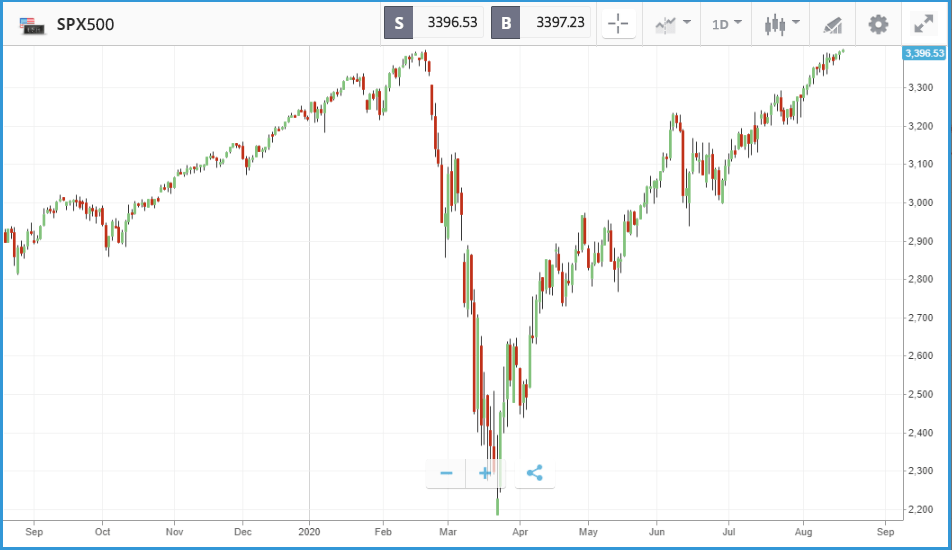

The S&P 500 index closed at an all-time high on Tuesday, with all of the losses it suffered in March, as the pandemic hit, now regained. In 2020 so far, the index has added 4.9%, and it is up 16.8% over the past 12 months – despite tens of millions of Americans out of work, and the continued surge of Covid-19 in many states. New York, the original epicenter of the virus in the US, is now largely under control, but major states including Texas, California and Florida continue to get worse.

The best performing S&P 500 stocks year-to-date range from pharmaceutical companies to online payment providers and chipmakers. Nvidia’s share price has soared by 108% due to demand for its graphics processors amid the shift to a work-from-home world. Similarly, peer Advanced Micro Devices has added 78%. PayPal has also enjoyed a big 2020, driven by consumers switching to online spending; its share price is up 80% year-to-date. For similar reasons, Amazon’s share price has also climbed 79% in 2020.

Amazon leads S&P to historic marker

It was Amazon that led the S&P 500 to a new all-time high on Tuesday, after the retail giant climbed 4.1% on reports that it is adding thousands of jobs in major cities. Microchip Technology, Salesforce, Alphabet (Google) and Adobe were the other companies that sat at the top of the index, with tech firms fittingly putting the S&P over the top after a rally that has been largely fueled by tech stocks. Driven by tech names, the index set both a new intra-day and closing price all-time high. Elsewhere, the Nasdaq Composite delivered the best day on Tuesday at an index level, finishing 0.7% higher to take its year-to-date gain to 25%. The Dow Jones Industrial Average fell marginally, with Chevron the biggest loser of the day. Its share price, which has been largely flat over the past three months, fell by 2.1%. While oil prices have recovered past $40 a barrel, they are still a long way off pre-pandemic levels and Chevron is down 27.3% YTD.

In corporate news, the battle to buy TikTok’s US operations raged on, with Oracle now in the running alongside Microsoft. President Trump said he supports Oracle, which was founded by Trump supporter Larry Ellison, in its effort to buy the Chinese social media firm. Twitter has also said that it is exploring an offer.

S&P 500: +0.2% Tuesday, +4.9% YTD

Dow Jones Industrial Average: -0.2% Tuesday, -2.7% YTD

Nasdaq Composite: 0.7% Tuesday, +25% YTD

FTSE 100 and FTSE 250 back in lock-step

The FTSE 100 and FTSE 250 each fell by 0.8% on Tuesday, with the two indices now at an almost identical year-to-date loss. Both indices have essentially been travelling horizontally, since the beginning of June, failing to build the recovery momentum that American stocks have generated. Between both the FTSE 100 and 250 outsourcing firm Capita suffered the worst day, sinking 20% after reporting a loss in its half year results. CEO Jonathan Lewis noted that the pandemic had fallen “in a pivotal year for Capita when we had expectations of beginning to generate revenue growth and sustainable cash flow … Instead we have had to focus on managing our way through the crisis.” Year-to-date, the company has lost 80% of its value, with much of that sell-off coming immediately in March as the pandemic hit.

FTSE 100: -0.8% Tuesday, -19.4% YTD

FTSE 250: -0.8% Tuesday, -19.5% YTD

What to watch

Nvidia: All eyes will be on Nvidia on Wednesday, as one of the best S&P 500 performers of the year so far reports its second quarterly earnings figures. Expectations are high, given that the pandemic has accelerated trends that translate directly into demand for Nvidia’s graphics chips – but analysts will likely probe management on the sustainability of the new business generated, and how they plan to benefit from those trends over the long haul. Wall Street analysts are estimating an earnings per share figure of $1.97, versus the $1.79 they predicted for the quarter three months ago, and generally favour a buy rating on the stock.

Lowes: Following rival DIY supplier Home Depot, which beat profit expectations on Tuesday but still saw its share price fall, Lowes will deliver its own quarterly report on Wednesday. The two firms are neck-and-neck share price wise in 2020 so far, with both up by just over 30%. Similar to home depot, key questions for Lowes’ management will be whether they see the home improvement trend sustaining, and any patterns in consumer activity. Currently, 24 Wall Street analysts rate the stock as a buy or overweight, five as a hold and one as a sell.

Retailers: Rival retailers TJX Companies and Target both report earnings on Wednesday, with Target the winner in 2020 so far – sitting on a 6.8% share price gain versus a 5.9% loss for TJX. How the firm benefited from rivals being forced to close stores, digital demand with shoppers forced online, and additional costs related to operating in the Covid-19 environment are all likely points of discussion on the company’s earnings call.

Crypto corner: bitcoin dips after breaking $12,000

Bitcoin failed to hold on to levels above $12,000 overnight after closing out the day above the key resistance level.

The biggest cryptoasset by market cap was off 3% this morning at $11,679, below the close yesterday of $12,040. Nonetheless, bitcoin remains up some 63% year-to-date, even accounting for the huge swings we have seen in 2020, and it has provided a lift for many hedge funds.

According to data provider Eurekahedge, crypto hedge fund managers have returned more than 50% per cent over the seven months to the end of July, compared with low single-digit gains from non-crypto hedge funds.

All data, figures & charts are valid as of 19/08/2020. All trading carries risk. Only risk capital you can afford to lose.