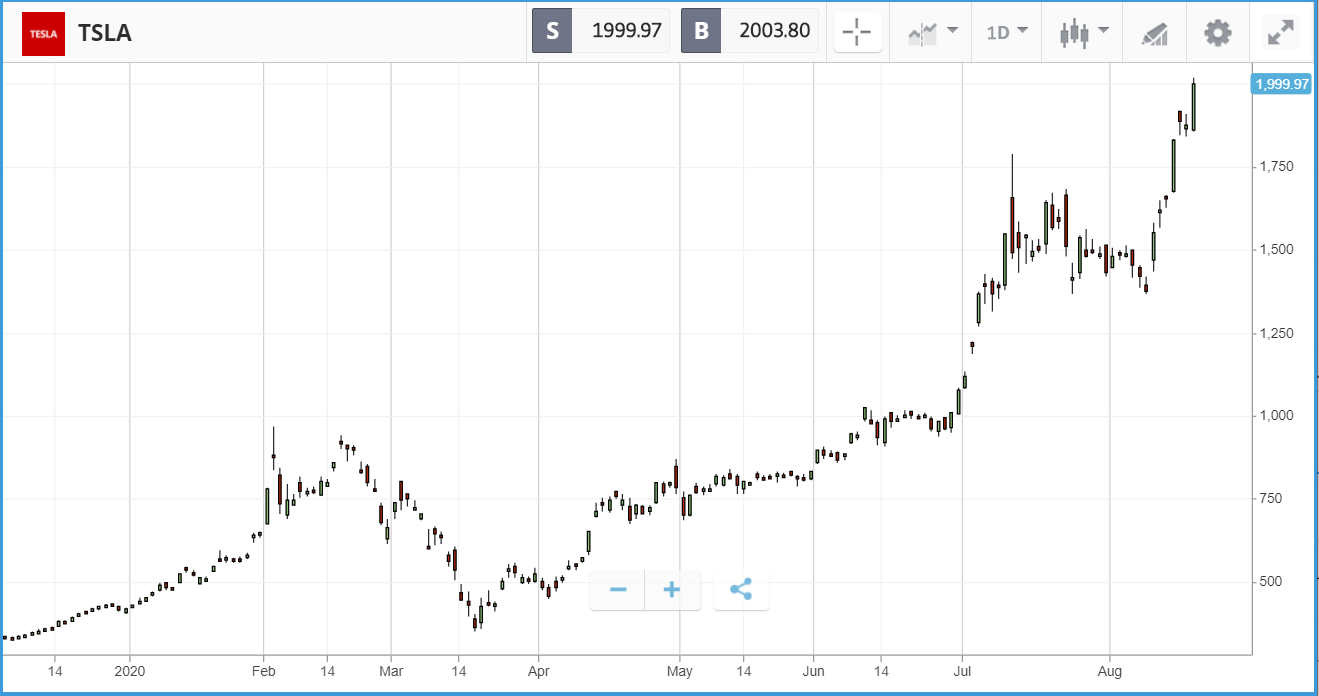

Technology stocks helped drive the S&P 500 up close to its record high, set earlier this week, after both Apple (which become the world’s first $2 trillion company) and Tesla climbed once again.

Shrugging off poor economic data which showed US initial jobless claims came in at 1.1 million last week, an increase of 135,000 on a week earlier, the S&P 500 moved within ten points of its record peak as the tech giants continued to show their dominance with gains of 2.2% and 6.6% respectively.

Tech-enabled peers Uber and Lyft also received a huge boost after it was ruled that they could remain up and running in California – a huge market for both firms – following a state appeals court hearing yesterday. The decision overruled that of a lower court which said that the two firms would have to change how they classify their workers from self-employed contractors to employees. Uber and Lyft are both based in California and had issued warnings that the ruling would cause them to shut down business in the state imminently. Per The Wall Street Journal, California accounted for 16% of Lyft’s ride bookings in Q2 this year, with Uber’s figure riding at around 9% pre-pandemic. Both companies are eyeing a November ballot where voters will decide whether to exempt them from the state law which led to the initial court ruling against the firms.

The positive close in the US helped lift Asian markets, with the Japanese Nikkei closing up 0.3% and Hong Kong’s Hang Seng up 1.4%.

Tesla is now bigger than Walmart, the world’s largest private employer

The Nasdaq Composite once again led the way out of the three major US stock indices on Thursday, adding 1.1% versus 0.3% for the S&P 500. Tesla delivered another big day, with its market cap now rapidly closing in on the $400bn mark. The company’s share price has now topped $2,000 for the first time, and its market capitalisation is greater than that of Walmart, the world’s largest private employer. Walmart generated revenue of $138bn in Q2 and a profit of $6.5bn, while Tesla delivered $6bn in revenue and $104m in profit.

Synopsys, an electronic design software firm, was one of the Nasdaq’s biggest winners yesterday, adding 8.6% following an expectation-beating earnings report. The firm’s share price is up by 54.6% year-to-date. Synopsys led the S&P 500, while cosmetics giant Estee Lauder brought up the rear of the index with a 6.7% loss, after delivering a larger than expected loss in its quarterly earnings.

S&P 500: +0.3% Thursday, +4.8% YTD

Dow Jones Industrial Average: +0.2% Thursday, -2.8% YTD

Nasdaq Composite: +1.1% Thursday, +25.6% YTD

House of Fraser sets landlord ultimatum

Thursday was a gloomy day for UK stocks, with the FTSE 100 sinking by 1.6% and the FTSE 250 off 0.5%. Asset managers were some of the names dragging the FTSE 100 lower, with Standard Life Aberdeen and M&G both sinking by more than 6%. Miners were down across the board too, with Anglo American, Glencore, Antofagasta and more all in the red, to the tune of 4.3%, 4.2% and 5.6% respectively. Only 10 FTSE 100 firms turned in a positive day, with six of those gaining less than 1% and none passing the 2% mark.

In the FTSE 250, House of Fraser owner Frasers Group led the way, with the embattled retailer reportedly threatening to close stores if landlords do not agree to shift to basing rents on sales figures. The ultimatum came as the company reported its latest set of quarterly results which, while painful in terms of tumbling profits, were more resilient than analysts had been expecting. Frasers Group stock jumped by more than 13% after the results were announced.

FTSE 100: -1.6% Thursday, -20.3% YTD

FTSE 250: -0.5% Thursday, -20.1% YTD

What to watch

Pinduoduo: The Nasdaq-listed Chinese e-commerce firm recently blasted through the $100bn market cap marker, surging 157% year-to-date as the pandemic drove consumers online. Right now the company, which reports earnings on Friday morning New York time, is in a spat with another of this year’s top performing stocks, Tesla. The electric car maker has objected to the fact its vehicles were sold by Pinduoduo at a heavy discount in a buying event for Chinese shoppers. Per the FT, Pinduoduo is the world’s largest company to have never delivered a profit, and it regularly records hefty sale subsidies as sales and marketing expenses.

Deere: Farm equipment firm Deere has proven relatively resilient this year share price wise, as while the way people consume has changed, the agricultural industry is still very much one we need. The firm’s share price is up 10.3%, following a 30% plus rally over the past three months. One question when the company reports earnings on Friday is how willing farmers are to spend big on new machinery in the midst of an economic meltdown. Deere’s saving grace versus some of its rivals has been its farming focus, versus more construction oriented firms that are dependent on economic growth to fuel developments. Currently Wall Street analysts favour an overweight rating on the stock on aggregate.

Foot Locker: Shoe retailer Foot Locker’s share price is down 30% year-to-date, as consumers have cut back on discretionary spending on fashion items. Sales at reopened stores, any indicators of a demand build up during lockdown, and how effective the firm has been at selling shoes online will all be key pieces of its Friday earnings call. Analysts currently favour a hold rating on the stock.

Crypto corner: Bitcoin lender raises $50m

BlockFi, a cryptocurrency lender and financial services company, has revealed it raised $50 million from investors in its latest fundraising round.

The platform, which has grown its revenue ten-fold over the past year, is on track to reach $100 million in revenue over the next 12 months and now boasts more than $1.5 billion in assets, according to a report in Forbes.

Backers included Morgan Creek Digital as well as a number of venture capitalists including Winklevoss Capital.

Commenting on the latest investment, Anthony Pompliano, Co-Founder and Partner at Morgan Creek Digital, said: “BlockFi’s platform offers investors unparalleled capabilities in the digital asset ecosystem. We’re excited to back this world-class team as they continue to add new products and expand into incremental areas that are disrupting traditional finance.”

All data, figures & charts are valid as of 21/08/2020. All trading carries risk. Only risk capital you can afford to lose