Markets have started the quarter on the back foot after more worrying data from Asia overnight showed the impact of coronavirus on manufacturing. Unlike China’s modest gain a day before, numbers came in well below expectations across the board, particularly in big exporter nations Japan and South Korea. The Nikkei closed down 4.5%.

We have also seen the situation in the US worsen as President Trump warned that the US is in for a “very painful two weeks.” Public health officials said that the virus could leave between 100,000 and 240,000 people in the country dead, with millions infected. Despite the lockdown measures, it looks as though the worst is yet to come across the pond. If the US becomes the next epicentre of the outbreak, it would be a third phase after China and Europe. This could see infection and mortality numbers spiral much higher than initially anticipated, particularly as the US scrambles to build makeshift hospitals with medical resources under severe strain.

From a technical standpoint, the sell off saw the S&P break the sequence of higher highs since the rally of last week and fall within the prevailing six week downtrend on the four hourly time frame after being rejected at the downward sloping resistance level.

The closing bell in the US last night signaled the end of the first quarter of 2020, officially confirming it as the worst quarter for stock markets since 2008. Of the major US stock indices, the S&P 500 finished the quarter down 20%, the Dow Jones Industrial Average down 23.2% and the Nasdaq Composite down 14.2%. The Nasdaq was helped by its heavy exposure to the technology sector, which has been the best performing year-to-date. Energy firms have been by far the hardest hit, bearing the brunt of both the oil price war and disruption from the pandemic, with the energy sector down more than 50% year-to-date on aggregate.

Yesterday, US stocks slipped again after a major index of consumer confidence fell from 132.6 last month to 120 this month, a 32-month low — although the figure came in above expectations. Another index produced by the same research group, focused on consumer expectations of income, business and labor market conditions declined from 108.1 to 88.2. The expectation is that consumers, who have been fueling the US’ economic growth in recent years while manufacturing has declined, will become more pessimistic as the crisis continues.

US stocks end quarter on a down day, Xerox ends hostile HP bid

The worst performing sector in the S&P 500 this quarter was also the only one to post a positive trading session on the last day of the quarter. The energy sector climbed 1.6% on Tuesday, health and communication services stocks were the next best performers with sub 1% losses. The utilities sector faced the hardest session, sinking 4%. The Nasdaq Composite fell by the smallest margin of the three major stock indices, losing 1%, as tech names continue to help it stay ahead of the S&P and Dow.

Chinese internet firm Netease was the biggest winner in the Nasdaq on Tuesday, gaining 4.6%. Many of its units, including mobile gaming and e-commerce platforms, are potential beneficiaries of the current environment. Year-to-date, the stock is up 4.7%. The Dow Jones Industrial Average faced the biggest Tuesday fall of the three, finishing 1.8% lower, with names including American Express, Home Depot and Walt Disney closing lower. In corporate news, Xerox ended its hostile attempt to take over the far larger HP, which has been raging for months, as its heavy reliance on debt to finance the deal became problematic in the current environment.

S&P 500: -1.6% Tuesday, -20% YTD

Dow Jones Industrial Average: -1.8% Tuesday, -23.2% YTD

Nasdaq Composite: -1% Tuesday, -14.2% YTD

Banks do away with dividends, buybacks under regulator pressure

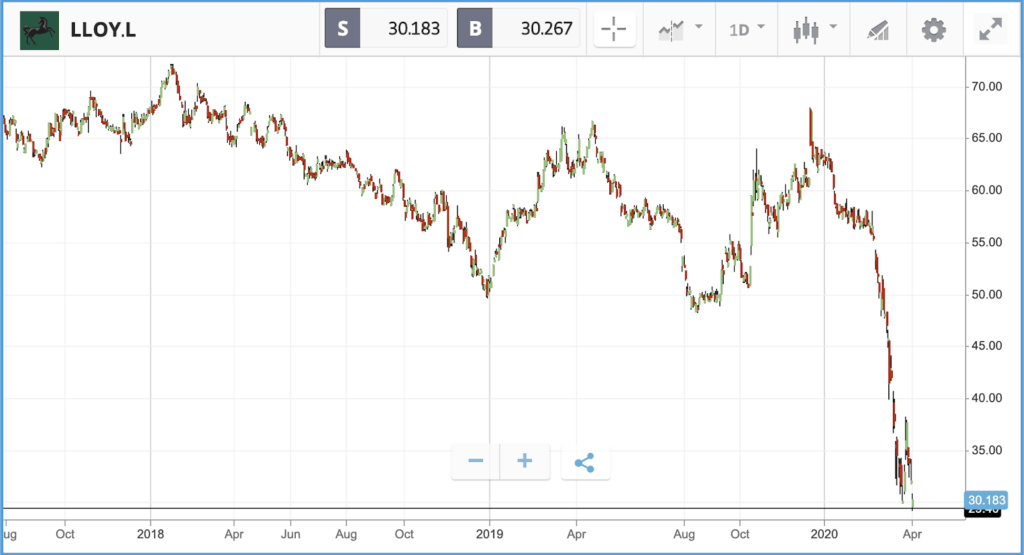

London-listed stocks rallied yesterday, following the release of data showing manufacturing in China had rebounded in March as the country emerged from its coronavirus-induced shutdown, although concerns over the accuracy of the figures persist. Despite closing the day higher, it was still a rollercoaster day for the FTSE 100. Having jumped shortly after the market open, the index fell back to a daily loss by lunchtime before rallying to a 2% gain in the afternoon. The big corporate news on Wednesday was a decision by the largest banks in the UK, under pressure from regulators, to halt their dividend payments days ahead of billions of pounds worth coming due. Lloyds, RBS, Barclays, HSBC, Santander and Standard Chartered all said they would cancel their dividends for 2019, halt share buybacks and not set aside cash for investor payouts this year. Although the move was anticipated, investors still responded negatively to the news. Lloyds Banking Group was the hardest hit, closing 4.5% down, followed by RBS at 3.8% and Standard Chartered at 2.1%. Lloyd’s is now trading at less than half of the value it was at the start of the year and is not far off the lowest close price we saw during the financial crisis.

FTSE 100: +2% Tuesday, -24.8% YTD

FTSE 250: +3.3% Tuesday, -31% YTD

What to watch

ISM manufacturing index: The ISM manufacturing index is a closely watched indicator of recent economic activity in the US, which is based on a survey of purchasing managers at 300 plus manufacturing firms. Expectations are for the index to come in at around 44, down from 50.1 last month (a figure above 50 indicates growth, while sub-50 indicates contraction). The figure for March will be released on Wednesday; last month, the index showed a slight dip but the data only captured the very early days of the coronavirus spread in the US. The release follows data from Chicago on Tuesday, where economic activity appeared to have deteriorated by less than anticipated.

ADP employment report: ADP is a private sector payroll processing company, which will put out its monthly national employment report for March on Wednesday, based on data from its clients. The report is expected to include more data from the second half of the month than government figures which will come out on Friday. Median forecasts predict a figure of 150,000 jobs lost, versus the 183,000 net additions in February. Data points such as this will likely feed into lawmakers’ decisions around the size and scope of future stimulus packages, which are reportedly already in the works even as the ink dries on the $2.2trn round just passed.

Motor vehicle sales: A first look at what is in store for carmakers in terms of the coronavirus impact will also be available on Wednesday, when motor vehicles sales will be released for March by most large firms — including Ford, General Motors and Toyota. The median forecast is for an annualised sales rate of 11.3 million, down from around 17 million a month ago. US listed Ford, General Motors and Fiat Chrysler have all lost more than 40% of their value in 2020 so far, adding to years of decline in the case of Ford and Fiat and stagnation in the case of General Motors.

Crypto corner:

The rebound in crypto currencies paused overnight and continued into this morning, with the three largest cryptoassets all seeing marginal declines.

Bitcoin was off 2% at $6,300, while Ethereum was 1.3% lower at $131 and XRP was down 1.9% at $0.170. The dip comes after a sharp rebound which has seen all three currencies jump 30% or more off lows.

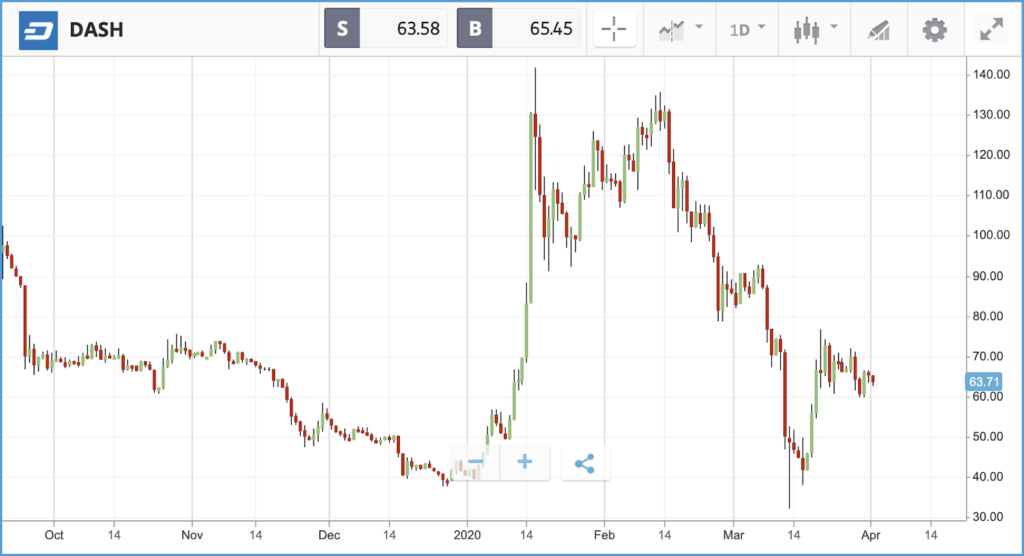

We have previously mentioned the upcoming bitcoin halving in May, well there will be another halving event before this. Miner rewards for Dash are designed to reduce by 7% year on year, the next event is on April 27th. Bitcoin halving events have seen a price rally in the past due to the notion that a lower mining incentive will result in a reduction in supply. It will be interesting to see if we see a similar impact on Dash over the coming weeks.

Toro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.