Ever wish you could set your investments on autopilot? eToro’s new Recurring Investments feature lets you do just that. By automating your investing, you can build steadily towards your goals, reduce volatility, and stop worrying about timing the market.

Here’s everything you need to know about this powerful tool — including how to set it up, and why automation could be your secret weapon for long-term growth.

What is recurring investment?

Recurring investment (RI), also known as recurring orders, allows you to set a fixed amount of money to invest monthly in your favourite assets. A recurring investment plan is:

- Easy to set up: Choose from thousands of stocks, ETFs, and crypto for your recurring plans. You decide which amount and date per month works best for you.

- Cost-effective: Start investing from $25, plus enjoy reduced FX fees and lower commission on recurring investments of stocks and ETFs.

- Consistent: With an automated plan, you can stick to your strategy and invest with consistency, no matter how busy you are.

- Less stressful: Free yourself from timing the market and worrying about missing opportunities.

- Flexible: No lock-in period means you can modify your plan or stop anytime — it’s completely up to you.

Why consider recurring investments?

Build a long-term strategy with consistency. By continuously investing as part of your regular budget, your portfolio has potential to grow over time. Recurring investments also help you leverage the compounding effect, turning consistent small contributions into bigger results.

Stay disciplined, even when life gets busy. Automation ensures you’re always contributing to your portfolio, even during hectic periods. This consistency is a key strategy to reaching financial goals.

Reduce risk with dollar-cost averaging. Investing smaller fixed amounts regularly, regardless of market conditions, enables investors to gain exposure at an average of varying purchase prices — averaging out the cost over time and helping to manage volatility.

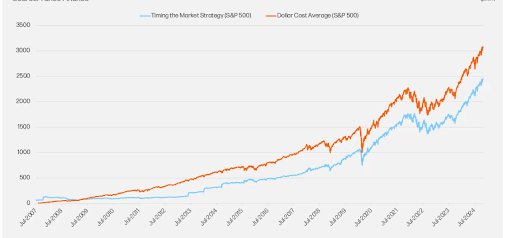

Timing the market vs. time in the market

Let’s take a closer look at what dollar-cost averaging can do.

Staying invested long term (known as “time in the market”) can often be more important than trying to predict the best times to buy or sell (“timing the market”). You can use “consistently investing a set amount each month” with a recurring investment plan as a dollar-cost averaging (DCA) trading strategy.

For example, the chart below illustrates how DCA outperformed timing the market on the SPDR S&P 500 (SPY) ETF, an exchange-traded fund which tracks the S&P 500 Index.

Hypothetical $1000 investment in SPDR S&P 500 (SPY) ETF (2007-2024)

Data as of December 1, 2024. For illustrative purposes only. Past performance is not an indication of future results.

Source: Yahoo Finance, Galaxy Asset Management.

If an investment was made whenever the index dropped by more than 5% (“buying the dip”), this would have resulted in 16 investments, compared to 210 months of consistent DCA — with DCA performing 1.25x better.

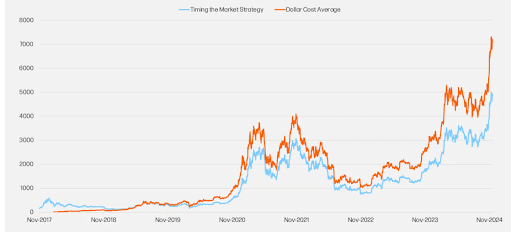

DCA’s advantage can be even more pronounced with volatile assets such as cryptocurrencies.

The charts below illustrate how buying Bitcoin (BTC) using a DCA strategy performed better than a perfect market-timing strategy over the same time period.

During the time frame from 2017 to 2024, DCA delivered 1.46x higher returns:

Hypothetical $1000 investment in Bitcoin (2017-2024)

Data as of December 1, 2024. For illustrative purposes only. Past performance is not an indication of future results.

Source: CCData, Galaxy Asset Management.

You can read more about dollar-cost averaging here.

Which assets can I invest in with recurring investments?

eToro offers a wide range of assets for recurring investments, allowing you to diversify and reduce risks:

- Stocks: Own shares in your favourite companies with no commission fees.

- ETFs: Invest in diversified funds designed to track specific sectors or markets.

- Crypto: Take advantage of the growing potential of digital currencies.

By diversifying across these asset types, you can create a well-balanced portfolio that aligns with your financial goals.

How to set up recurring investments on eToro

- Log in to your eToro account. (Don’t have an account yet? Get one here.)

- Choose your asset. Head to the specific stock, ETF, or crypto for which you want to set up an RI, or click here to discover top assets.

- Click “Invest.”

- Select “Recurring Investment” and enter the amount and date each month that works for you.

- Confirm your settings. That’s it — your portfolio is set for recurring payments.

What to consider before starting recurring investments

Before setting up your RI, it’s worth thinking about a few key factors:

- Your budget: Start with an amount that fits your financial comfort zone.

- Frequency: Decide how often you want to invest (e.g., weekly or monthly).

- Your goals: Are you saving for retirement, building wealth, or experimenting with crypto? Your strategy will depend on your objectives.

- Market trends: While RI can help to mitigate market timing risks, you’ll want to stay informed about major market movements in order to make the best investment decisions.

Start building your future today

With Recurring Investments on eToro, you can create a disciplined, consistent strategy to help grow your portfolio while enjoying:

- Low commission fees on stocks and ETFs

- Low $25 minimum investment to get started

- Complete flexibility with no lock-in periods

Whether you’re just starting out on your investment journey, or looking for a simple way to help grow your existing portfolio, Recurring Investments could be the solution you’ve been waiting for.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

For crypto: Don’t invest unless you’re prepared to lose all of the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more