Markets have taken another leg down this morning as fears over a second wave of infections continue to grow and the outlook for economic recovery appears increasingly bleak.

US stocks sank on Wednesday afternoon after Federal Reserve chairman Jerome Powell said that further interventions may be required in order to support the US economy, in the face of an unemployment rate that stands at close to 15%. Powell played down the rumblings that the Fed was seriously considering negative interest rates, and said that additional fiscal support from Congress may be required and would be “worth it”, despite the United States’ rising debt burden. “This tradeoff is one for our elected representatives, who wield powers of taxation and spending,” he said. Powell’s speech sent the S&P 500 tumbling; the index closed out the day 1.8% lower with all 11 sectors in the red.

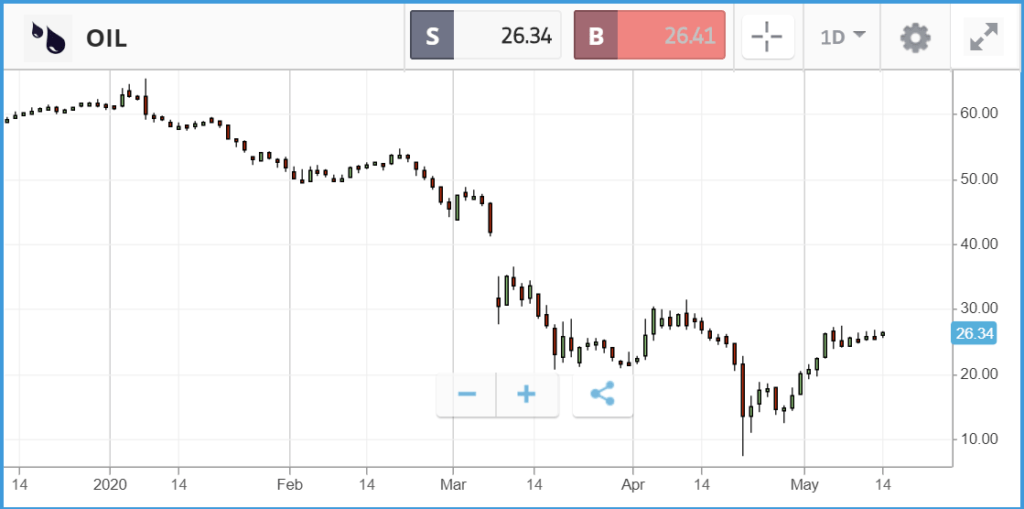

In other news, the US Commodity Futures Trading Commission took the unusual step of warning brokers and exchanges that they should be ready for the price of oil futures contracts to drop below zero again. WTI crude oil contracts for June delivery will expire next week, and investors will be nervous of a repeat of last month, when all hell broke loose in the last few days before expiration. Despite this, an unexpected drawdown in US crude inventories has seen prices hold firm.

United sinks after linked Colombian airline goes under

In the S&P 500 the energy sector was the hardest hit in the Wednesday afternoon rout, sinking 4.4%, with the energy equipment and services subsector losing 7.7%. Smaller energy names fell hardest, with National-Oilwell Varco, Noble Energy, Halliburton and Apache all closing the day more than 9% lower.

United Airlines also continued its slump, falling 9% and taking its loss this week close to 20%. The airline has been the hardest hit by the current crisis out of all the major US carriers, with its stock down more than 75% year-to-date. United has been under particular pressure this week, as Colombian airline Avianca — in which United is a stakeholder — filed for bankruptcy. Comments from Boeing’s CEO on Tuesday predicting that some airlines will go bankrupt also affected sentiment towards airline stocks.

In the Dow Jones Industrial Average, for the second day running, 29 of the index’s 30 stocks were in the red, with American Express, Walgreens Boots Alliance and ExxonMobil falling hardest.

S&P 500: -1.8% Wednesday, -12.7% YTD

Dow Jones Industrial Average: -2.2% Wednesday, -18.5% YTD

Nasdaq Composite: -1.6% Wednesday, -1.2% YTD

Stocks slip after UK GDP data

London-listed stocks slipped yesterday after the Office for National Statistics reported that UK GDP fell by 2% in the first quarter of 2020, including a 5.8% drop in March alone — when widespread lockdowns hit. The biggest weights on the economy were a drop in consumer spending and net trade. Investors were also digesting comments from Bank of England governor Andrew Bailey, who said in an ITV interview that financial markets are expecting the central bank to conduct more quantitative easing.

The FTSE 100 fell by 1.5%, with cruise firm Carnival, turnaround specialist Melrose Industries and InterContinental Hotels Group the biggest losers, falling 10.8%, 9.2% and 8.6% respectively. Carnival sank in advance of Norwegian Cruise Lines reporting its latest quarterly earnings this morning. Investors have also been wary this week of the prospects for the travel industry, following a warning from the director of the US National Institute of Allergy and Infectious Disease. Dr. Anthony Fauci warned that a vaccine or treatment for Covid-19 is not likely to be ready by the autumn.

The FTSE 250 also fell yesterday, closing 1.8% lower; luxury car maker Aston Martin Lagonda continued its slide with a 16% loss.

FTSE 100: -1.5% Wednesday, -21.7% YTD

FTSE 250: -1.8% Wednesday, -27.4% YTD

What to watch

Brookfield Asset Management: Alternative investments giant Brookfield reports its Q1 2020 earnings today, investors will be looking for insight into how the firm is deploying assets to make opportunistic acquisitions during this volatile period. This week, the firm announced that it is setting up a $5bn fund to take stakes in struggling retailers, using both its own resources and those of its institutional clients. The progress made on integrating Oaktree Capital Management, which Brookfield closed the $4.7bn acquisition of in September last year, will also likely be in the spotlight. Analyst expectations for Brookfield’s Q1 earnings per share figure have actually increased over the past three months.

Applied Materials: Applied Materials provides equipment and software involved in the production of semiconductors. The $47.3bn market cap firm’s stock is down 15.6% year-to-date, but thanks to a huge rally in 2019 the company’s share price is up 24.1% over the past 12 months. As with other semiconductor firms, the benefits Applied Materials expects to derive from the rollout of 5G technology will be one point of interest when the company reports quarterly earnings today. Currently, Wall Street analysts favour a buy rating on the stock, although expectations for the firm’s earnings per share figure have fallen more than 10% over the past three months.

NortonLifeLock: Cyber security firm Norton reports its latest set of quarterly earnings today, investors will be looking for any increased demand for the company’s products driven by workers logging into systems remotely while stuck at home. A significant tax liability from an asset sale is likely to have weighed on the firm’s quarter, however, Norton’s share price is down 20% year-to-date, but up 4.8% over the past 12 months; analysts favour a hold rating on the stock.

Crypto corner: Speculation over $10,000 breach mounts as Bitcoin hits two key metrics

Analysts pointed to BTC’s potential to breach the $10,000 price barrier after two key metrics that measure bullishness were met, Cointelegraph reports. In the wake of the halving on 12 May, Bitcoin has experienced diminished volatility, and has now breached the $9,400 barrier, seen by some analysts as a key ‘resistance point’ on the road to a $9,750 – and then $10,000 – price.

Bitcoin surged in early trading today, and is currently around $9,444. Meanwhile, Ethereum likewise witnessed increases, now trading around $199.33 early doors. Finally, XRP saw more modest gains in the last 24 hours, up around 2.5% now trading around $0.2016.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.