Hi Everyone,

Here are the key points from the FOMC minutes:

-

A number of Fed officials stressed the need for Fed flexibility

-

Most officials saw the July rate cut as a mid-cycle adjustment

-

FOMC members agreed it was important to maintain ‘optionality’

-

Officials saw trade uncertainty as a ‘persistent headwind’

-

Officials viewed sustained expansion as the baseline outlook

Link: Reuters Article

The Day Ahead

Economic data due today includes Japanese, Eurozone and US preliminary manufacturing and services PMI figures for August. The latest ECB meeting minutes will also be released. In the afternoon we should be on the lookout for the Eurozone consumer confidence data for August and the latest jobless numbers in the US, which are forecast to come in at 216,000 from previously published 220,000. The annual Jackson Hole central banking symposium starts today, continuing into the weekend.

Traditional Markets

Earning results yesterday from Target and Lowe’s supported Wall Street. Target’s shares surged 19.4% and Lowe’s rallied 10.3%.

Target – The retailer posted an adjusted quarterly profit of $1.82 per share, 20 cents a share above estimates. Revenue also exceeded forecasts. Comparable-store sales were up 3.4%, above the 2.9% estimate of analysts surveyed by Refinitiv. Target also raised its full-year earnings outlook.

Lowe’s – The home improvement retailer beat estimates by 14 cents a share, with adjusted quarterly profit of $2.15 per share. Revenue also beat forecasts. Comparable-store sales rose 2.3%, better than the 1.9% consensus estimate.

Urban Outfitters – The ‘lifestyle’ retailer reported a quarterly profit of 61 cents per share, 3 cents a share above estimates. However, both revenue and comparable-store sales came in below Wall Street forecasts, as digital sales growth did not offset declines at the company’s Urban Outfitters, Anthropologie, and Free People stores.

Tesla – The energy division of Tesla is being sued by Walmart, with the retailer alleging that Tesla’s “widespread negligence” is responsible for repeated fires in Tesla solar energy systems. Walmart is asking the court to force Tesla to remove solar panels from more than 240 of its stores and to pay damages. Tesla has not yet responded to the claims.

Antofagasta – The FTSE100 listed copper miner posted a 44% jump in first-half profit this morning, despite weaker copper prices citing higher sales and keeping production costs down.

Macro

Italian Prime Minister Giuseppe Conte’s resignation on Tuesday was perceived as a positive for the Italian equity markets yesterday. Investors returned to the FTSE MIB Italian equity index which rallied over 300 points or 1.5%. UK Prime Minister Boris Johnson visited Germany’s Chancellor Angela Merkel yesterday and is visiting France’s President Emmanuel Macron today. These visits ahead of the G7 meeting (24-26 August) are seen as an attempt by Johnson to generate some support for his plans to renegotiate the current Brexit deal. The UK may delay naming the next Bank of England Governor to replace Mark Carney until after the 31 October Brexit deadline. Commodity traders are closely watching EIA crude oil stocks change data. After several weeks of unexpected crude oil inventory builds, yesterday’s US weekly inventory figures showed a bigger draw down of 2.73 million versus an expected 1.8 million barrels. The WTI crude oil price initially reacted bullishly, trading around the $57.00 level after the data release, but failed to sustain the rally, closing the day at $55.60 or 0.80% lower.

Crypto

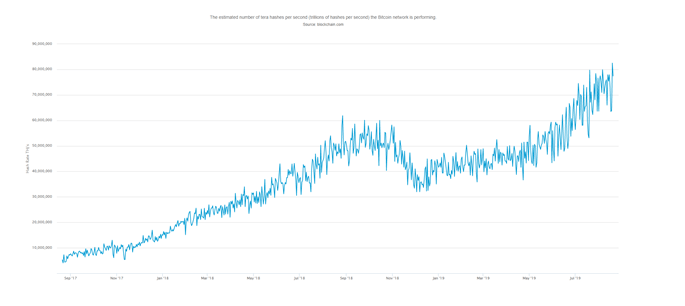

Crypto investor optimism, driven by the recent news that the Bitcoin hash rate had broken another new all-time high according to blockchain.com, was short lived.

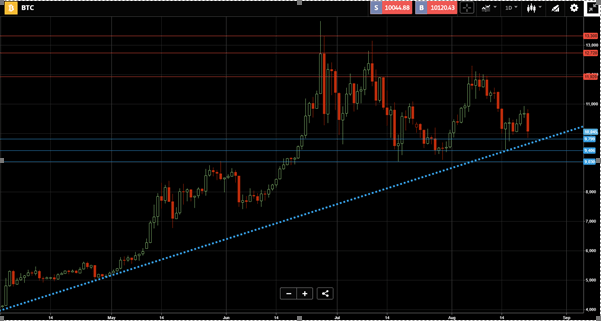

Bitcoin’s bearish correction yesterday, down 700 points or 6.5% touched the 9,800 level intraday. Current price action is pointing to the key trading level at the psychologically important 10,000. A confirmed move below 10,000 and an end of day close lower could trigger a bearish reaction targeting additional downside supports at 9,400 followed by 9,030 and 8,750. The upside is capped by the initial resistance at 11,000. A confirmed breakout higher and an end of day close above 11,000 could trigger a bullish reaction targeting additional upside resistances at the 11,900-12,000 levels.

Cryptopia has acquired encrypted assets held by platform customers

After losing $16 million from hacking in January this year, Cryptopia, the New Zealand crypto-equity exchange, has filed for US bankruptcy protection. Yesterday, Cryptopia posted a statement on its Twitter feed about the next steps. The statement said that they have successfully acquired data stored in the Arizona data center, which enables the platform to identify the cryptoassets held by the exchange’s customers, and that they have begun to transfer funds to the ‘safe’ created after the hacking in January. Although, this process is being hindered by the fact that Cryptopia kept customers’ assets in pooled wallets and as such it is not possible to determine individual ownership based on the individual customer keys in users’ wallets.

Link – coindesk.com

All data, figures & charts are valid as of August 22nd. All trading carries risk. Only risk capital you can afford to lose.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.