Asian markets continued to tumble early today, fueled by fears the pandemic was worsening across the pond. US futures are now ticking up, thanks to reassurance the worst of the crisis appears to be passing in China and South Korea.

Stocks slipped yesterday following a statement from President Trump warning that almost 250,000 people in the US could die from Covid-19, with investors also eyeing today’s weekly initial jobless claim release. All three of the major US indices fell by 4.4%, with the financial, real estate and utility sectors of the S&P 500 all sinking by more than 6%.

As Q1 drew to a close, there were a number of reference points for investors on Tuesday demonstrating the beginnings of the economic impact of the pandemic. Toyota’s daily sales in the US were down 32% in March, and the number of vehicles General Motors sold in the first quarter was 7% lower than Q1 2019, while Fiat Chrysler’s Q1 sales sank by more than 10%. Automakers are responding with home delivery and incentives for potential buyers, but the sales damage will likely be severe, particularly as most firms have now halted production of new vehicles.

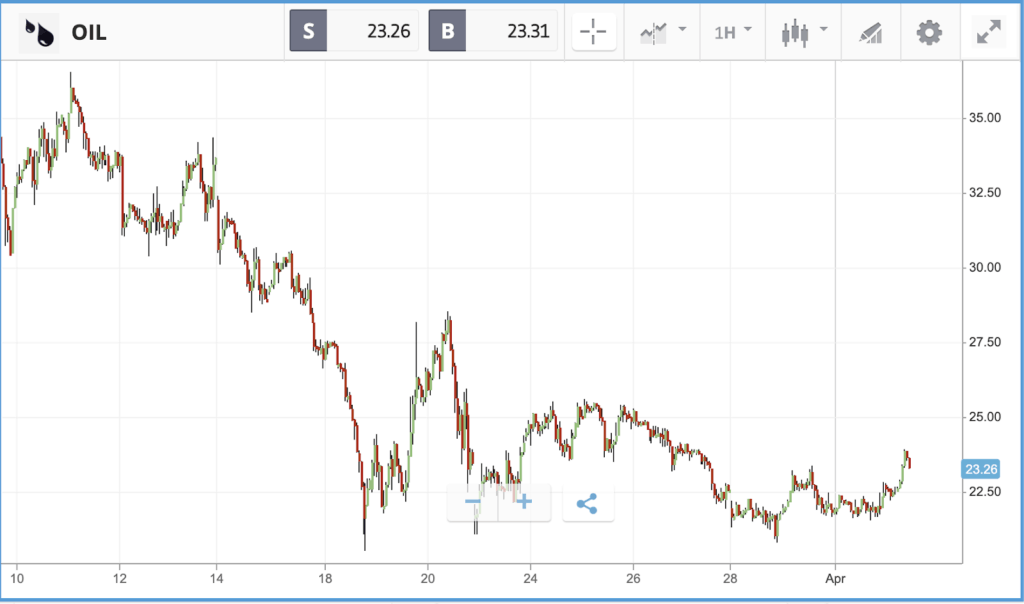

One significant milestone on Wednesday was the first bankruptcy among large US shale oil producers, with Whiting Petroleum — which produced 123,000 barrels a day in Q4 2019 — going under in the face of an impending deadline to repay hundreds of millions in outstanding debt. The firm is the first among many likely victims of the oil price war, as the current sub-$30 price of oil is a long way off the breakeven point for most producers.

Cruise firm Carnival pays high price to stay afloat

Two other data points released on Wednesday actually came in better than expected, although that is likely down to the point at which the data was collected falling too early in the month to capture the full impact of the pandemic. The March ISM manufacturing index came in at 49.1%, sinking into contraction territory (sub-50%) but a long way off the 44% that had been expected by economists. Similarly, the ADP employment report showed that the private sector shed 27,000 jobs in March, versus the 180,000 job loss that had been anticipated.

Walmart was the only positive name of the 30 stocks that make up the Dow Jones Industrial Average, with Boeing plus financial giants JPMorgan Chase and Goldman Sachs near the back of the pack. One factor driving bank stocks was the fall of the yield on 10-year treasuries this week, which is back below 0.6%. Lower interest rates eat into banks’ margins, as they are left with little wiggle room between the rates they offer savers and the rates they lend at. In the S&P 500, cruise firms Carnival and Royal Caribbean came in last on Wednesday, with Carnival falling by 33% after issuing more than $6bn in new debt and equity. The price of survival was high for the firm, which paid 11.5% on $4bn in 2023 bonds as part of the package. Close to the top of the pile was retailer Target, which gained 2.5%. The firm has enjoyed weeks of massive customer traffic driven by shoppers stocking up, but this week has seen the first decline in those figures since the crisis began.

S&P 500: -4.4% Wednesday, -23.5% YTD

Dow Jones Industrial Average: -4.4% Wednesday, -26.6% YTD

Nasdaq Composite: -4.4% Wednesday, -20% YTD

BAT spikes as it joins race to develop a Covid-19 vaccine

London-listed stocks sank on Wednesday after the UK reported its largest daily death toll from the coronavirus, at 563, taking the total past 2,000. The FTSE 100 and FTSE 250 both sank by just under 4%, with the former now down 27.7% year-to-date. It is not just amateur investors being caught out by the market whipsaw. One of investment firm Invesco’s star fund managers, Mark Barnett — a protege of fallen star Neil Woodford — was forced to mark down the value of unlisted stocks held in two funds by 60%. Barnett will be selling the securities, aiming to avoid the kind of liquidity crisis that sank Woodford late last year.

In the FTSE 100, Carnival’s London listing was the biggest loser, falling 20.6%, while Lloyds, Barclays and HSBC all fell by 10% or more as investors reacted to regulators forcing banks to scrap dividend payments. There were bright spots in the FTSE, however. Online grocer Ocado Group continued its strong run, climbing 9% and taking its one month gain past 15%. Morrison Supermarkets and Sainsbury’s also posted gains. Cigarette maker British American Tobacco gained 3.5%, after becoming an unlikely participant in the race to produce a coronavirus vaccine. The firm announced on Wednesday that its biotech subsidiary Kentucky BioProcessing is working on a vaccine; the BAT division was involved in developing an Ebola treatment in 2014.

FTSE 100: -3.8% Wednesday, -27.7% YTD

FTSE 250: -3.7% Wednesday, -33.5% YTD

What to watch

Walgreens Boots: Pharmacy giant Walgreens Boots reports its latest quarterly update on Thursday, where investors will be watching closely to see how a retailer on the front lines of the coronavirus pandemic has been impacted by the crisis. The firm’s role in testing for the virus is certain to feature on the earnings call, as will upticks in footfall and demand caused by shoppers buying up medication and household goods. Walgreens stock is down roughly in line with the broader market year-to-date. Wall Street analysts are anticipating an earnings per share figure of $1.46 for the quarter being reported, and overwhelmingly favour a hold rating on the stock.

Initial weekly jobless claims: Another Thursday means another initial weekly jobless claims report, with economists expecting a figure of 4 million, up from the record breaking 3.3 million people who signed up for unemployment benefits last week. There is a high degree of uncertainty around those predictions and some firms, including Bank of America and Pantheon Macroeconomics, are anticipating figures as high as 5.5 million. The weekly figure will be one of the most closely watched numbers as the crisis unfolds, as it provides a more regular look into the spreading economic impact of the virus than many of the monthly economic reports.

International Consolidated Airlines (IAG.L): British Airways announced it is furloughing around 36,000 staff following negotiations with the Unite union, with a deal struck to suspend staff but avoid making them redundant. Those staff will fall under the British government’s new furloughed payment scheme, which covers up to 80% of an individual’s salary. The BA fleet has been mostly grounded due to the pandemic and is fast burning through its cash pile, much like other airlines.

Crypto corner:

The world’s three major cryptoassets all experienced late surges yesterday, which have carried over into early trading this morning.

Bitcoin trended down to a low of $6156 before rallying hard to $6708 late on. It is trading back around $6600 this morning. Ethereum surged late in the day to a high of $137.45, and is trading around $136.60 early on this morning. XRP‘s surge arrived later and reached fresh highs early this morning, trading around $0.1766.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.