Hi Everyone,

To say that crypto regulations in the United States are unclear would be a bit of an understatement. Progress is being made but it seems to always be two steps forward and one step back, or as CZ put it this morning, short term pains for long term gains.

The remark came shortly after the announcement that Binance will be opening an official US website in partnership with BAM asset management. Unfortunately, that means that current US customers will lose access to the main Binance site, along with about 150 altcoins.

Last night, Bakkt officially announced that they will begin testing their new bitcoin futures product on the ICE exchange on July 22nd, two days after the 50th anniversary of the Apollo 11 moon landing, and approximately seven months after the initial intended launch date.

Also within the last 24 hours, an article came out from the Wall Street Journal that seems to confirm the participation of several major players in the Facebook Coin’s consortium. Visa, MasterCard, Paypal, and even Uber will each reportedly spend $10 million to ‘govern’ the network.

Regulators have every right to be worried. After all, this is the land that brought us Wells Fargo. A bank that is now having serious trouble finding someone who wants to run it.

So, yes, the future is uncertain but there’s definitely room to position a profitable portfolio right now.

eToro, Senior Market Analyst

Today’s Highlights

- Who will Lead them

- Gold Breakout

- Digital Gold

Please note: All data, figures & graphs are valid as of June 14th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

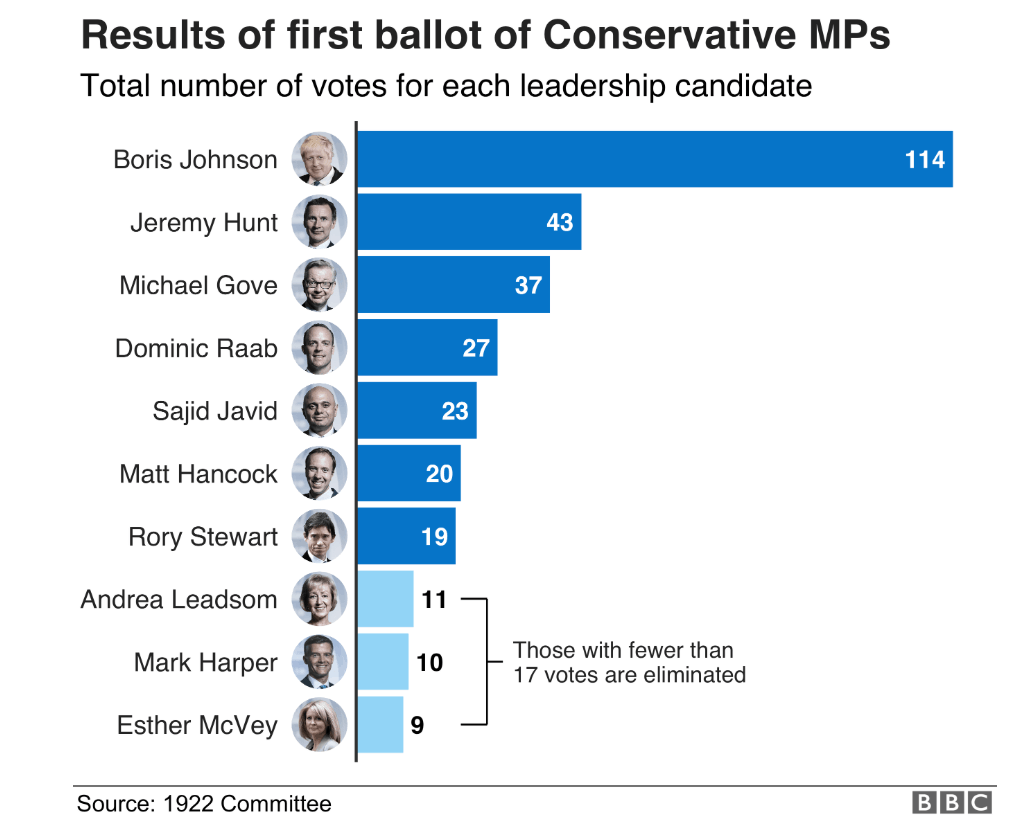

Now that May is gone the UK Conservative party is in the midst of finding a new leader. A vote last night has confirmed that the clear frontrunner is none other than Boris Johnson.

Johnson received a total of 114 votes from his peers, significantly ahead of the runner ups, Jeremy Hunt and Michael Gove.

Next week the seven remaining candidates will face off to see who will be leading the country through the process of leaving the EU.

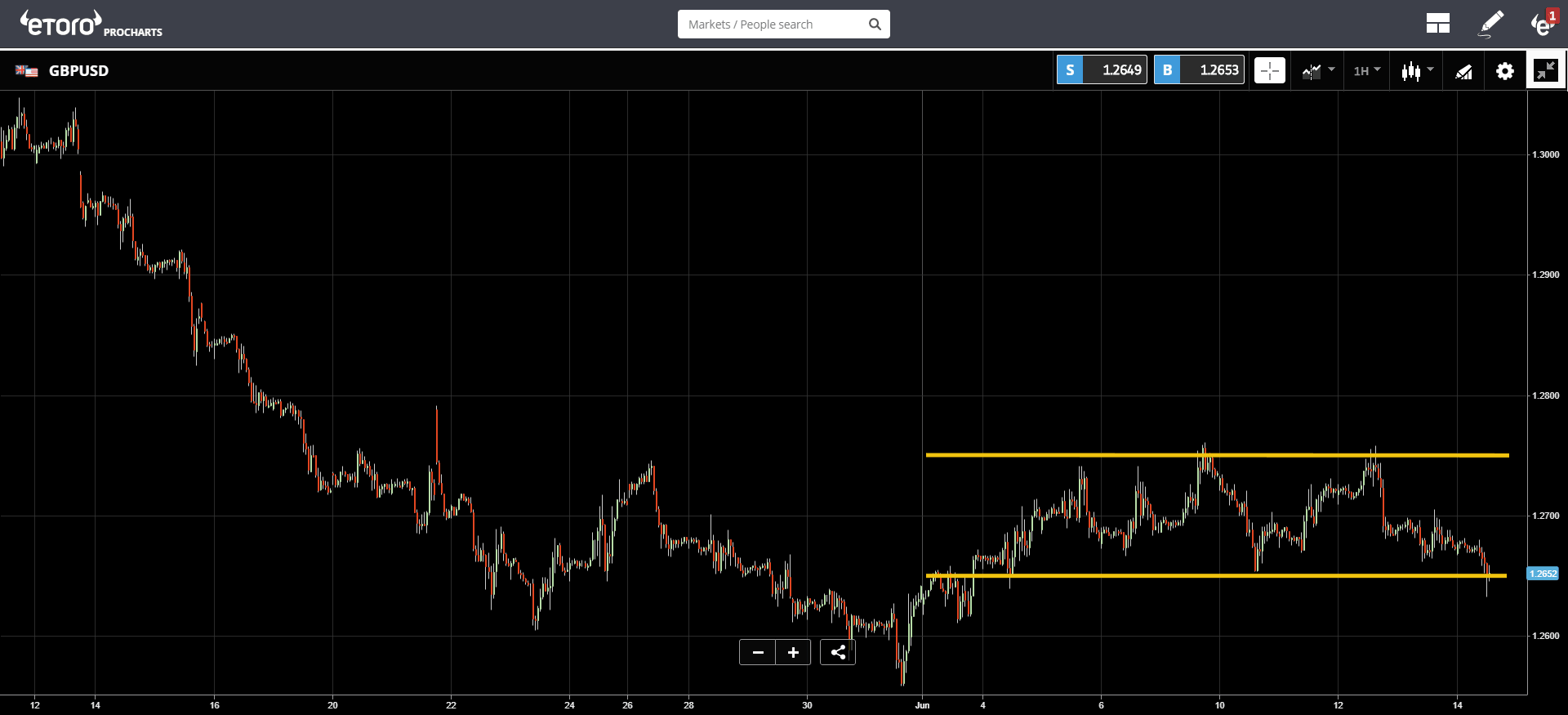

The British Pound is under a bit of pressure this morning, falling briefly below the trading range it’s been holding throughout the month (from 1.2650 to 1.2750).

More Markets

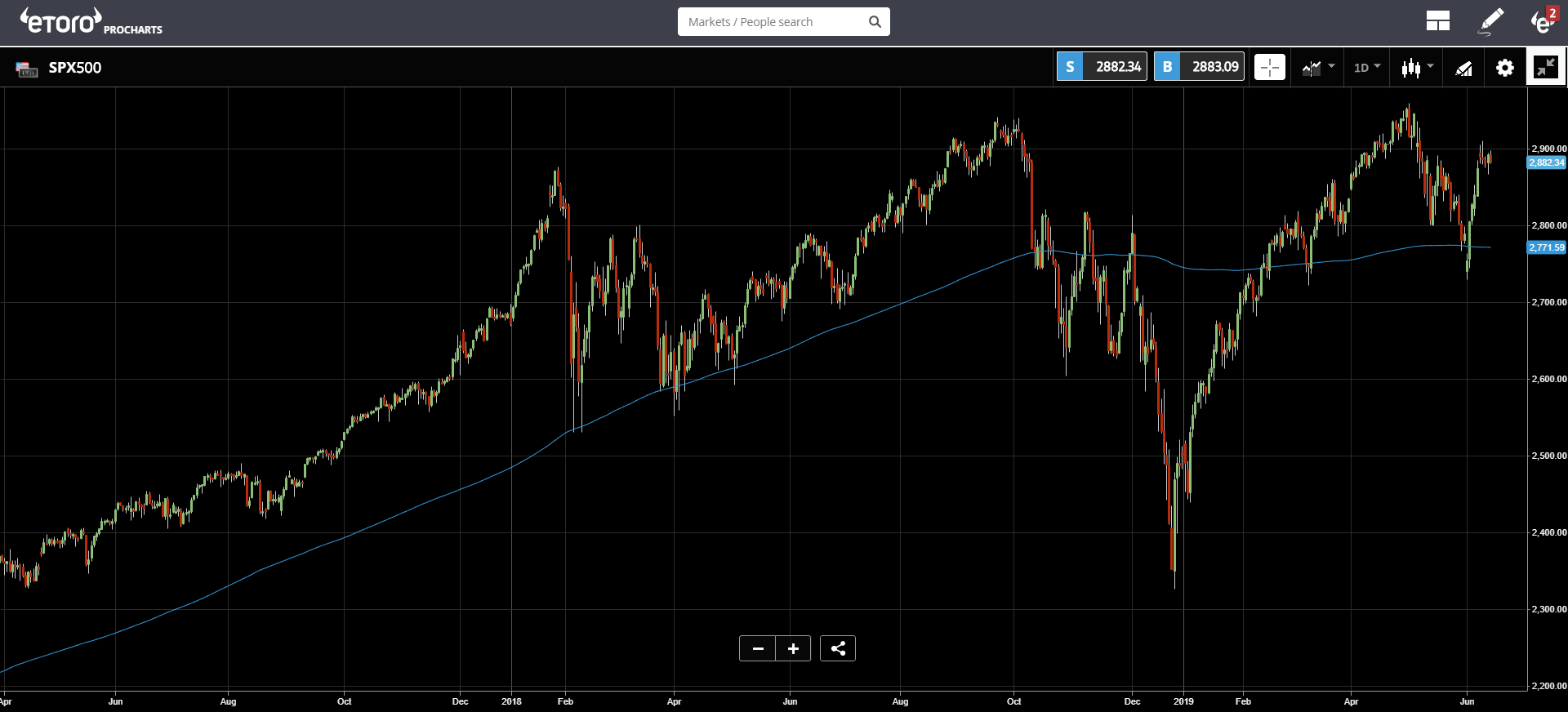

Stocks are also feeling some short term pain this morning. It’s quite possible that the oil tanker incident yesterday near the Strait of Hormuz is putting some additional pressure on investors today. Though to me this looks a lot like what we’re currently seeing in the crypto market, consolidation near the top.

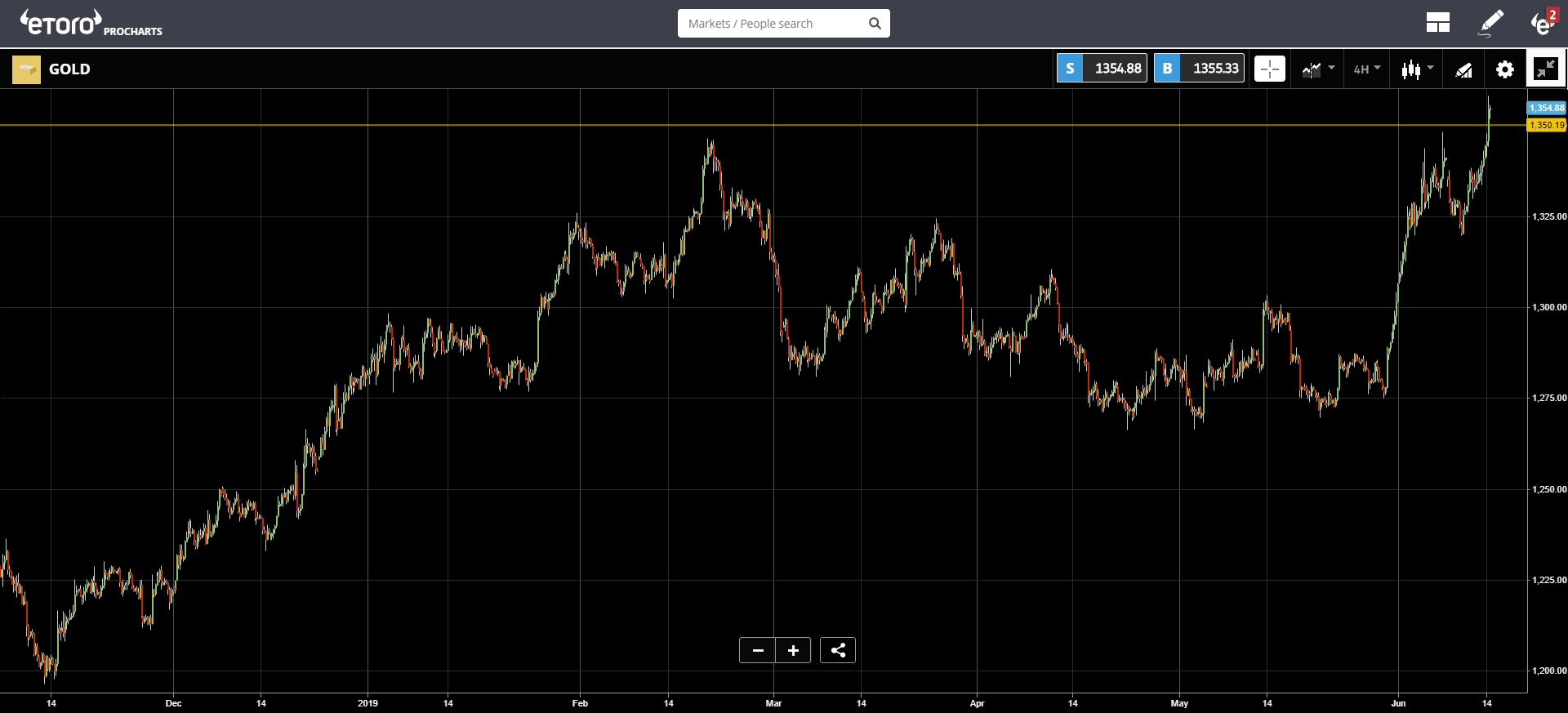

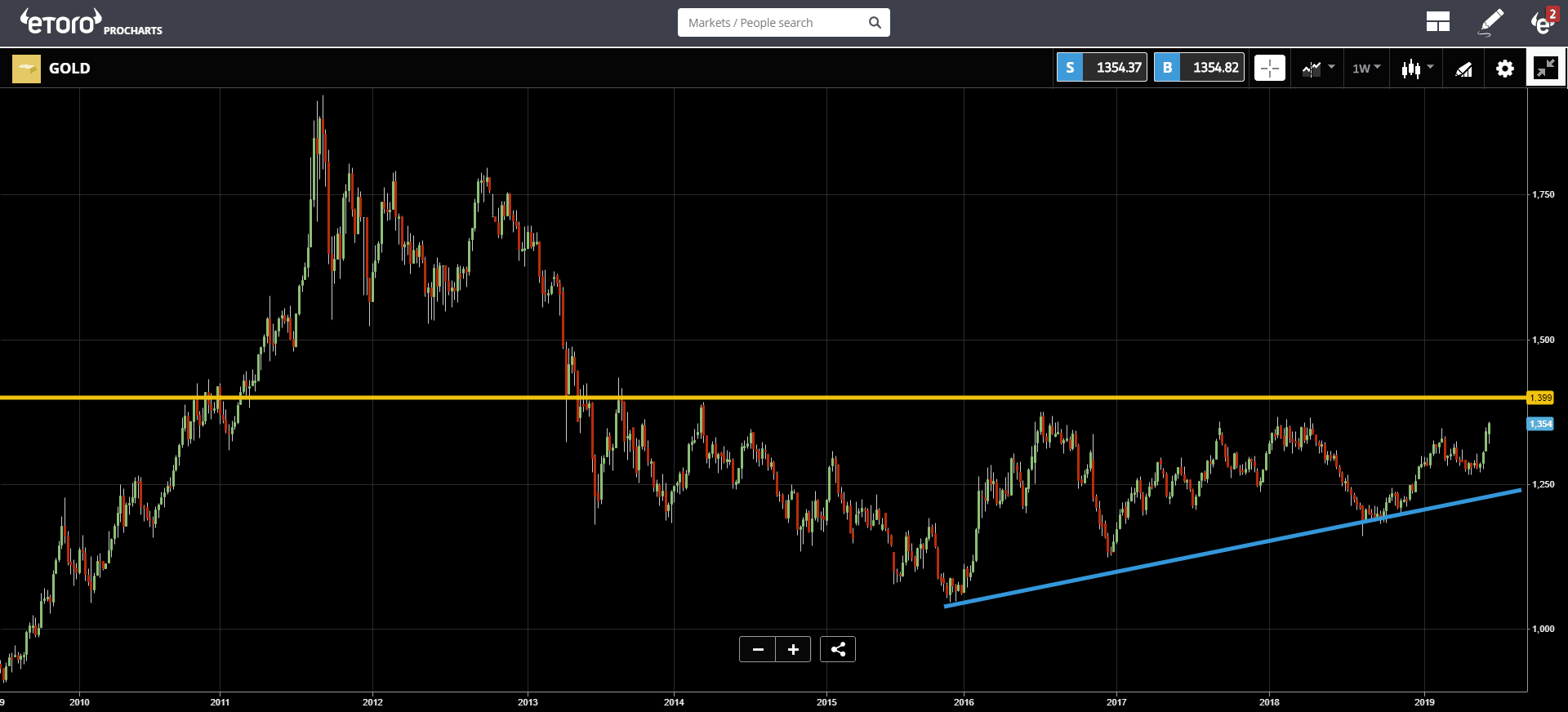

Whether due to political tensions, expected rate cuts, a slightly weaker US Dollar, or a general de-dollarization trend, gold is performing fantastically today.

This morning we saw a significant breakout above $1,350 per ounce, a level that created serious resistance in late-February.

Zooming out on the chart, we can see some even more heavier resistance coming up at $1,400 a price that hasn’t been seen since 2013.

It will likely be a fierce battle to break it and we could very well see another retracement or two before building up the strength, but if $1,400 should fall it would likely generate a lot of excitement around the world’s oldest store of value in an economic environment that is in desperate search of places to park wealth.

Crypto in the USA

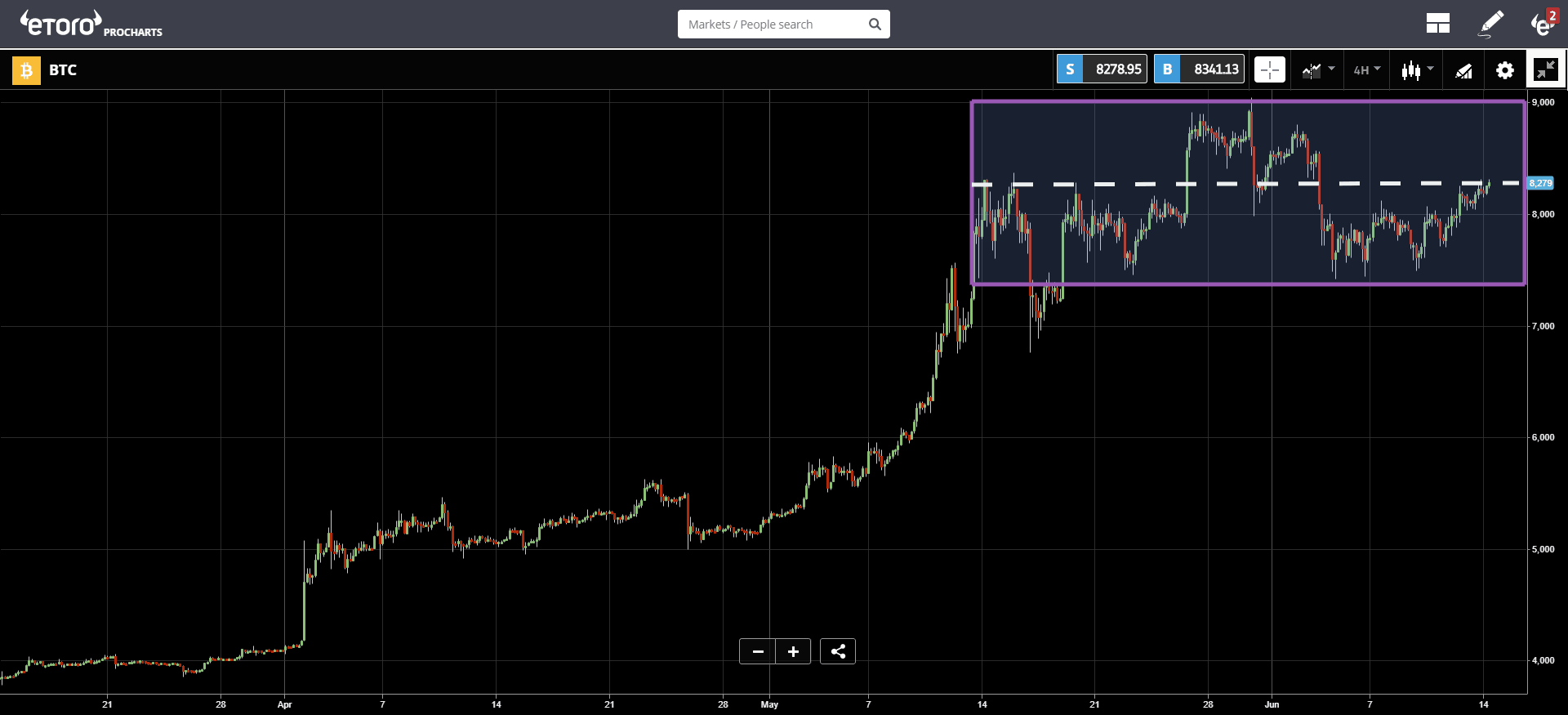

Bitcoin is now testing the upper half of the consolidation range that we identified at the start of this week. Volumes are holding steady at their elevated levels as the crypto renaissance continues.

The next few movements may prove critical. A strong breakout in either direction at this point could determine if we’re headed for another massive bull run, or for a tamer bull cycle.

For your entertainment this weekend, going along with the Crypto in the USA theme stressed above, I highly recommend this short film from CoinTelegraph.

Crypto in the USA – CoinTelegraph Documentary – Part 1

Have a fantastic weekend!

Best Regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.