Hi Everyone,

It’s been five years in the making but the People’s Bank of China says that it is finally ready to release their own CBDC (Central Bank Digital Currency).

Mr. Mu Changchun who heads the PBoC’s Payments and Settlement Division explained to the China 40 Finance Group over the weekend the complexities of the first cryptocurrency created by a major central bank.

It may come as no surprise that the unique two-tier system has the PBoC in the top tier and Chinese commercial banks as the second tier. So, not exactly an open-source network like bitcoin. Changchun says that this particular strategy will work best with the needs of the Chinese economy.

Personally, I’m still struggling to understand the advantage of this over the current system. Something tells me that this is a completely different animal from what we know as cryptocurrencies.

Meanwhile, in a much smaller economy…

Now here’s a landmark of innovation.

Blockchain technology is quickly hastening a new era in which financial assets can be traded and stored in a more free and fair manner.

Onwards and upwards!

Today’s Highlights

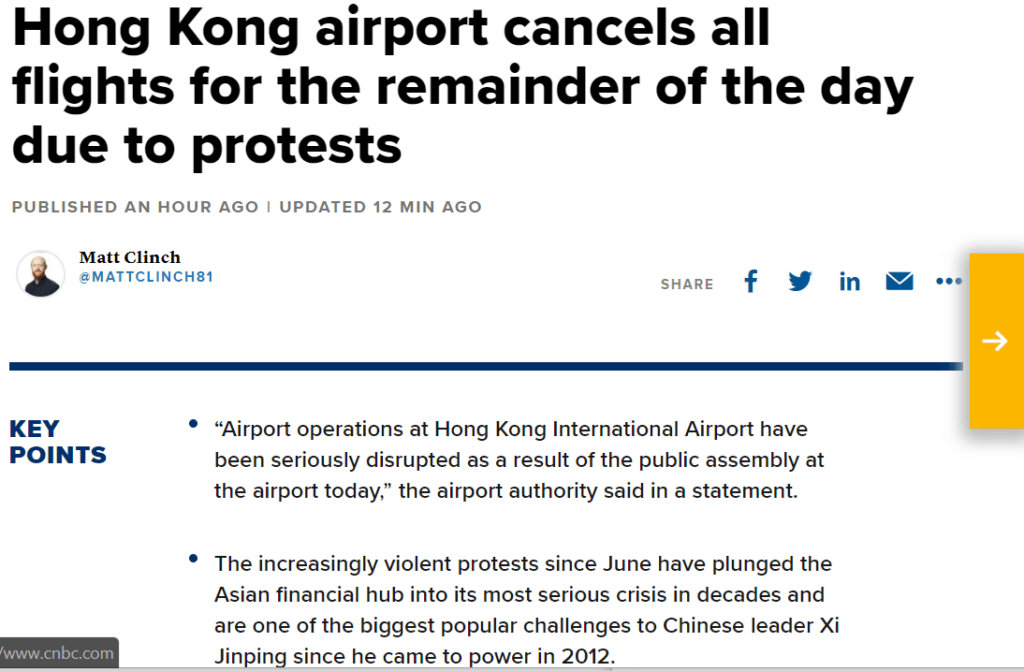

- HK Flight Shutdown

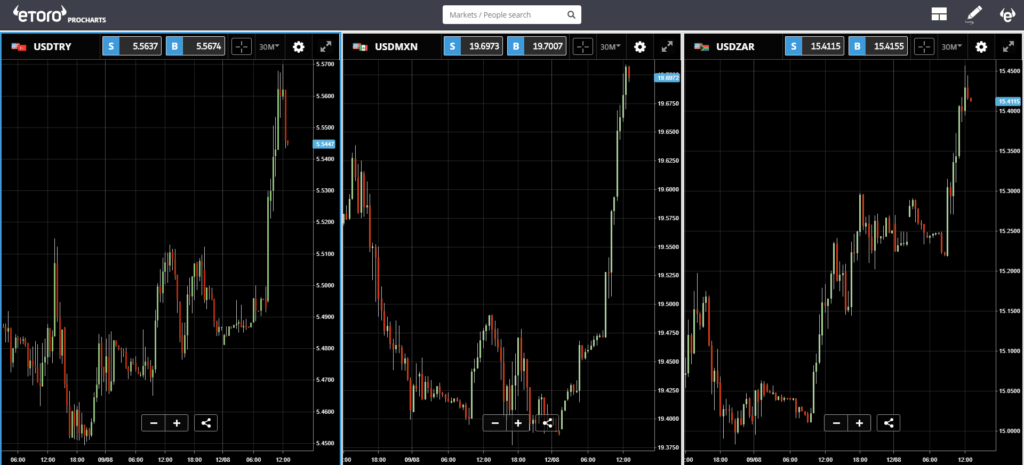

- Race to the Bottom

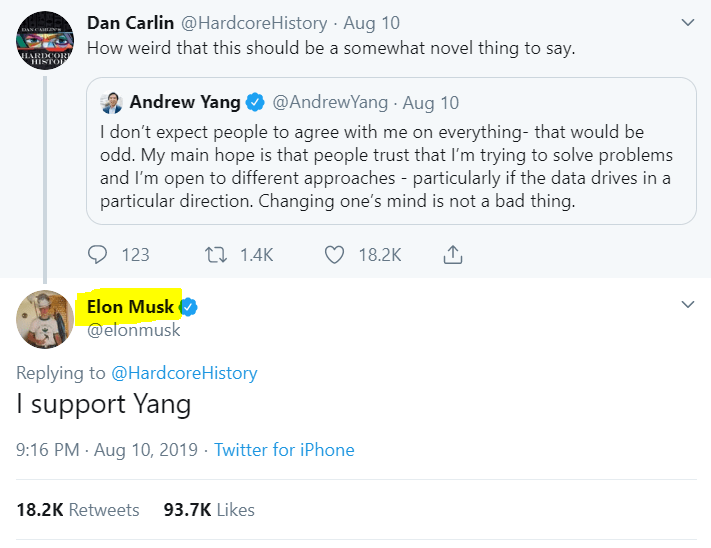

- The Blockchain President?

Traditional Markets

This latest escalation seems to have had a direct impact on stock markets this morning. Within moments of the announcement from the HK aviation authority global stocks began to tumble, from Shanghai to the futures in New York.

What a shame too because the European open did look pretty positive until then.

Currency Wars

Blockchain President

As much as I hate to rain on Yang’s parade, I would like to say that the chances of him being elected in 2020 are extremely thin.

Being a sitting President is an extraordinary advantage for Donald J Trump and so he is most likely to win. But even deeper than that, as far as the Democratic party is concerned, Yang is far from a front runner. The favorite as it stands is former VP Joe Biden, followed by Elizabeth Warren.

However, I did notice Yang getting some TV time on Fox News of all places today. So, you never know.

Have an amazing week ahead!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.