Good morning everyone,

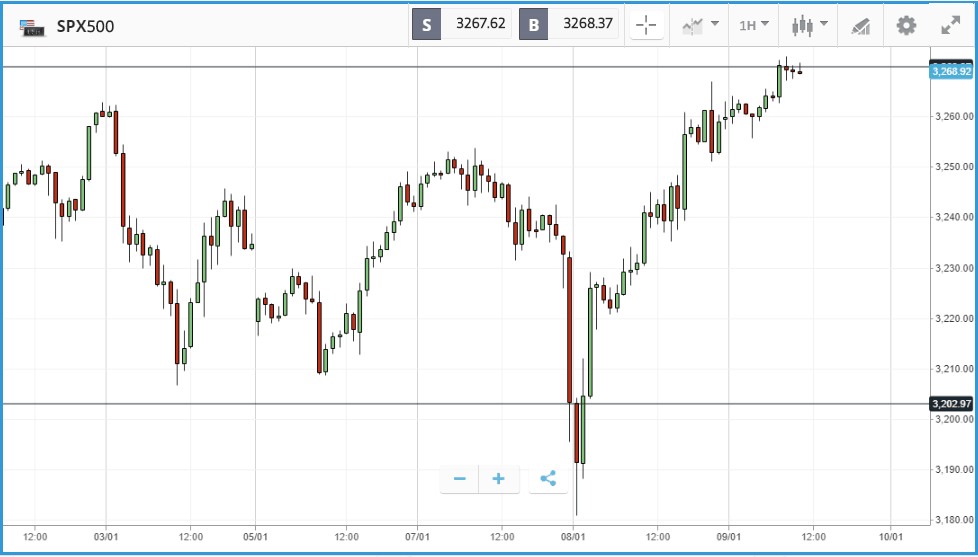

Markets have bounced back this morning after an apparent de-escalation in the conflict between the US and Iran with President Trump’s retaliation taking the form of sanctions rather than a military response. The S&P 500 has reached another record high which may encourage investors due to the ‘5 day rule’. The S&P has ended the year positively 80% of the time when it has been up after the first 5 trading sessions, going back 62 years.

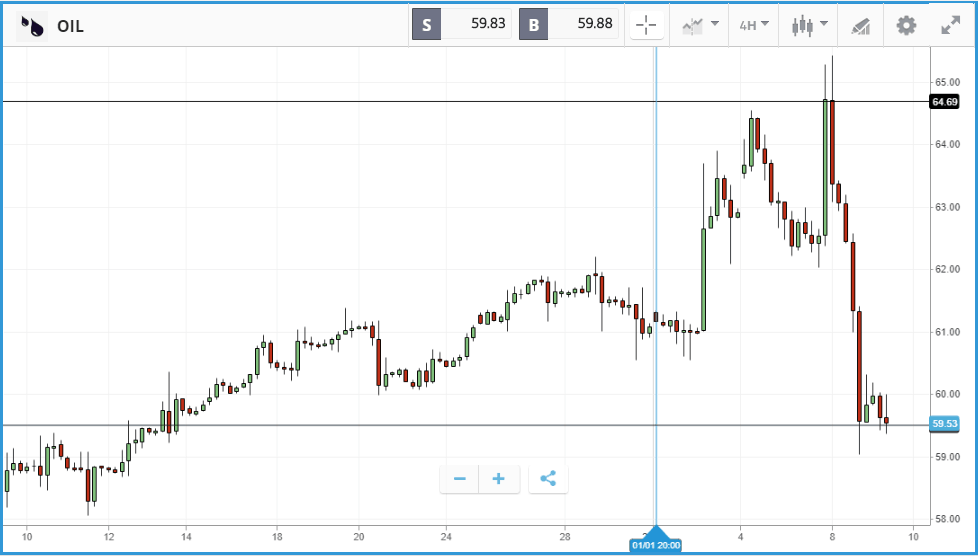

On the other hand, oil has given back all of its 2020 gains and then some, dipping below $60 a barrel as supply fears ease.

Mixed fortunes for retailers

Marks & Spencer, one of Britain’s best known retailers, has seen shares collapse this morning amid a very disappointing update. Whilst the performance in their grocery business continued to perform, clothing and home disappointed. Their online presence is far behind their competitors as well, a key shift that the company really should be taking heed of as fewer shoppers head to the high street. The company commented that the turnaround was making progress but it seems investors have voted with their feet with shares down nearly 10% at the time of writing. It appears M&S would be best served focusing on its successful food business going forward.

On the other hand, Tesco, the UK’s largest supermarket, today reported its fifth consecutive year of growth in sales over Christmas, with like for like sales up 0.4% and total sales up 0.2%.

The group’s chief executive Dave Lewis said the results had been achieved in the face of a subdued UK market, sentiments that were echoed by the British Retail Consortium (BRC).

The BRC said this morning that total sales fell 0.1% in 2019, marking the first annual sales decline since 1995. Sales in November and December were particularly weak, falling 0.9%.

Slow start to the year for Walgreens

Pharmacy retailer Walgreens Boots Alliance suffered a tough first earnings report of 2020, as rising sales were not enough to offset a fall in profits of around 6% year-over-year. This is not the first time in the past year that Walgreens has missed earnings estimates. The firm’s stock closed 5.8% down on the news, making it the biggest faller in the S&P 500, Nasdaq Composite and Dow Jones Industrial Average. CEO Stefano Pessina described it as a “slow start to the financial year”, pointing to competition in the US pharmacy market and poor trading conditions in the UK. In November, there were reports of a $70bn deal to take the firm private via private equity firm KKR, but the topic was not addressed on the analyst call.

Tesla leads the Nasdaq Composite higher

In US stocks, Tesla continued its run upwards, gaining 4.9% on Wednesday with its market cap closing in on $90bn. The company’s shares are now up close to 50% over the past month, and more than 100% since the beginning of October. All three of the main US indices posted a positive day, led by the Nasdaq Composite which climbed 0.67% thanks to Tesla, Netflix and a number of pharmaceutical names. At the bottom of the S&P 500 were a number of energy names, as oil prices fell back on the apparent cooling of tensions between the US and Iran. Firms that lost out included Cabot Oil & Gas, Marathon Oil and Devon Energy, which lost 3.82%, 3.7% and 3.55% respectively.

S&P 500: +0.49% Wednesday, +0.69% YTD

Dow Jones Industrial Average: +0.56% Wednesday, +0.72% YTD

Nasdaq Composite: +0.67% Wednesday, +1.75% YTD

NMC Health continues to unravel as big shareholders get out

The week has only gotten worse for FTSE 100 constituent NMC Health, which runs hospitals in the Middle East, after two major stakeholders sold a combined £375m stake at a big discount. Its share price lost 15.9% on Wednesday. Questions raised by short seller Muddy Waters last month about the company’s financial position kicked off the unraveling of NMC’s share price, which has now halved since 16th December. Shares have had somewhat of a reprieve this morning, rising 6% but they are by no means out of the woods yet.

FTSE 100: +0.01% Wednesday, +0.43% YTD

FTSE 250: -0.83% Wednesday, -1.06% YTD

Stocks to watch

Synnex Corp: IT supply chain firm Synnex reports earnings on January 9, after posting a near 50% share price rise over the past year. The company has beaten earnings expectations in all of the past four quarters, including a major beat last quarter when it delivered an earnings per share figure of $3.30 versus an expected $2.86. Investors will be watching for continued benefits from its acquisition of Convergys which was completed in late 2018. However, Zacks Equity Research warned that macro issues could dampen benefits from new business wins.

Acuity Brands: $5.7bn market cap Acuity Brands provides building management and lighting services. It faced a rocky 2019, with several steep share price falls, but has still climbed more than 20% over the past year. Sure to be a feature of the firm’s earnings call is the announcement today that Neil Ashe will become the company’s next President and CEO in a year’s time. Wall Street analysts have an average 12-month share price target of $138.44 on the stock, versus its current $143.12.

Crypto corner:

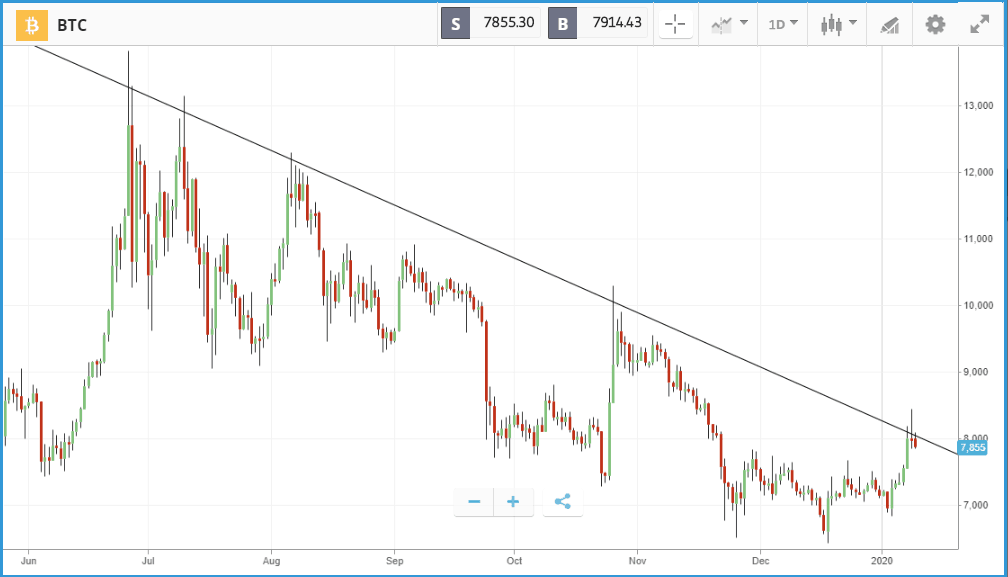

Cryptoassets pulled back from year-to-date highs, Bitcoin had moved above $8,300 yesterday, officially entering a bull market year-to-date from the lows seen at the start of the year. However, it retreated back below $8,000 this morning, trading at $7,914. It seems the 6 month resistance in the daily timeframe may still be proving to be a hurdle, similar to XRP which we highlighted yesterday.

CME Group to launch options on Bitcoin futures

CME Group have confirmed they will launch options on Bitcoin futures this coming Monday, January 13th. This follows on from rival exchange Bakkt launching their Bitcoin options last month. As opposed to futures, with options there is no obligation to sell the contract on expiry, there are also possibilities for investors to hedge their exposure using the product.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.