On the final day of a tumultuous Q1 markets have opened positively, despite the quarter going down in the record books as the worst since 2002. Asian markets rallied overnight as Chinese manufacturing data came in ahead of expectations, bouncing from record lows last month. To put this in perspective, it is still way off levels seen prior to the outbreak and there is a threat that a dip in foreign demand could cause a prolonged decline.

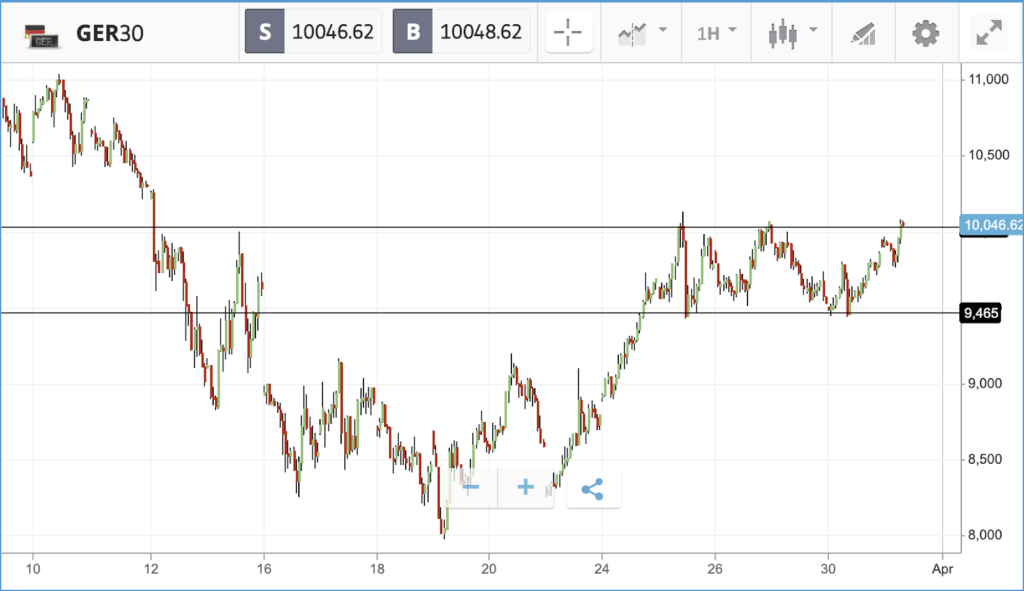

The Dax is leading the way in European markets this morning, up over 2.5%. It is currently challenging some key resistance on the hourly timeframe at the top of the channel it has traded in over the last week or so.

The FTSE100 is also up nearly 2%, despite ratings agency Fitch downgrading UK sovereign debt to AA- with a negative outlook. The FTSE is being boosted by its strong commodities contingent as oil prices bounced back after the US and Russia agreed on talks to stabilise energy prices. Unlike many other industries, BP CEO Bernard Looney also pledged to not make any of the firm’s 73,000 employees redundant over the next three months, despite the huge pressure on the sector.

On Monday, retailers including Macy’s, Gap and Kohls — who between them employ close to half a million people — said that they are furloughing huge numbers of workers without pay. Department store chain Macy’s is furloughing most of its 125,000 strong workforce, while 85,000 of Kohl’s 120,000 plus employees are affected. The announcements are the latest in a flood of bad news for the US labour market and the retail sector, where firms who have failed to adapt to the onslaught from online services in recent years had already faced an investor exodus ahead of the current crisis. In the five years before the pandemic hit, Macy’s had lost close to 80% of its market cap, and it has now sunk 59% in the past month.

The mass retail furlough will add to the onslaught of newly unemployed Americans, some 3.3 million of whom signed up for unemployment benefits last week — more than quadruple the previously weekly record from 1982. Despite the poor news from the retail sector, US stocks enjoyed a rally on Monday as investors reacted to President Trump conceding that coronavirus measures need to remain in place, and Johnson & Johnson said that it will begin human testing of a coronavirus vaccine by September. The firm has committed more than $1bn in partnership with a federal government agency to fund research into a vaccine. The pharmaceutical giant and consumer goods firm’s share price jumped 8% on Monday as a result.

Health names soar in Monday rally

All three of the major US stock indices finished more than 3% up on Monday, with healthcare the best performing of the 11 sectors in the S&P 500. The sector gained 4.7%, driven by the healthcare technology and pharmaceutical sub-sectors, which gained 7.1% and 5.8% respectively.

Hospital firm Universal Health Services and insurer Cigna led the way, both posting double digit gains. Over the weekend Cigna and Humana, another leading insurer, announced that they would be waiving patient costs for any coronavirus treatment including hospitalisations for members of their plans. Both United Health Services and Cigna’s share prices are now up close to 40% over the past five trading days, while Humana is up 45%.

Following the price of US crude oil skittering below $20 a barrel, the energy sector was the worst performer in the S&P 500, gaining 1%. The back of the S&P 500 was dominated by oil, travel and retail names. In the Dow Jones Industrial Average, which climbed 3.2%, Johnson & Johnson led the way, followed by rival pharmaceutical giant Merck, Microsoft, and Intel, which all gained more than 5%. Boeing was the sole name in the red among the Dow’s 30 constituent companies, with investors picking their moment to exit after the company’s 90% plus rally over the past two weeks (Boeing stock remains down more than 50% year-to-date.)

S&P 500: +3.4% Monday, -18.7% YTD

Dow Jones Industrial Average: +3.2% Monday, -21.8% YTD

Nasdaq Composite: +3.6% Monday, -13.4% YTD

Bank dividends in the spotlight with billions due imminently

In the UK on Monday, dividends were in the spotlight as £7.5bn of payments are due from banks including Barclays, HSBC, Lloyds and Royal Bank of Scotland over the next few weeks. The financial giants are reportedly anticipating that the Prudential Regulation Authority will step in to block the payments, following steps taken by the European Central Bank to force banks in the eurozone to halt dividend payments and share buybacks. Buybacks have become a controversial subject as the crisis has worn on, with firms including airlines falling under scrutiny for handing so much cash back to shareholders in recent years and then looking to governments for a bailout to deal with the current crisis. Barclays, which also set a 2050 net zero carbon target on Monday, saw its share price fall 3.5% on the day, while the FTSE 100 rallied by 1% over all.

The FTSE 100 initially fell sharply when markets opened on Monday, but rallied throughout the day, crossing into positive territory in late afternoon, once investors saw US markets open and climb. BP jumped 5.9% despite the negative oil price news, after announcing it will not cut jobs over the next three months, Royal Dutch Shell climbed by more than 3%. In the FTSE 250, which closed down 1% on Monday, property development firm Hammerson was the biggest loser, finishing 22.1% lower. The firm canceled its dividend and withdrew its 2020 guidance, plus announced that it had only taken in a third of rent due for the second quarter; the company owns major shopping centers and leases to retailers across the UK.

FTSE 100: +1% Monday, -26.2% YTD

FTSE 250: -1% Monday, -33.2% YTD

What to watch

McCormick: One earnings announcement to watch on Tuesday will be spice, seasoning and flavouring producer McCormick & Company, which will report its latest quarterly update. The $19bn market cap firm sits at an interesting nexus point of the coronavirus pandemic. On one hand, it will be losing out heavily from the restaurants and other commercial buyers who are not currently operating, but on the other far more people are currently cooking from home. The firm has increased wages for its hourly workers during the pandemic, and its share price is down by significantly less than the broader market following a 26% rally over the past five trading days. Currently though, analysts are not positive on the prospects for the stock overall. It has one buy rating, six holds, and six underweight or sells.

Consumer confidence index: One of the big US economic data points being released this week is the Conference Board’s March consumer confidence survey on Tuesday, where expectations are that the index will fall from its 130.7 February number to 115. The data will add another layer to the story told by last week’s mammoth initial jobless claims figure of 3.3m, which is difficult to read into given that many workers have been temporarily furloughed while the crisis continues. There is no guarantee for many workers they will have a job to go back to, but some are retaining benefits such as health insurance while they are furloughed, and the $2trn stimulus package just passed enhances unemployment benefits. As a result, the knock-on effect on consumer confidence may not be as straightforward as it appears.

Crypto corner:

Cryptoassets followed suit and rallied yesterday alongside stock market gains. Bitcoin hit a high of $6579 before trading back down to around $6400 early this morning. Meanwhile, Ethereum experienced more volatility, peaking at $134.54 in the evening before moving back down to $130.56 early on. XRP had a strong start to the day but finished flatter, peaking at $0.1733 and now around $0.1711 this morning.

Binance looks set to acquire CoinMarketCap in a deal worth up to $400m and is likely one of the two acquisitions Binance CEO, Changpeng Zhao alluded to earlier in the year. CoinMarketCap is the go-to site for crypto data and attracts significantly more traffic than Binance, which is likely what made it a very attractive acquisition prospect

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.