Hi Everyone,

So, when I wrote in yesterday’s market update that a bitcoin ETF could happen tomorrow, I didn’t mean it literally. Yet, it seems that an asset manager in California may have just found a way to squeeze one past the US authorities.

The new proposal from Reality Shares is a bit different from the previously filed bitcoin ETF applications in that it limits the maximum exposure of bitcoin to 15% of the total portfolio.

By creating a well-diversified portfolio that contains several different currencies and other stable assets, investors in this ETF would be more protected from the volatility inherent in the crypto market as well as from any sort of market manipulation that the SEC seems so concerned about.

This is exactly what we’ve been recommending here at eToro for some time now. In our view, investors should be able to limit their risk by diversifying their portfolio into many different assets and keeping the exposure to the high-risk assets to a small portion of their account.

Personally, I’m amazed that it took this long for someone to make such a proposal. In retrospect, this probably should have been a line of conversation with the authorities from the very beginning and it will be interesting to see how they respond.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

Days to next Shutdown: 3 | Days to Brexit: 45

Goldman’s Call for Risk

Is Bart Simpson Coming to Bitcoin?

Please note: All data, figures & graphs are valid as of February 12th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Things on the geopolitical front seem to be accelerating at a brisk pace in a good way.

With three days left to another potential US government shutdown, it seems like the authorities are closing in a possible deal. Hopes are high that a deal could be signed, even though it contains only a fraction of the money that the President wanted for border security and there hasn’t been any official word from the White House just yet on whether Trump will agree to this deal or not.

In addition, there is continued progression on the US-China trade talks with US representatives Stephen Mnuchin and Robert Lighthizer due in Beijing on Thursday. Reportedly, there is interest from the leaders of the two nations for a meeting, but no indication on when that might happen.

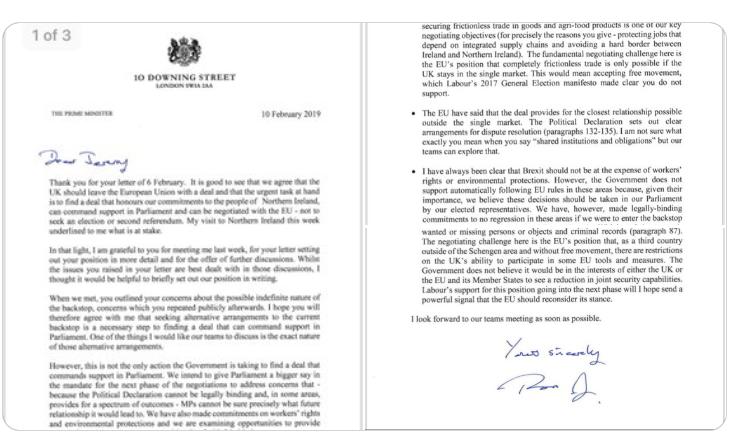

A highly publicized letter was sent last night from UK Prime Minister Theresa May to opposition leader Jeremy Corbyn in which May outlined the things that the two parties agreed on and the remaining points of contention.

May will be giving a statement to MPs this afternoon to try and bridge the gap, so let’s hope it’s a good one.

What’s worth noting from the markets lately is the strength of the US Dollar, which has been gaining steadily since the beginning of the month. This is a bit odd given the softer language from the Fed, reduced geopolitical tension, and the apparent appetite for risk in the market. Not sure what it means just yet.

Goldman Throws Caution to the Wind

We’ve been talking an awful lot about central banks lately and it seems that analysts at Goldman have too.

During the volatile period of 2018, their recommendation was to acquire stocks of robust companies that could weather any sort of tightening cycle that the Fed was deploying.

However, now that the Fed’s strategy has shifted to a more loose monetary policy, Goldman has ditched its strategy as well and is now advocating targeting companies with a weaker balance sheet.

Crypto Testing

The effects of the weekend rally seem to be slowly fading and the crypto markets are oddly mixed. Some are slightly up and some are slightly down but as usual, we need to keep our eyes on the leader of the pack, $BTC, which is down about 1% over the last 24 hours.

Of course, this is a very moderate decline and can easily be turned around, but looking at both sides of the coin, it could also be an indication the excitement was premature.

At this point, bitcoin is struggling to hold the interim support of $3,550.

Should the level be breached to the downside, this could very easily turn into another Bart Simpson formation, which has become famous in the crypto markets.

Of course, if we do manage to hold the line, there’s plenty of potential on the upside as well. Just as I’m writing, it seems we have some really cool breaking news that two public pensions in the United States are now diversifying a small part of their assets into crypto.

The timing just seems right for this type of action as well. With prices down 80% or more from the all-time high, now seems like a great time for managers of large investment funds to start dipping their toes in the water.

As always, thanks for reading, feel free to reach me, and have an awesome day!!!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.