Morgan Stanley has cautioned that a failure by Republican and Democrat lawmakers to agree on a new round of fiscal stimulus would set back the US economic recovery from the pandemic by six months. Amid a strong start to the week on Wall Street on Monday, the bank said without a breakthrough, the US economy will not get back to pre-pandemic levels until Q4 2021, Bloomberg reported.

Elsewhere, there was a flurry of corporate news to start the week. Amazon hit headlines after announcing that it is hiring 100,000 new employees in $15 an hour jobs, plus sign up bonuses, to support its warehouse and delivery operations across the US and Canada. Fiat Chrysler and Peugeot owner PSA announced a change to the terms of their merger deal to retain cash, resulting in a substantial cut to Fiat Chrysler’s dividend. Lastly, Oracle’s deal with TikTok owner ByteDance to rework its US operations made progress, with the Treasury Department saying it will review the agreement, according to The WSJ. The deal still faces a substantial hurdle in terms of potential opposition from President Trump, given that the deal may leave the firm under Chinese ownership.

IPO fever is also back, with two of the biggest listings since Uber last year taking place this week. Snowflake, the cloud software business, is expected to raise $2.2bn, while Unity, a video game software company, will raise $950m. Sumo Logic, another data software platform, expects to raise $281m.

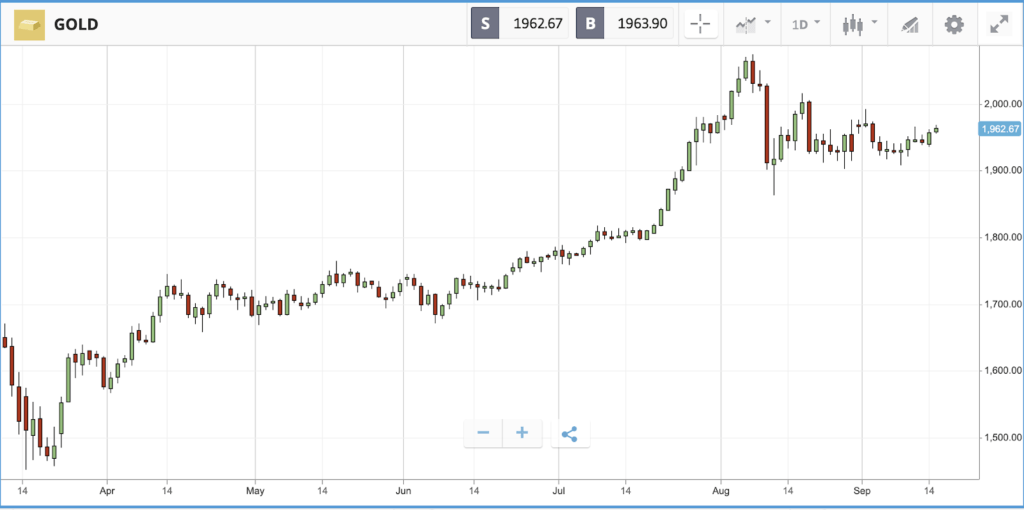

Meanwhile, overnight in Asia markets were mute, with Hong Kong’s Hang Seng up marginally by 0.2% and Japan’s Nikkei down 0.5%. Gold also climbed back towards the $2,000 mark, reaching $1,968 this morning.

Tesla, Micron both jump after Goldman Sachs notes

In the S&P 500 the real estate and information technology sectors led a bounceback on Monday after last week’s sell-off, with the index as a whole closing the day 1.3% higher. Retailer Kohl’s led the index with a 9.6% gain, although the stock still remains more than 50% down year-to-date. In the Nasdaq Composite, which posted the best day at +1.9%, Tesla, Micron and Nvidia were among the names that helped the index higher. Tesla jumped 12.6% and continued rising in after-hours trading amid the broader tech rebound, and a note from Goldman Sachs to clients that highlighted a surge in weekly downloads of the company’s app. Micron also gained 6.4% after Goldman Sachs upgraded its rating on the company’s stock to a buy and gave the firm’s shares a $58 price target – versus their previous $45 level. At the bottom of the pile on Monday was Citigroup, which fell 5.6% after announcing that it is resuming job cuts in order to reduce costs.

S&P 500: +1.3% Monday, +4.7% YTD

Dow Jones Industrial Average: +1.2% Monday, -1.9% YTD

Nasdaq Composite: +1.9% Monday, +23.2% YTD

G4S jumps after hostile takeover attempt revealed

The FTSE 100 was close to flat on Monday, with Ocado Group leading the index after gaining 3.9% and British Airways parent International Consolidated Airlines Group down 30.8% at the back. IAG’s plummet is not a cause for investor concern however; it was a technicality related to a rights issue. Other names that held the FTSE 100 back on Monday included miners Polymetal International and Fresnillo, which both sank by more than 3.5%, and BP which declined by 1.9%. The FTSE 250 performed comparatively well on Monday, adding 0.7%, and is now ahead of its large cap sibling year-to-date. Security firm G4S provided a big boost, adding 25% after news broke that Canadian firm GardaWorld has made a multi-billion dollar offer to acquire the firm. The takeover attempt is a hostile one, with GardaWorld stating that three approaches it has made to engage with the G4S board have been “dismissed or ignored.”

FTSE 100: -0.1% Monday, -20.1% YTD

FTSE 250: +0.7% Monday, -19.2% YTD

What to watch

Adobe: Software firm Adobe has surged 47.3% year-to-date, as demand from businesses for digital and cloud based solutions have jumped due to the pandemic. The firm reports its latest set of quarterly earnings on Tuesday, where analysts are anticipating an earnings-per-share figure of around $2.40. The pace and sustainability of customer acquisition being driven by the pandemic will be key features of the Tuesday earnings call. The bulk of Wall Street analysts lean towards a buy rating on the stock, although there are seven holds and one sell rating.

FedEx: Delivery giant FedEx also delivers its quarterly earnings update on Tuesday, after a three-month period that has seen its shares surge by over 75%, taking its year-to-date gain past 50%. Surging demand for e-commerce, which has greatly amplified the number of packages in motion, has been a boon for the company along with key rival UPS. The cost of tackling the surge in volume, and whether FedEx can find scale efficiencies to improve its margin, will be a key feature of its earnings report. Wall Street analysts have been shifting in favour of a buy rating on the stock over the past three months.

UK inflation: Both month-over-month and year-over-year inflation rate data will be reported for August in the UK on Wednesday. Last month, the consumer price index registered a 1% annual increase versus 2019, a jump versus June’s 0.6% figure.

Crypto corner: European Union to roll out new legislation for cryptoassets

A senior official from the European Union has said that concerns among the bloc’s finance ministers about cryptoassets will be addressed in future legislation.

Following calls on Friday from finance ministers of major EU members like Germany and France for heightened restrictions on “stablecoins”, the European Commission has moved to address these concerns. European Commission executive vice president Valdis Dombrovskis reportedly said new legislation is on the way to regulate them. He said: “Some ministers expressed some concerns about the risks of so-called stablecoins currently outside our rules. Rest assured that our legislative proposals will address those concerns comprehensively.

“We will regulate the risks for financial stability and monetary sovereignty linked to so-called ‘stablecoins’ used for payments purposes.” However, he added that the goal was not to stifle innovation. “We want to be proportionate: cryptoassets provide many opportunities, and we want to regulate innovation in, not out,” he said.