscriber numbers in North America coming in lower. The company also beat analyst earnings estimates; net income of $587m was up from $134m in Q3 2018, and earnings per share came in at $1.31 versus estimates of $0.52. Health giant Johnson & Johnson posted a middling set of results, missing sales expectations but beating on earnings per share. Its share price slipped by 0.7%.

S&P 500: 0% Wednesday, +2.8% YTD

Dow Jones Industrial Average: 0% Wednesday, +2.3% YTD

Nasdaq Composite: +0.1% Wednesday, +4.6% YTD

TUI’s 737 Max fleet holds it back

In UK stocks, the FTSE 100 closed 0.5% lower, held back by airline TUI, healthcare provider NMC Health and fashion house Burberry Group, which all fell by 5% or more. Boeing’s 737 Max airliner makes up a significant portion of TUI’s fleet and was hurt by the news that Boeing doesn’t expect the plane to be cleared to fly again until at least July. The FTSE was also hamstrung by an increase in the value of the pound versus the dollar and euro, whereas the more domestically focused FTSE 250 gained 0.1%. Sterling was boosted by a report from the Confederation of British Industry, showing business sentiment has swung upwards since the general election. In the FTSE 250, online ticketing service Trainline led the way with a 5.7% share price increase. The firm went public in September at an IPO price of 435p and closed on Wednesday at 507p.

FTSE 100: -0.5% Wednesday, +0.4% YTD

FTSE 250: +0.1% Wednesday, -0.6% YTD

Stocks to watch

Procter & Gamble: Consumer goods giant Procter & Gamble is the firm behind brands such as Gillette, Pantene and Bounty. After years of moving horizontally, the firm’s share price kicked into high gear from May 2018 onwards and has climbed by around 75% since then. Wall Street analysts are split between a buy and hold rating on the stock, with 12-month price estimates ranging from $111 to $140, versus its Wednesday close price of $126.31. Investors will be watching for signs sales growth and margin expansion can continue at pace when P&G reports earnings on Thursday (its fiscal Q2), after the firm raised its sales and profit forecasts back in October.

Intel: Intel has enjoyed the broader rally among semiconductor stocks in recent months, adding more than a third to its market cap since the beginning of September. On Wednesday, ahead of announcing quarterly earnings on Thursday, Intel stock popped 3.6%. There have been reports that the firm is planning to cut prices to defend its market position against rival AMD, which is certain to be a feature of the analyst call after it puts out its numbers. At present, 15 analysts rate the stock as a buy or overweight, 19 as a hold, and eight as an underweight or sell. The average 12-month price target is $59.13, to its $62.73 Wednesday close.

Comcast: One of the more under-the-radar names in the streaming wars is Comcast, which plans to launch its own service with subsidiary NBC in the US this summer – named Peacock. The service will have three price tiers and will potentially be able to set itself apart by offering live sports content through NBC’s many broadcast deals. Peacock will likely be a subject of significant interest on Comcast’s Thursday earnings call. Wall Street analysts overwhelmingly rate the stock as a buy and are expecting an earnings per share figure of $0.77 for the quarter.

Crypto corner:

Having crossed through the $9,000 mark over the weekend, Bitcoin has struggled to make headway for much of the week, with a level around $8,600 being held consistently. Today, even that has proved a stretch for the currency which has dropped back to $8,544 this morning.

Peers Ethereum and XRP are down harder, both off over 2% at $161.7 and $0.228 respectively, erasing some of the bull market gains they have made year-to-date.

Amun launches inverse bitcoin ETP

Swiss digital asset firm Amun has launched the 21 Shares Short Bitcoin ETP (SBTC) on its home exchange SIX. The aim of which is to give simplicity to crypto bears who may be unfamiliar with using more complex derivatives such as futures or options. The product also does not involve margin, or in effect a borrowed capital as a traditional short position would, it would operate like a stock, if you think bitcoin is going to go down, buy it.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.