After opening sharply lower on Monday morning, US stocks staged a comeback over the course of the day, with the S&P 500 finishing the day 0.8% higher and the tech heavy Nasdaq Composite up 1.4%. Investors were buoyed by movements from the Federal Reserve, which said that it is expanding its bond buying program to include the debt of individual companies. Up until now, the central bank had only been buying ETFs in order to pump money into corporate bond markets.

The new program will allow the Fed to buy up to $750bn in corporate debt, and was initially announced back in March. Under the program, which starts today, the Fed will be buying individual investment grade bonds on the secondary market that have maturities of five years or less. The central bank also has a primary credit facility that will focus on buying investment grade bonds directly from firms, which is not yet operational. Bond buying, which helps keep markets running smoothly and provides companies with access to capital, is one of several actions the Fed is taking to confront the economic damage caused by the pandemic.

Financial names ride Fed intervention wave

All 11 sectors in the S&P 500 finished Monday in the green following the market comeback as the day progressed. Financials stocks were the biggest winner, gaining 1.4% overall, as investors viewed the Fed taking further steps to ensure the stability of the bond markets as positive for the sector. The consumer finance sub-sector climbed the furthest at 2%, but remains down 25% year-to-date. Only bank stocks have fared worse within the financials sector; they are down 31.9% year-to-date.

Tech stocks including Tesla and Electronic Arts helped the Nasdaq Composite to its 1.4% gain for the day, with the two firms closing 6% and 3.7% higher respectively. Tesla’s share price remains just below its all-time high $1,025 closing price from last Wednesday, however, following downgrades from analysts at Morgan Stanley and Goldman Sachs on Friday.

In the Dow Jones Industrial Average, which gained 0.6% on Monday, Raytheon Technologies, Goldman Sachs Group and American Express were the day’s biggest winners, all finishing the day more than 2% up.

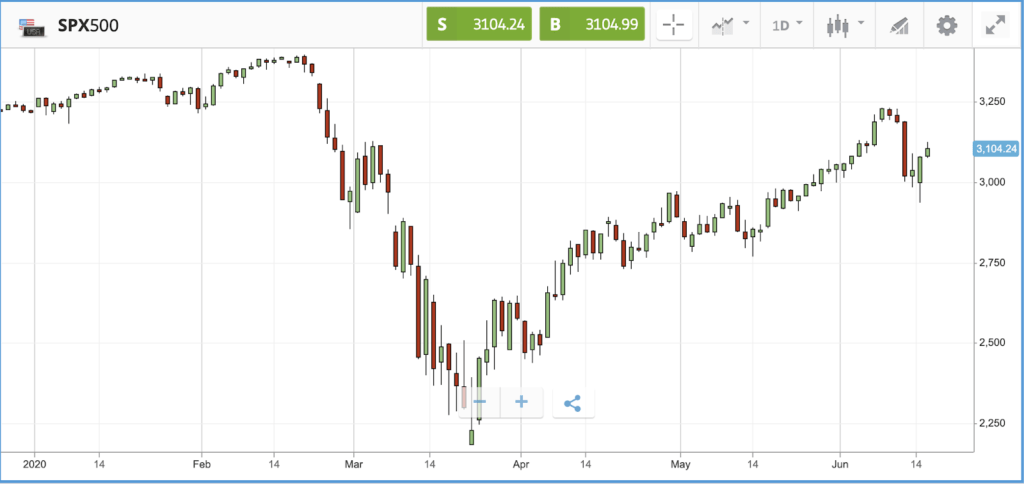

S&P 500: +0.8% Monday, -5.1% YTD

Dow Jones Industrial Average: +0.6% Monday, -9.7% YTD

Nasdaq Composite: +1.4% Monday, +8.4% YTD

BP expects to take a $17.5bn hit to value of its assets

Oil giant BP has cut its oil price forecasts for decades into the future, and expects the price of Brent crude to average $55 a barrel between now and 2050. As a result, the firm said that it expects to write down the value of its assets by £13.8bn, and will need to become a “leaner, faster-moving and lower-cost organisation”. The news follows an announcement from the firm last week that it plans to cut 10,000 jobs.

On Monday, the FTSE 100 fell by 0.7%. Similar to the US, the index opened sharply lower versus its Friday closing price, and recovered throughout the day. Miner Fresnillo, housebuilder Barratt Developments and airline easyJet fell hardest yesterday, closing the day 5.9%, 5.1% and 4.7% lower respectively. At the other end of the spectrum, distribution firm Bunzl, investment firm M&G and equipment rental company Ashtead Group topped the table. Further down the company size spectrum, the FTSE 250 was close to flat on Monday.

FTSE 100: -0.7% Monday, -19.6% YTD

FTSE 250: +0.1% Monday, -21.9% YTD

What to watch

Oracle: Software firm Oracle provides database and cloud services to businesses, and has been shifting its business towards a subscription model for years. Its share price is flat year-to-date, following a 24.7% rally over the past three months. The firm notched a significant recent win in April, when it won a cloud computing deal with video conference provider Zoom Technologies, which has been one of the biggest success stories during the pandemic. Oracle reports its latest set of quarterly earnings on today, where analysts are anticipating an earnings per share figure of $1.15, down from the $1.22 for the quarter they had been expecting three months ago.

Jerome Powell testimony: Today, US retail sale and industrial production figures will be released, on the same day that Federal Reserve chairman Jerome Powell testifies before Congress. Powell’s testimony before the Senate Banking Committee and House Financial Services Committee will give lawmakers a chance to question him on the state of the economy, and follows the Fed putting out a cautious view last week of how long the recovery will take.

UK inflation: On Wednesday, UK inflation figures for May will be released. In April, UK inflation fell to its lowest level in four years, and was in fact even lower than it first appeared. On Monday this week, the Office for National Statistics said that the retail price index — seen by many as an outdated measure of inflation — was incorrectly calculated, with the correct level of annual RPI inflation in April at 1.4%, versus the 1.5% reported.

Crypto corner: Worldwide cryptoasset interest mapped

Data from Google Trends, compiled by Blockchaincenter.net into a world map, shows where the most Bitcoin “maximalist” countries in the world are. It would appear Bitcoin heavily dominates internet searches in Africa and South America, with Kenya the country that takes the number one spot, where 94.7% of cryptoasset searches are for Bitcoin.

Unsurprisingly Bitcoin dominates overall searches by a significant margin, accounting for 80.8% of searches globally, with Ethereum following on 13.7% and XRP on 7.7%. The map also charts the least Bitcoin-friendly nations. The Ukraine (66%), Russia (66.6%) and Serbia (67.9%) all have the least interest.

While the map underpins Bitcoin’s dominance of global interest in cryptoassets, some smaller coins have made the top 10 for searches despite being nowhere near the same size. Dogecoin, which is not even in the top 30 largest cryptoassets by market cap, makes the top 10 for searches, presumably for its relation to a well-known meme.

All data, figures & charts are valid as of 16/06/2020. All trading carries risk. Only risk capital you can afford to lose