Good morning everyone,

Expect some thinner volumes today as US markets observe Martin Luther King Jr Day. US markets will reopen as normal tomorrow.

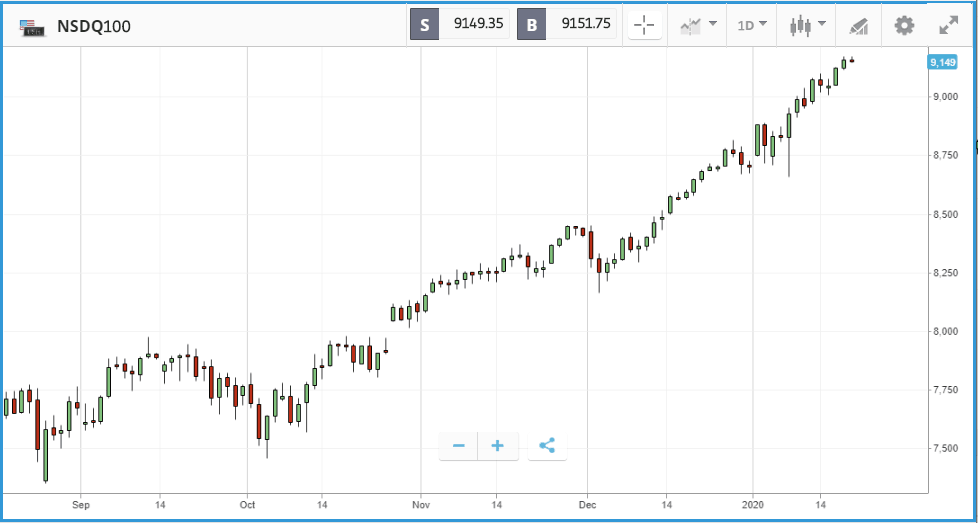

In US stocks last week, technology firms continued to lead the way, with the tech-heavy Nasdaq composite up 4.6% in January so far. Advanced Micro Devices (AMD), one of the US market’s top performers last year, is helping to drive the index higher. The semiconductor firm is up 11.1% year-to-date and has gained 145% over the past 12 months. Rival Qualcomm, which has double the market cap, is not far behind. The stock is up 8.7% YTD, including a 4.5% gain on Friday after analysts at Citi upgraded their rating on the firm from neutral to buy. Analyst Christopher Daley said that the company’s share of the emerging 5G market gives it room to expand revenues and margins. Nvidia and Micron Technology are both off to strong starts too, with share price gains of 5.9% and 7.2%, respectively, while Intel is lagging behind with a 0.4% share price drop year-to-date.

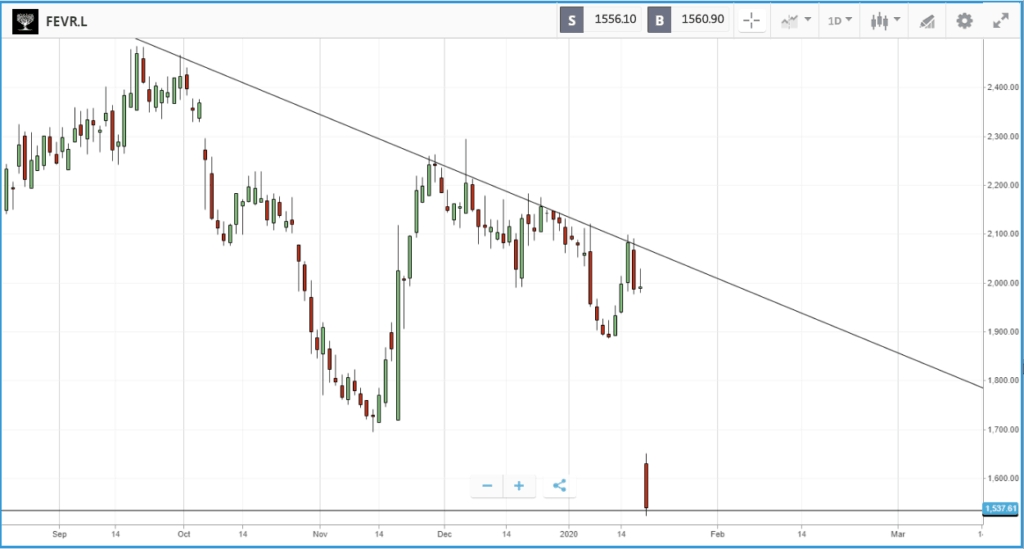

Has FeverTree lost its fizz?

FeverTree, the drinks manufacturer, has today warned its full year results will be below expectations after a subdued Christmas trading period in the UK.

Despite success abroad, and an overall rise in revenues of 9.7%, a weaker than expected UK performance prompted the board to warn that revenues could decline by 5% for 2019 as a whole. The company blamed weak UK consumer confidence for the lacklustre numbers and shares are down 22% at the time of writing. This is the second revenue warning in the space of 3 months with shares having lost 60% of their value since their September 2018 peak, analysts at Jefferies have even said the company may now be a takeover target for one of the big soda companies. Can a turnaround in fortunes see shares fill the gap? Or could further revenue warnings see them fall further?

China deal relief boosts stocks

While the first week of the US Q4 corporate earnings season led to big share price moves in individual names, there were some broader factors driving the market higher last week. Investment firm Charles Schwab pointed to a host of favorable economic reports from China covering December, while new US home construction also hit its highest level in more than a decade. There was also relief that the US-China phase one trade deal was finally signed, although trade will likely remain a significant source of volatility as negotiations on a phase two deal begin. During the week, the Nasdaq Composite climbed 2.3%, the S&P 500 2% and the Dow Jones Industrial Average 1.8%. Boeing held the Dow back on Friday with a 2.4% share price drop. While the plane maker’s stock is still trading around 25% lower than its peak before the 737 Max crisis hit, over the past six months its stock is effectively flat, albeit with lots of ups and downs along the way.

S&P 500: +0.4% Friday, +3.1% YTD

Dow Jones Industrial Average: +0.2% Friday, +2.8% YTD

Nasdaq Composite: +0.3% Friday, +4.6% YTD

Rate cut rumours push UK stocks higher

Both the FTSE 100 and FTSE 250 received a boost on Friday, taking the FTSE 100 to a 1.1% gain for the week, and 1.5% for the FTSE 250. UK shares were in part driven by reports that the Bank of England may be gearing up for further interest rate cutting, after poor Christmas retail sales figures. Retail sales have now been declining for five straight months, with no evidence that there has been any pick-up following the general election. As with the US economy, UK growth has been heavily consumer dependent. NMC Health led the FTSE 100 with an 8.1% share price gain, as it continued digging its way out of the hole created when short seller Muddy Waters took aim at the firm. The company’s stock is still trading around 40% below where it was before Muddy Waters published allegations questioning NMC’s financials. Food producer Cranswick led the FTSE 250 with a 9.4% share price gain.

FTSE 100: +1.1% +0.9% Friday, +1.8% YTD

FTSE 250: +1.5% +0.8% Friday, +0% YTD

Stocks to watch

Netflix: With performance lagging behind its FAANG peers, as well as competition heating up in the streaming space, tomorrow’s update from Netflix will be under close scrutiny. Management guidance for Q4 revenue is $5.44 billion, representing 30% year on year growth. Another key metric will be the number of subscribers. Apple and Disney have recently launched rival services and Netflix will need to ensure they do not lose subscribers in order to achieve the punchy revenue targets they have set themselves. Shares are currently up 4.7% year to date.

Southwest Airlines: Like its rivals, budget US carrier Southwest has essentially delivered a flat return over the past six months. The firm has been caught up in Boeing’s 737 Max debacle, as its 34 Max 8 airliners are currently grounded. It is not as badly hit as some competitors; the company’s website says the aircraft accounted for less than 5% of its daily operations. Southwest had a big Q3, coming in with an earnings per share figure of $1.23 versus an anticipated $1.08. Wall Street analysts are split on the stock, with eight rating it as a buy, 12 as a hold and two as a sell. Sector peers JetBlue and American Airlines will join Southwest in reporting before the open on Thursday.

BlackRock throws weight behind responsible investing

ESG and sustainable investing took a major step last week, as BlackRock announced publicly – via chief executive Larry Fink’s annual letter to companies – that it would be making sustainability and climate risks key components of its investing strategy. The commitment by the world’s largest asset manager throws significant weight behind the movement, which has accelerated over the past year in terms of asset flows. “Climate change has become a defining factor in companies’ long-term prospects … but awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance,” Fink wrote. As part of its commitment, BlackRock will be exiting investments with high environmental risks, including thermal coal, and launch new investment products that screen for fossil fuels. The RenewableEnergy Smart Portfolio is one way investors can access this space on eToro.

US financials are more than bullish headlines

Despite interest rate cuts last year, sentiment surrounding the US financials sector is broadly positive, with many predicting that it will have a big 2020. Q4 earnings results posted over the past week point to more a mixed picture, however. While companies such as JPMorgan and Morgan Stanley weathered the interest rate storm well, and delivered blockbuster earnings, others including BNY Mellon and Wells Fargo require huge investments in order to secure their future. BNY Mellon stock tanked after its Q4 earnings, as it announced to investors that its expenses could expand significantly this year.

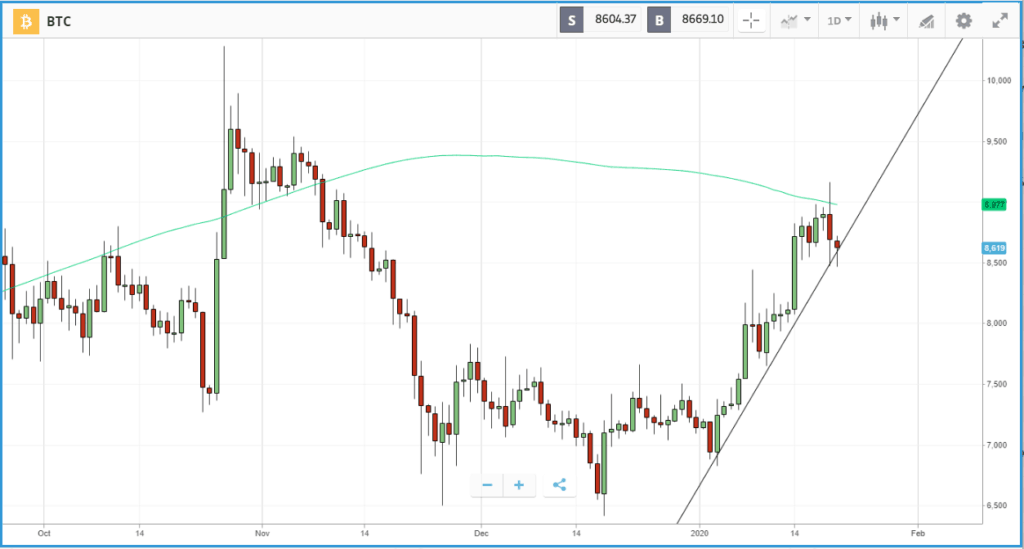

Crypto corner

Having moved above $9,000 over the weekend, Bitcoin retreated back to $8,619 this morning. It is hardly surprising after such a strong rally since the start of the year that some sort of retracement was on the cards. So long as the lows remain higher, we could see bitcoin make another push forward to challenge the 200 day moving average that it bounced back off over the weekend. However, further selling pressure and a breakdown could see a retracement back towards levels seen at the start of the year.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.